Flyover Stock: Ferguson (FERG)

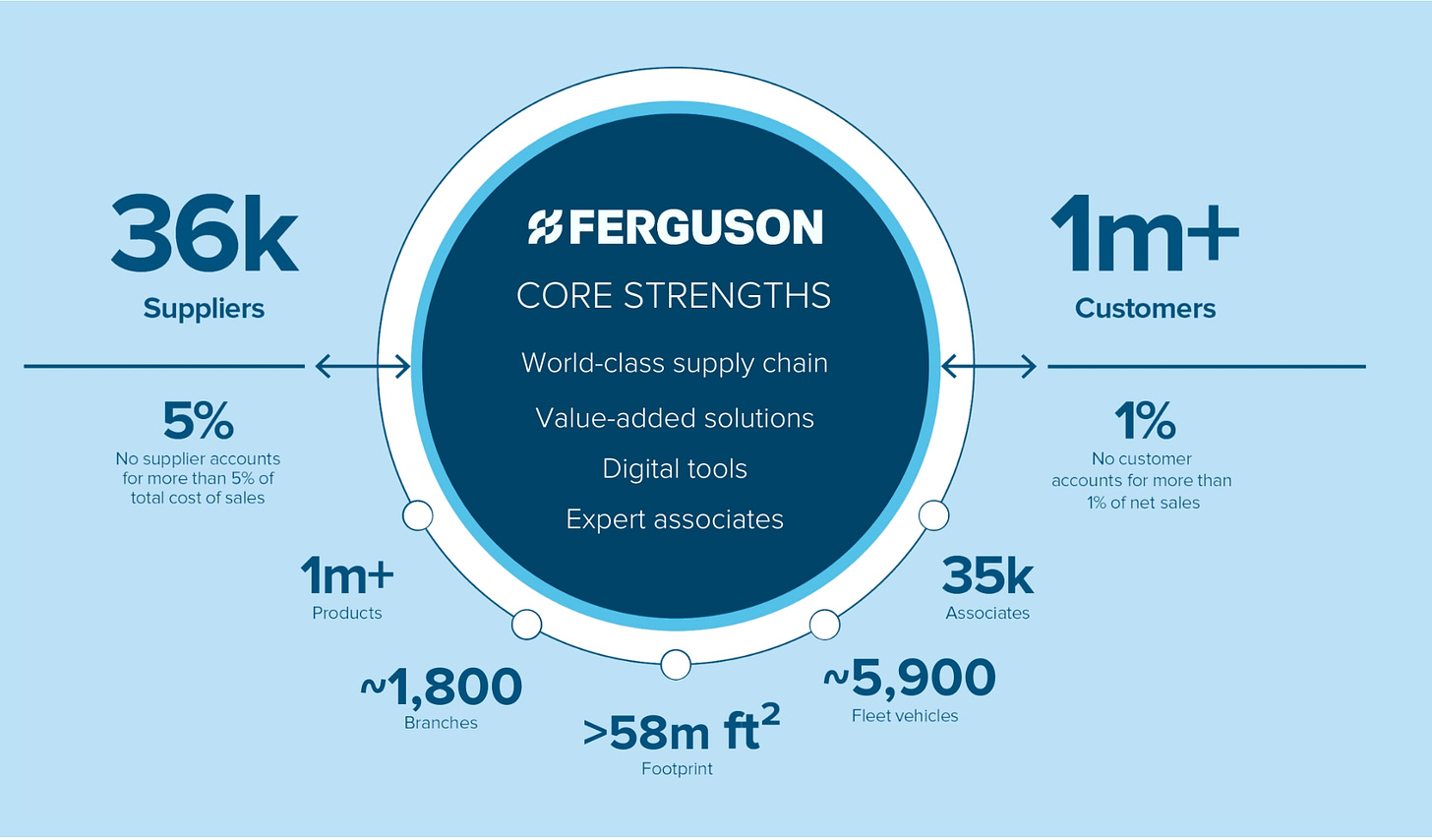

A critical nexus between thousands of suppliers and over a million customers.

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC or its clients owned shares of Ferguson and Amazon.

Please see important disclaimers.

A few summers ago, I was having ice cream with my family at a new parlor in town when I looked across the street and noticed something.

On the side of a red brick building was a sign for a local roofing and window distributor that added “Since 1875.”

150 years is no small feat. I came to learn that it’s a fourth-generation owned business with some locations around the tri-state area.

I’d followed great publicly-traded distributors like Fastenal, Grainger, and Watsco for a few years, but it wasn’t until I sat across from this local distributor with some mint chocolate chip ice cream that it hit me:

Distribution, done well, is intrinsically durable.

In an age of rapid technological disruption, that makes it an attractive business model to understand.

Why is distribution durable?

Business-to-business: One of the great things about B2B businesses is that once a product or service becomes part of a process, it’s hard to unseat. Business operators value reliability, so switching to an unproven competitor can be a risky proposition.

Local relationships: Especially in the trades, front-line employees don’t care whether or not you’re a national or global supplier. What matters is that you can solve problems in their area. Over time, customers and distributors get to know each other by name and these personal relationships account for more than dollars. Tradespeople know their business is cyclical and it’s important to have reliable local partners to work with through the ups and downs.

Reduce friction: While large suppliers have at times tried to do their own distribution, they realize it’s a lot harder and more expensive than it looks. It’s much more efficient to sell to one distributor than it is to sell to hundreds of small businesses in an area.

Local response: Suppliers don’t want to respond to local emergencies or solve job-site issues. Distributors being on the ground and close to their customers play this role in the network.

Value-added services: A good distribution business doesn’t just match suppliers and customers. It also provides value-added services like product customization, inventory management, credit and financing, and design consultation.

A distributor that sees to the above becomes a mission-critical partner for both suppliers and customers.

Water infrastructure distributor Core & Main was one of the first Flyover Stock profiles. Today, we’ll talk about one of its competitors, Ferguson.

Ferguson’s business is larger and more diversified than Core & Main, but it remains a lesser-known company to U.S. investors, due in part to the fact that it was owned by a U.K.-based parent company for 40 years and its primary shares were listed in London until 2022.

Further, despite having a $46 billion market cap, Ferguson is not yet part of the S&P 500.

Let’s take a closer look at the moat and management team behind Ferguson.