3 Healthcare Stocks on My Radar

Sorting through one of the worst performing sectors of the past year.

One of my favorite strategies is to look for promising companies in unpopular sectors.

At various points in a market cycle, entire sectors or sub-sectors can get caught up in a wave of indiscriminate selling. Maybe most of the companies in those groups deserve to be sold off, but there are typically a few that don’t. As the saying goes, they’ve been thrown out with the bathwater.

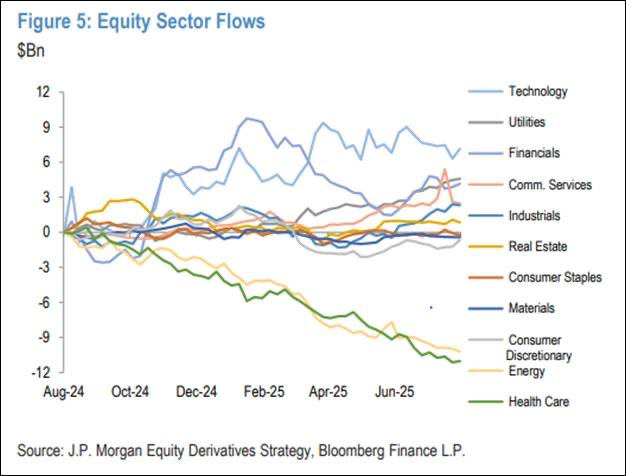

And in an era where passive investment vehicles rule the day, it stands to reason that the indiscriminate selling of broad groups of stocks will be more common. Active fund managers selling (and buying) individual stocks after doing deep research is becoming less impactful on the overall market. “Flows” matter more today.

As an active manger, this dynamic should provide more opportunities to find companies that have been sold off to unjustifiable levels, especially in out of favor industries.

For a variety of reasons, healthcare has been out of favor in recent quarters. Uncertainty around regulatory and policy issues, rising input costs alongside worries about reimbursement rates, and higher interest rates have all been headwinds.

Given that it’s an out of favor sector with negative flows, there are likely good opportunities within the healthcare sector today. Here, we’ll consider three ideas that may be worthy of further research.

(In the below posts, I’m limiting myself to a 500-word maximum per company, as my natural inclination is toward doing full reports. Consequently, there may be important matters missed or not discussed in the summaries. As always, this is not advice - please do your own research.)

To augment and accelerate my research, I’ll implement an AI-driven research platform called Tenzing MEMO. In 2022, my friend Nick Kapur launched the platform with Tom Saberhagen, a former partner and co-portfolio manager at Akre Capital, as a way to keep tabs on a large universe of companies with the limited resources of a small firm.

In May, Tenzing MEMO launched version 2.0, which features an improved mobile interface, chat history, and an additional 1,000+ research-ready stocks.

Professional investors who are interested in a free trial to Tenzing MEMO can register on the Tenzing MEMO website (all new users receive a generous, no commitment free trial to kick the tires of the software). Tip: register with your work email for expedited service.

As an added bonus, Tenzing is generously offering Flyover Stocks members an additional 10% off yearly subscriptions. Based on the pricing of various platforms I’ve been pitched over the years, their rates are quite reasonable given the breadth and depth of the available data.

You can sign up for a free trial here, and if you like it enough to buy it, reference code FLYWITHUS to receive the extra 10% off your annual subscription.

Additional disclosure: I have an established partnership with Tenzing MEMO for which I may receive a commission on product sales. I only promote third-party products that I use and enjoy. Please see important disclaimers.

DexCom (DXCM)

Market cap: $30 billion

Headquarters: San Diego, CA

DexCom sells continuous glucose monitoring (CGM) devices used by millions of people managing their Type 1 and Type 2 diabetes as well as others who are tracking their glucose for other purposes.

It was founded in 1999 with the sole focus of improving glucose monitoring and was one of the early pioneers in providing patients with accurate, continuous, and real-time data. Previously, the standard of care for glucose monitoring was periodic finger pricks, which was far less comfortable and helpful for the user.

Its major competitors like Abbott (FreeStyle Libre) and Medtronic (Guardian) are formidable, but lack DexCom’s focused obsession with the space. From an innovation standpoint, that may favor DexCom.

DexCom’s value proposition is performance and its ability to integrate its products (e.g. G6, G7, Stelo) with various platforms. By comparison, other CGMs are typically locked into their own ecosystems and compete more on price than on performance.

What’s more, DexCom has a razor-and-blade business model in which its hardware accounts for just 5% of total revenue and its disposable sensors account for the remaining 95%. Management also noted at a January conference that “our retention rates are much higher than anybody else in this industry.”

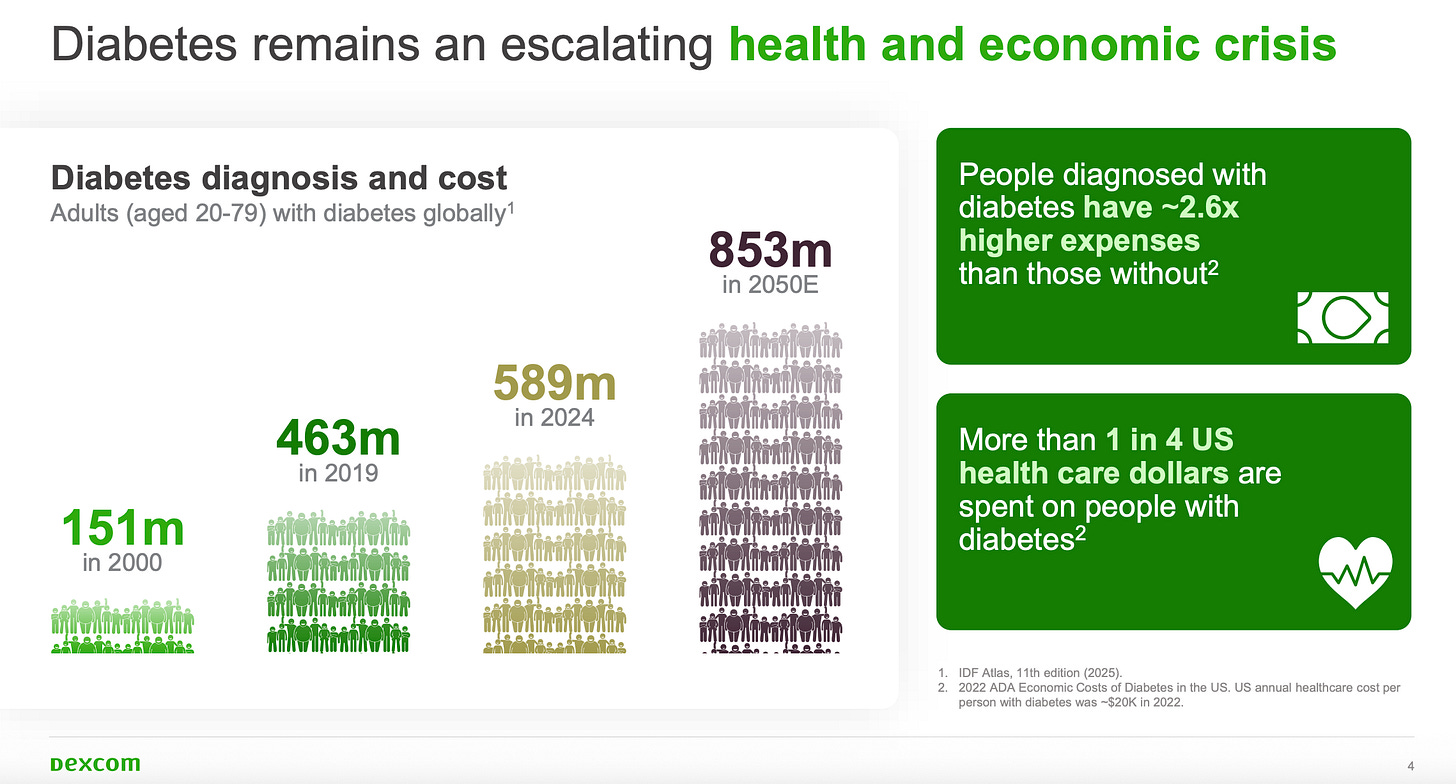

An intriguing setup, especially when you consider the rising population diagnosed with diabetes; however, DexCom’s stock has been in a rut for some time, posting total returns of negative 20% over the last five years.

To figure out what’s behind this, I consulted Tenzing MEMO’s bear case function. Among other responses, it included the following:

DexCom’s core market is becoming increasingly crowded. Abbott’s FreeStyle Libre platform continues to gain share globally, offering a lower-cost alternative with broad reimbursement and a strong direct-to-consumer presence. Medtronic, while historically less successful in CGM, is investing heavily in next-generation sensors and integrated diabetes management. Both competitors have the scale and resources to pressure DexCom on price and innovation. Additionally, the rapid adoption of GLP-1 drugs for diabetes and obesity management may reduce the addressable market for CGM, particularly among type 2 diabetics, as some patients may require less intensive glucose monitoring.

These are serious challenges that are worth further investigation. But as Tenzing MEMO’s bull case function notes, not all is lost.

Several factors could enable DexCom to exceed current expectations. First, CGM market penetration remains low in large segments, especially among type 2 diabetics and prediabetics—populations numbering over 100 million in the U.S. alone. Recent expansions in insurance coverage, including broader pharmacy benefit manager adoption, position DexCom to capture incremental share. Second, international markets are underpenetrated but growing rapidly, with new reimbursement wins and direct market entries (e.g., Japan, Saudi Arabia) expected to drive further adoption. Third, the company’s move into over-the-counter and wellness markets with Stelo could open new revenue streams.

There’s a lot to consider when weighing DexCom. If you dig into it, I think you need to form a view of how GLP-1 drugs could impact Type 2 diabetes demand and how CGM might be used outside of diabetes care.

A quick note: Flyover Stocks grows through word of mouth. If you think others would benefit from this piece, a like or share helps more investors find our community. Thank you!

Align Technology (ALGN)

Market cap: $9.5 billion

Headquarters: Tempe, AZ

If you’ve had teenagers needing orthodontia, you’ve likely heard of Invisalign. But for the uninitiated, Invisalign is a clear plastic alternative to metal braces traditionally used by orthodontists to align and straighten patients’ teeth.

In 1998, Align received FDA clearance for Invisalign. Orthodontists were initially slow to adopt the new option for various reasons. Even today, some orthodontists refuse to offer Invisalign because they were trained on metal braces in school, don’t want to make the upfront investment, or aren’t convinced that it can handle more complex cases.

Over time, however, customers have increasingly asked for clear aligners rather than the metal wire and bracket braces so dentists and orthodontists have had to adjust or risk losing business. Invisalign is particularly popular with adult users who want to straighten their teeth but not have the social stigma that may come with metal braces (in the U.S., at least, metal braces are typically associated with teenage years).

The start to finish process is typically a consultation with a dental professional, a scan using Invisalign’s proprietary iTero scanning technology, concluding with a delivery of plastic aligners that the patient is supposed to use as directed. Over time, the aligners move the teeth into the proper position. Dental professionals can make adjustments as needed during the process.

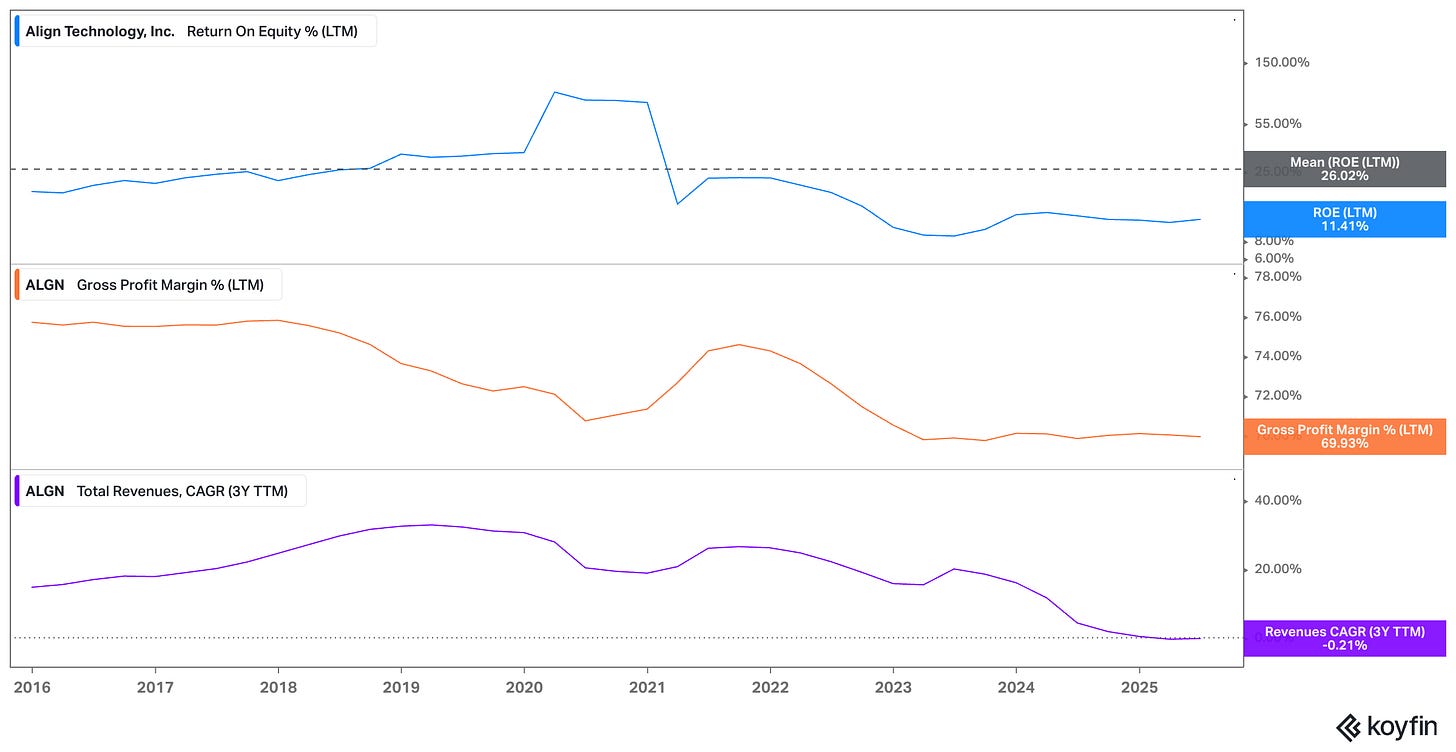

Invisalign demand was strong during 2020 and 2021 as many adults took the opportunity during COVID quarantine to straighten their teeth. Demand has cooled in recent years while competition intensified following the expiration of the foundational Invisalign patents in 2017. 3M, Henry Schein, and Dentsply, for instance, each have their own versions of Invisalign on offer and typically aim to undercut Invisalign on price.

According to Align’s most recent investor presentation, about 65% of its volume in 2024 was from the adult market while the remaining 35% was for the teen market. This makes Align more exposed to discretionary spending trends. For teens, alignment is almost a necessity while it’s usually a cosmetic “nice to have” for adults.

I asked Tenzing MEMO’s “The Edge” function, which is in beta testing, and is “designed to act as your thought partner [and] solicits Tenzing MEMO's intuitions to assess the potential for alpha over practical time horizons.”

The business is sound but bruised. Align still sits on a strong franchise: ~20.8 million lifetime patients, a 70% gross margin business pre-charges, and an installed base of >100k iTero scanners (about half the global intraoral scanning market). Yet the core engine—clear aligner ASPs—has been slipping as mix tilts to lower-priced products and discounts; volume is roughly flat (+0.3% y/y in Q2’25). My instinct says the moat is intact but narrower than the market once believed. The advantage has migrated from product to platform (digital workflow, ADP tools, iTero, exocad), which is less visible in near-term results but still real.

What Align has going for it from an economic moat perspective is the brand recognition - many consumers call all clear aligners “Invisalign” - as well as switching costs related to dental offices that have already adopted the platform. Similar to DexCom’s story, Align is the leading innovator in the space and is more likely to produce a game-changing technology than its also-ran competitors.

Fortrea Holdings (FTRE)

Market cap: $929 million

Headquarters: Durham, NC

As we’ve seen from our coverage of Medpace, the biotech CRO (contract research organization) space has had a volatile year or so, due primarily to an uncertain biotech funding environment. For early-stage biotech capital providers, rising interest rates make biotech investments less attractive because the potential payoffs are long-dated since molecules need to go through rigorous clinical testing to receive necessary regulatory approvals.

CROs like Fortrea and Medpace are heavily dependent on the volume of work coming from pharmaceutical and biotech customers. It’s a high fixed-cost business model due mainly to the labor intensity associated with clinical trial management. Finding skilled labor such as statisticians, regulatory experts, and medical professionals necessary to handle the complexity of the clinical trials is not always easy. If a CRO lays off too many of these skilled workers in a soft market, they may be understaffed for when the market recovers. The opposite is also true.

Fortrea was spun-off from LabCorp in June 2023 and was saddled with substantial debt as part of the transaction. It couldn’t have come at a worse time in the biotech cycle as activity stalled following the COVID and post-COVID funding rush where low-to-zero interest rates made funding speculative projects more palatable for early-stage investors.

The CRO space is highly fragmented and competitive, so I wanted to understand more about what made Fortrea different and what idiosyncratic risks it might have.

Tenzing MEMO’s “Positioning” function ran a SWOT analysis and provided these strength and weaknesses:

Strengths:

Global scale and operational footprint in ~100 countries, with over 15,000 employees.

Deep expertise in clinical pharmacology and oncology, with a track record of over 5,900 clinical trials in five years.

Flexible delivery models (full service, functional service provider, hybrid) tailored to client needs.

Access to large clinical datasets and technology platforms, including AI-driven tools for trial management.

Strong relationships with both large pharma and biotech, offering both scale and personalized service.

Weaknesses:

High customer concentration increases vulnerability to contract losses or renegotiations.

Recent financial performance has been weak, with negative margins and significant goodwill impairments.

Ongoing restructuring and cost-cutting may disrupt operations or service quality.

Heavy reliance on a few large clients and exposure to industry cyclicality.

A new CEO also started in August, so there seems to be a lot of change happening at Fortrea.

While it’s a less attractive business to me than Medpace, Fortrea’s an interesting turnaround candidate if that’s something you enjoy researching.

Stay patient, stay focused.

Todd

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC or its clients owned shares of Medpace.

Please see important disclaimers.