3 More Flyover Stocks on My Radar

Precision, Pipes, and Paint: Uncovering the Durable Moats in the Heartland's Industrial Niche.

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC or its clients owned shares of Ferguson.

The author, his immediate family, and/or KNA Capital Management, LLC or its clients have no positions (long or short) in Mettler-Toledo International (MTD), Mueller Water Products (MWA), or RPM International (RPM).

Please see important disclaimers.

Even in a bull market where many stocks look expensive, it’s important to keep a well-stocked bullpen on quality ideas. In the event of changing conditions, you’ll be that much closer to capitalizing on the opportunity rather than starting from scratch while others are panicking.

That’s why I like doing periodic short profiles of overlooked companies with attractive attributes like this one alongside monthly deep dives.

In the latest installment of “Flyover Stocks on My Radar” we’re taking a look at two Ohio-based companies with long track records of success - Mettler-Toledo and RPM International - and Mueller Water Products, a Georgia-based company with a large market share in the municipal water industry.

The AI-driven research platform Tenzing MEMO is a tool I use for efficiency gains in my research process. As a solo investor, using Tenzing MEMO has helped me accelerate the initial research phase on new ideas and keep up with existing coverage by quickly synthesizing information.

Disclosure: Tenzing MEMO is a commercial partner and sponsor of this newsletter. I receive compensation or benefits if readers sign up using the promotional code. This section is an advertisement.

Nick and Tom at Tenzing MEMO are offering an exclusive trial for professional investors who use the FLYWITHUS code during signup. This code provides an extended 4-week trial (versus the standard 2-week trial) and six tickers to sample (versus the standard four).

I’ll feature some of Tenzing MEMO’s insights in this post alongside my own analysis. If you’re a professional investor interested in exploring its capabilities, you can find more information about the offer here. Please remember to use the FLYWITHUS code when you sign up to access the enhanced benefits.

Mettler-Toledo International (MTD)

Since the dawn of commerce, buyers have not enjoyed getting ripped off. Historical research has found evidence of balance weights dated to 3,000 BC to facilitate trade in a variety of products and smooth the flows of commerce.

Accurate scales and measurement systems continue to play a critical role in the global economy by lubricating trade, science, and industrial activity.

While Mettler-Toledo was officially formed in 1992 as a combination of Ohio-based Toledo Scale and Switzerland-based Mettler Instruments, the company traces its roots back to the early 20th century. A Toledo, Ohio-based inventor named Allen DeVilbiss, Jr. developed a spring-less scale that appealed to both sellers and buyers as it helped ensure an honest transaction. In 1901, a former National Cash Register manager named Henry Theobald bought the patent and scaled production nationwide.

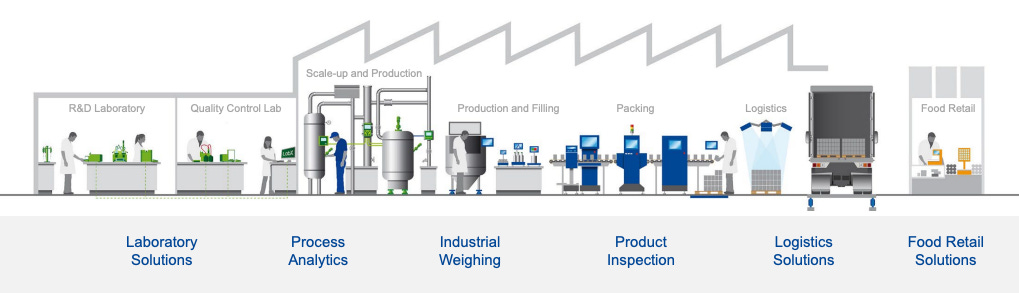

Today, Mettler-Toledo generates about 40% of its revenue from life sciences, 20% from food manufacturers, 13% from the chemicals industry, and 28% from “other” which includes food retail (e.g. the self-checkout scales), logistics (e.g. vehicle scales), and utilities (e.g. gas analytics).

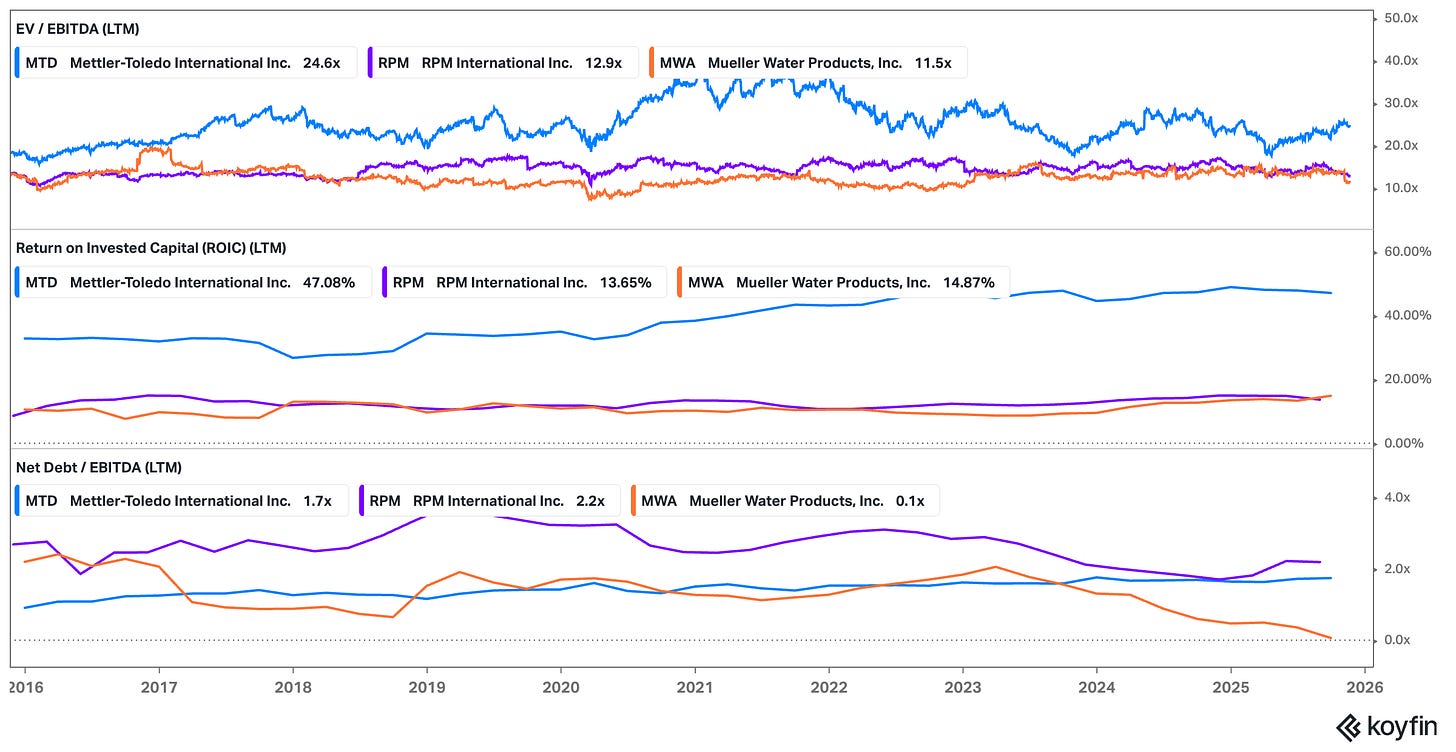

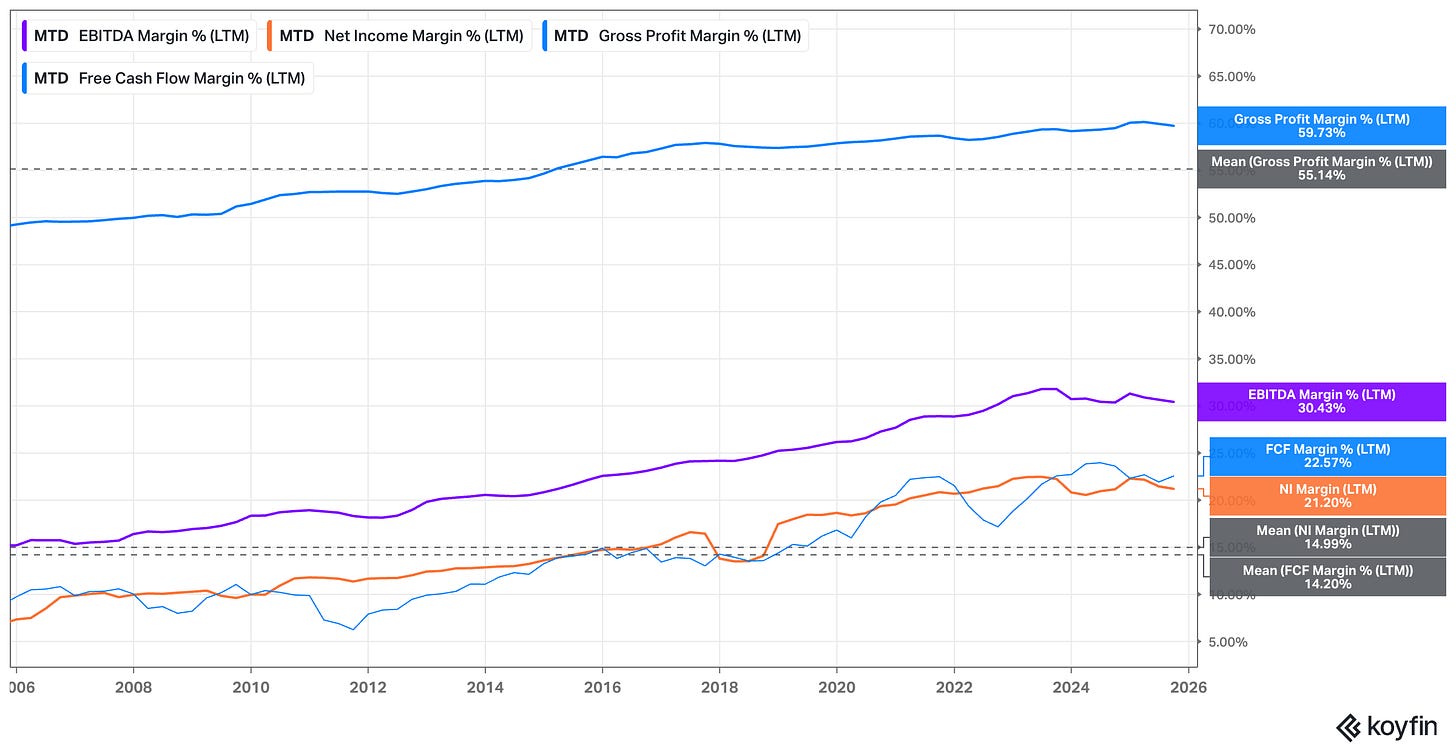

Over the last 20 years, Mettler-Toledo’s margins have not just been steady, but they’ve ticked higher over time, suggesting a positive moat trend.

Eager to learn what’s behind Mettler-Toledo’s impressive margin history, I asked Tenzing MEMO to help me understand its major moat sources.

Here’s what it generated:

Switching costs

Regulated workflows: Replacing an instrument often requires revalidation, SOP updates, staff retraining, method transfers, and requalification for audits (e.g., pharma GMP, 21 CFR Part 11). That is time-consuming and risky, so customers avoid switching.

Installed base and service: A large global installed base under calibration/service contracts creates ongoing ties; integrated ordering and digital workflows (e.g., procurement interfaces, customer portal, software like LabX) add process lock-in.

Evidence: Premium pricing and stable margins despite cycles; recurring service/consumables tied to specific gear.

Intangible assets (brand, IP, regulatory credibility)

Brand/reputation for precision, reliability, and compliance is critical where measurement errors can halt production or fail audits.

Deep application know-how and software IP embedded in workflows reinforces perceived quality and justifies pricing.

Evidence: Leadership in core categories (lab balances often cited above 50% share), high gross margin around the high-50% range, and resilient demand in regulated end-markets.

Just like that, I have some research threads to pull. Mettler-Toledo has all the makings of a classic Flyover Stock and may appear as a full company profile sometime soon.

Mueller Water Products (MWA)

We’ve talked a lot about water-related stocks in the last few years, including Hawkins, Ferguson, and Core & Main. According to the U.S. Environmental Protection Agency, there are approximately 240,000 water main breaks per year in the U.S., with “trillions of gallons of treated drinking water” lost in the process. On a rather gross note, “billions of gallons of raw sewage are discharged into local surface waters from agin wastewater conveyance systems every year.”

Suffice it to say, large and consistent investments in U.S. water infrastructure are needed over the next decade and beyond. While water infrastructure is far from glamorous, it’s worth your time to learn about the companies that might benefit from these secular tailwinds.

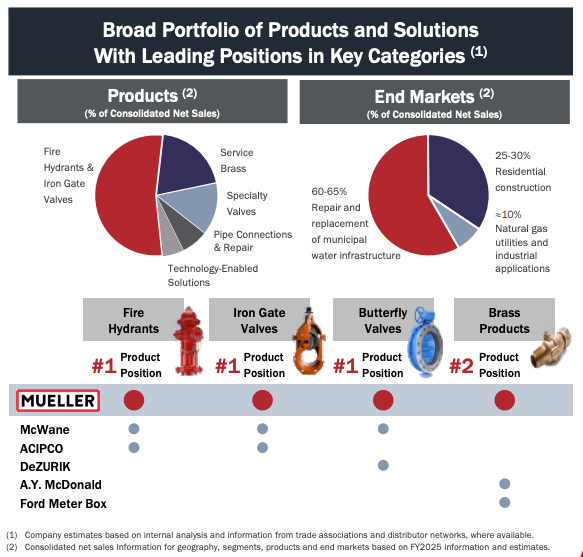

Mueller Water Products traces its history back to 1857 - ancient by U.S. standards - and plays a mission-critical role in municipal water infrastructure.

Due in part to its multi-decade relationships and massive installed base of products across the U.S., municipal water works customers typically return to Mueller for repairs and maintenance.

Over the last decade, Mueller Water’s ROIC has averaged 11% and stands at 15% on a trailing-twelve month basis. This is suggestive of a narrow rather than a wide moat and is most likely due to its reliance on municipal spending, which is a double-edged sword. On one hand, municipal water projects tend to be large and having deep and enduring relationships with these customers is valuable to Mueller Water, but the municipalities also play providers off one another to get the best prices. This dynamic keeps a lid on ROIC expansion.

On this note, Tenzing MEMO sizes up the risk, saying:

MWA’s revenues are heavily concentrated in the North American municipal water market, with over 85% of sales derived from U.S. and Canadian utilities. This customer base is highly sensitive to government budgets and political priorities. Any downturn in municipal spending—whether due to economic recession, fiscal austerity, or shifting policy—can directly reduce demand for MWA’s core products. A hypothetical 10% reduction in municipal capital budgets could translate to a similar decline in MWA’s top line, with outsized impact on earnings due to operating leverage.

That said, Mueller Water has a rock-solid balance sheet with just $20 million in net debt. This hasn’t always been the case, so the next step in my research would be to investigate the company’s approach to capital allocation. Is the repaired balance sheet here to stay or is it just a pause before a round of M&A?

RPM International (RPM)

If you’re a homeowner, you probably have at least one RPM International product in your garage or storage area. A quick look through mine shows Rust-Oleum, DAP, Kwik Seal, and Plastic Wood products and I’m sure there’s a few more in the way back that I’ll find when I clean up the garage.

RPM International was founded in 1947 as “Republic Powdered Metals.” The initial product was a heavy-duty aluminum roof coating called Alumanation (great name!) that’s still sold today. If you believe there’s “riches in the niches” as the saying goes, then RPM is a company you need to know because that’s their entire business model.

In 2025, about 65% of its annual revenue comes from repair and maintenance end markets, 30% from new construction, and the remaining 5% from specialty OEM sources. Its biggest sub-market is roofing (26% of revenue), followed by paints & coatings (14%), and sealants & adhesives (13%).

One of the things that differentiates RPM is its decentralized, entrepreneurial culture and business model. According to Tenzing MEMO, “Each operating company (e.g., Tremco, Stonhard, Euclid Chemical, Rust‑Oleum/DAP in Consumer) has its own leadership team accountable for growth, pricing, mix, service, and profitability.”

Procurement, on the other hand, is handled centrally where RPM has more bargaining power than the individual operating companies do.

Both of these factors have contributed to solid long-term stock performance and 52 consecutive years of dividend growth.

RPM faces some stiff competition across its product portfolio, which keeps ROIC hovering around the 12% long-term average mark. Despite going up against the likes of Sherwin-Williams and PPG, RPM has historically held its own by focusing on the niches and building trusted brands within those areas of the market.

What are some of the stocks on your radar? Let me know in the comments below.

Have a Happy Thanksgiving!

Stay patient, stay focused.

Todd

NSSC is the sort of business I think you might also be interested in.

Interesting! :)