Flyover Stock: Mettler-Toledo (MTD)

Digging into Mettler-Toledo's moat, stewardship, and forecastability to determine if the multiple premiums are justified

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC or its clients do not own shares of Mettler-Toledo, but may own shares of other companies mentioned below the paywall.

Please see important disclaimers.

“There is nothing new to be discovered in physics now. All that remains is more and more precise measurement.” - Lord Kelvin

I hinted in the most recent edition of “Stocks on My Radar” that Mettler-Toledo may have a full Flyover Stock profile in the near future. Well, the future is now.

There are some high quality businesses in the great state of Ohio. We’ve covered a few already in other monthly profiles, but I’m ashamed to admit I didn’t know much about Columbus-based Mettler-Toledo until recently.

Perhaps that’s because it’s technically headquartered in Switzerland as a byproduct of Mettler’s (Swiss) acquisition of Toledo Scale in 1989. As discussed later on, Mettler-Toledo’s C-suite is divided between Switzerland and Ohio.

In the “Stocks on My Radar” post we covered the basics of what makes Mettler-Toledo an attractive business, but today we’ll dig into the nuances of the company’s economic moat, management stewardship, and forecastability. We’ll also consider ways to value Mettler-Toledo.

Business overview

Headquarters: Switzerland / Columbus, Ohio

Market cap: $28.9 billion

Revenue TTM: $3.9 billion

Net debt: $2.2 billion

P/E (ttm): 35x

Average 10 year P/E: 37x

Dividend yield: N/A

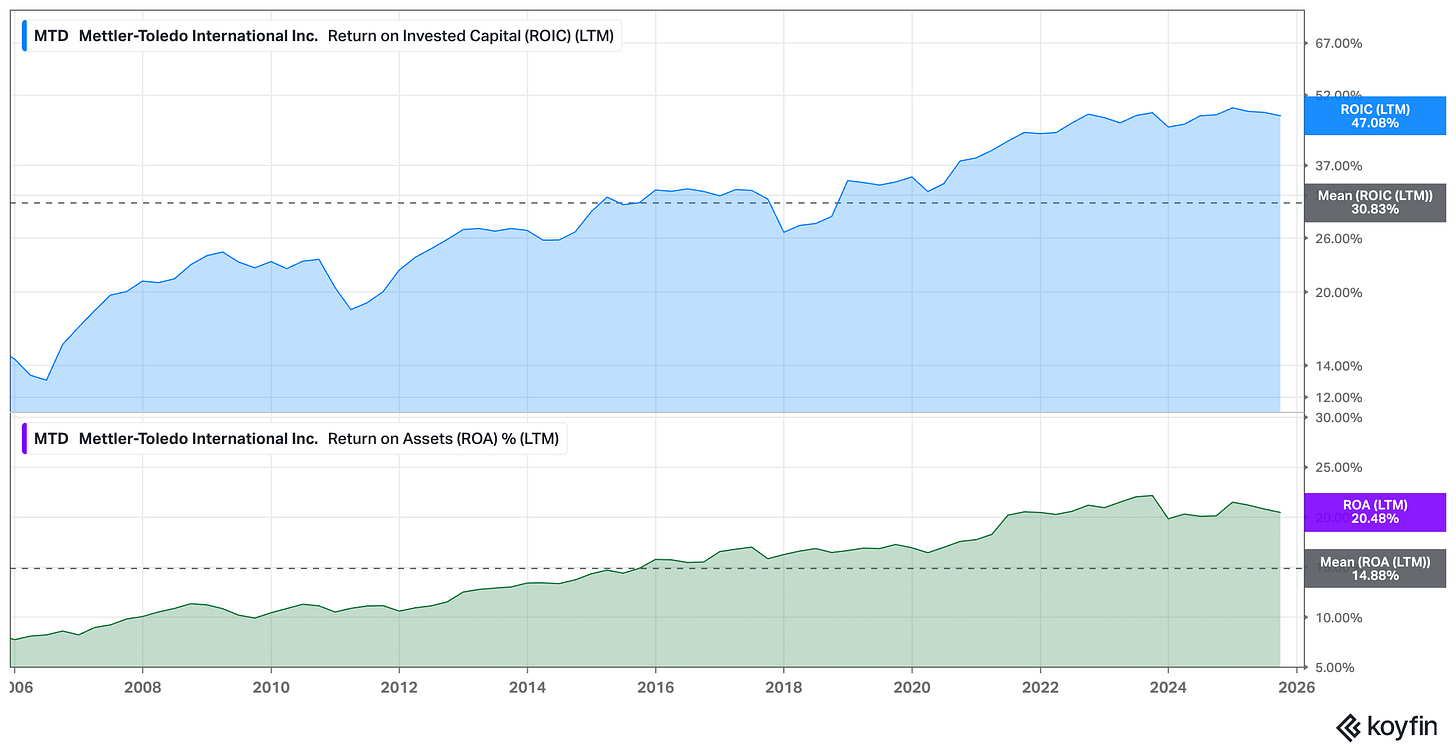

Another reason why I may have not looked closely at MTD is its consistently high valuation multiples.

But in the words of Ted Lasso, via Walt Whitman, it pays to be curious and not judgmental. Rather than dismiss MTD as an idea here because it looks expensive, let’s dig into why that’s consistently been the case. It has to be doing something worth noting.

More importantly, I want to better understand what makes MTD tick so that in the event of a pullback in the market or in the MTD stock itself, I can better assess the situation.

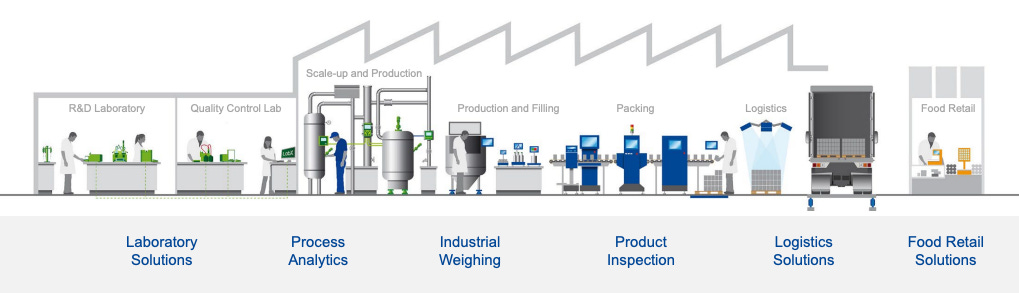

As we discussed in the previous brief of MTD, the company specializes in precision instruments and services designed for global life sciences, industrial, and food manufacturing customers.

In these industries, the accuracy of measurements, inspections, and analytics that MTD offers can literally mean the difference between life and death.

Consequently, customers are inclined to buy from reputable suppliers with a track record of accuracy and reliability. In life sciences, in particular, there’s an added need for accurate measurements to ensure regulatory compliance.