How to Quantify the Qualitative

Investing is a decision-making business and it's easier to make decisions when you better understand what you're comparing and contrasting.

Audio version:

The year-end rally provided an opportunity to make some changes to my portfolio.

I avoid trading activity as much as possible. I don’t enjoy selling. I’d much rather watch great businesses bought at attractive prices flourish. But sometimes, activity is prudent. As with gardening, there are times when pruning is good for the long-term health of both the plants and the garden.

In particular, selling some of my Costco shares was behaviorally tricky. It’s been my largest position, and I’ve owned it for over a decade. I’ve been rewarded for not selling in the past and do not think the stock is as overvalued as some, even astute Costco followers, believe.

With the stock trading at record-high multiples and above my fair value range and the portfolio weight getting uncomfortably large, however, it seemed reasonable to reallocate some capital.

But how much should I trim, and how should I reallocate the proceeds?

These types of questions are what make selling so tricky, but selling is a critical component of portfolio management.

As we discussed in Position Sizing: Optimizing for Better Returns, position sizing is a function of conviction (quality assessment + level of understanding) and valuation.

Holding valuation equal across all holdings, a higher conviction name should have a larger slice of the portfolio. Holding conviction equal, more capital should be put behind the most undervalued names.

It sounds easy when it's put that way, but in practice, it’s a much murkier process. Valuation is inherently quantitative, making ranking across the portfolio more straightforward.

Conviction, in contrast, is a qualitative process. To address this issue, I wrote in Letting Go: Why Selling is so Hard to Do:

“However, when a new idea gets interesting, you wonder if it should replace an existing position. But which one?…

To remove some emotion from the equation, quantify your qualitative judgments about each company. Rank characteristics like moat, management, and financial strength relative to your other holdings. If a new idea has better rankings than one treading water at the bottom, the bottom rank is the one to go.”

In this post, I will introduce a system for quantifying qualitative judgments and how they impact position-sizing decisions. In the future, each new Flyover Stock profile will include my scores.

You may want to use different attributes that better suit your approach or a modified scoring system, but I believe you’ll find this a helpful process.

Let’s start with some general premises.

First, a company has passed a quality threshold. The reason it's being scored at all is that it doesn't score a zero in any of the categories below. In other words, these aren’t ranks relative to the entire universe of stocks but relative to a set of quality businesses.

Second, the scores aren’t static. Companies aren’t stationary and are getting stronger or weaker every day. As such, the scores can and should change over time.

Finally, the scores for each category are from one (lowest) to five (highest) based on the following assumptions.

1 = 10th percentile (middling / at risk)

2 = 30th percentile

3 = 50th percentile (solid)

4 = 70th percentile

5 = 90th percentile (truly exceptional)

After each category is ranked, I use the simple average of the scores to arrive at an overall score.

I'll explain each category and provide three examples from my portfolio to illustrate the system.

Moat width - How difficult would it be for a competitor to eat away at the company’s competitive advantages and, therefore, its returns on invested capital?

Moat durability - How likely will the company continue to out-earn its cost of capital over the next decade and beyond?

Moat trend - How likely will the company's competitive advantages strengthen over the next 3-5 years?

Stewardship - How well is management allocating capital in a manner that will increase the company’s intrinsic value?

Simplicity - How easy is it to explain to someone how the business turns revenue into cash flow?

Forecastability - How well do I understand the key performance variables of the business, and how confident am I in my ability to forecast them?

These are representative questions for each category, and there are more ways to consider each attribute.

To illustrate the scoring system, here’s how I rank three companies most investors are familiar with - Costco, Nintendo, and Diageo.

Right away, we can see a few advantages of this process.

First, it forces you to think through what you mean when discussing each company's quality attributes. Diageo has a wide moat, but I worry about longer-term impacts on alcohol demand and some expensive acquisitions in recent years. I can account for these concerns and track them over time with the scoring system.

Second, we now have more defined premises for debate - internal or external. Suppose you score Nintendo's stewardship score differently. Great, tell me why. That's a better conversation than talking about why Nintendo is or isn't a quality company.

Finally, I can make more informed portfolio management decisions with these scores in hand. Diageo, for example, has lower quality scores than Costco. Still, if I want to sell some Costco and reinvest the proceeds into Diageo shares, I know how much I'm giving up in terms of relative quality in exchange for more potential upside to fair value.

The next step in determining position sizing would be to consider how well I know the companies and the discounts (or premiums) to fair value for each holding. Those are topics for another day.

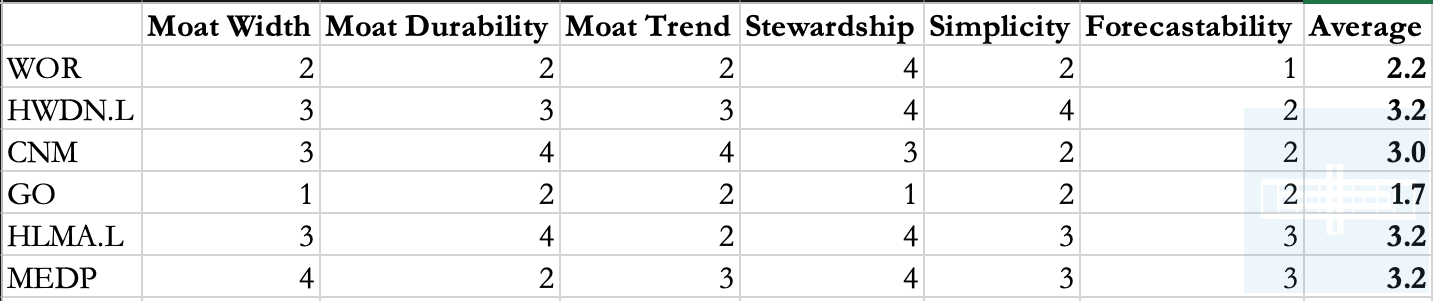

For some additional examples, I’ve rated each of the profiled Flyover Stocks to date.

If you read each of the profiles on their own, you may assume that I feel generally equally about them in terms of quality. But these ratings show that’s not true. While they all cross my quality threshold, I have a more favorable view on the relative quality of Howdens Joinery, Halma, and Medpace versus Worthington Enterprises and Grocery Outlet Holdings.

I would own them all at the right price, but with different position sizes, holding valuation equal.

In this post, we’ve discussed an example of how investors can quantify qualitative analysis to help make portfolio level decisions. The better we’re able to express and understand our own thinking around qualitative analysis, the more informed and confident we can be in making trades in our portfolios, however rare that may occur.

Do you use a similar quantitative method in your portfolio? Let me know in the comments section below. If you enjoyed this post, please like or share this post so that more thoughtful investors can find our community and be sure to follow the Flyover Stocks podcast wherever you get your podcast feed.

Stay patient, stay focused.

Todd

At the time of publication, Todd and/or his family owned shares of Costco, Nintendo, Diageo, Worthington Enterprises, and Howdens Joinery.

Disclaimer:

This material is published by W8 Group, LLC and is for informational, entertainment, and educational purposes only and is not financial advice or a solicitation to deal in any of the securities mentioned. All investments carry risks, including the risk of losing all your investment. Investors should carefully consider the risks involved before making any investment decision. Be sure to do your own due diligence before making an investment of any kind.

At time of publication, the author or his family may have an interest in the securities mentioned or discussed. Any ownership of this kind will be disclosed at the time of publication, but may not be updated if ownership of a particular security changes after publication.

This newsletter does not provide buy or sell recommendations and articles should not be interpreted this way.

Information presented may be sourced from third parties and public filings. Unless otherwise specified, any links to these sources are included for convenience only and are not endorsements, sponsorships, or recommendations of any opinions expressed or services offered by those third parties.

Flyover Stocks has partnered with Koyfin to provide a discount to Koyfin’s services for Flyover Stocks readers. The W8 Group, LLC, which publishes Flyover Stocks, may receive a commission from a reader’s purchase of Koyfin services.