The Inevitable Capital Cycle

Long-term investors need to be attuned to the rhythms of capital flows

“What has been will be again, what has been done will be done again; there is nothing new under the sun.” - Ecclesiastes 1:9

There’s good reason why Marathon Asset Management’s Capital Returns is a favorite among quality investors.

The book’s key message is that “changes in the amount of capital employed within an industry are likely to impact future returns [and] how the competitive position of a company is affected by changes in the industry’s supply side.”

The more capital or supply that’s added to a sector is likely to have an inverse relationship on that industry’s profitability and its competitive positioning. As returns on capital improve in an industry, capital naturally flows toward it, leading to increased competition and lower returns on capital.

The lower returns on capital then force weaker hands out of the market, creating a new opportunity for surviving participants to earn high returns.

Two recent examples are homebuilding and bourbon. The combination of COVID quarantines, millennials reaching prime earning/family formation age, constrained housing supply, work from home arrangements, and low interest rates drove strong house construction demand for a few years.

Even rising interest rates in 2022 didn’t seem to slow demand, as homebuilders adjusted by buying down mortgage rates to appeal to apprehensive buyers.

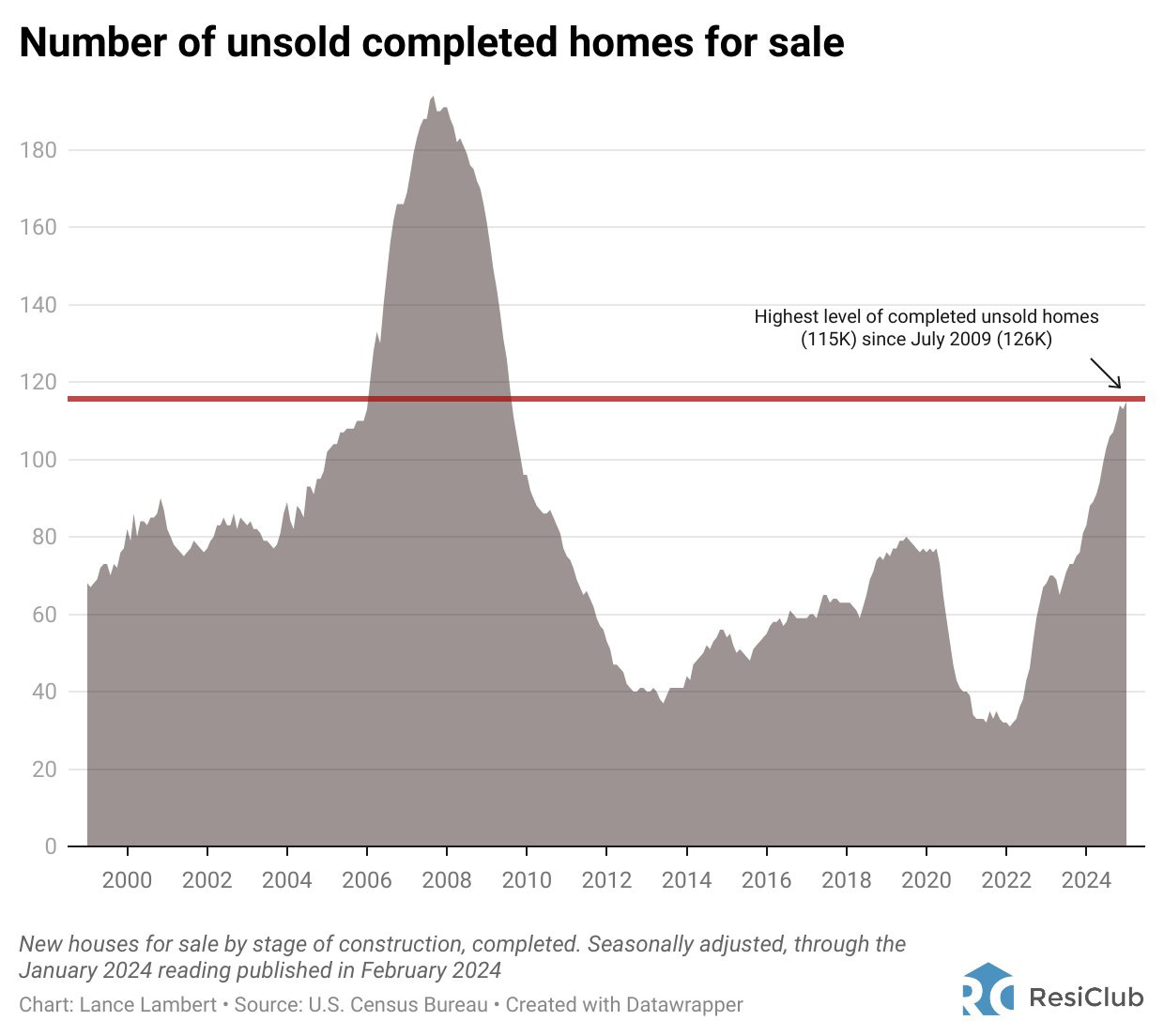

As the chart above suggests, this cycle has turned. One of the factors contributing to the reversal is that companies started to require employees to come back into the office full time. Many homes that were built during the pandemic were built far from city centers when work-from-home/hybrid arrangements seemed like they were going to be the new normal.

That’s the thing: we don’t know what will cause the cycle to turn, or when it will occur. Investors who thought the housing boom would end with higher rates in 2022 were wrong and the cycle continued for another two years. What we can be confident in is that it will turn, eventually.

A time lag between production and demand can exacerbate the capital cycle. This has been on full display in the bourbon industry. As the chart below illustrates, the bourbon boom played out over nearly two decades.

Today, there are record levels of Kentucky bourbon inventory aging in warehouses. Because bourbon needs to be aged for at least two years to be labeled “straight bourbon” there is a timing mismatch. Barrels filled years ago anticipated the continued robust demand today, but for various reasons that is not the case.

If you search for “distillery closing” you’ll find a number of recent examples of distilleries launched in recent years closing their doors, with comments about slowing spirits markets as the main culprit.

This suggests that the cycle has begun to turn. How long it takes to play out is the billion-dollar question.

As we discussed two weeks ago, however, investor pessimism around bourbon and liquor in general is high and that in itself could be a sign to do further research.

As Marathon suggests in the book:

“The turn in the capital cycle often occurs during periods of maximum pessimism as the weakest competitor throws in the towel at the point of extreme stress. When the pain of losses coincides with a depressed share price, investors can find wonderful opportunities, particularly if they are willing to take a multiyear view and put up with short-term volatility.” (emphasis mine)

Aye, that’s the rub.

The capital cycle makes complete sense, but it’s so easy to lose sight of it in the moment. Especially in the social media age, compelling narratives crafted during the boom and busts of the cycle suggest “this time is different,” and we are prone - myself included! - to wondering if that is indeed the case.

Even if we recognize the capital cycle at play, it’s unclear how long it might take to play out. Depending on the circumstances, a cycle could take 3-5 years to turn. That’s 6-10 times longer than the average holding period for U.S. stocks and feels like an eternity when you’re managing money.

In the meantime, you worry that you’ll stop dancing while the music is still playing or, conversely, jump in too early and look foolish in front of your clients while the industry finds a bottom.

It’s one thing to understand the capital cycle, it’s another to invest through it. The question we need to ask ourselves, then, is, “Are we truly long-term investors?”

If the answer is no - and no shame if that’s the answer - then the capital cycle takes a back seat to momentum trading.

If the answer is yes, then we need to be emotionally, behaviorally, and structurally prepared to manage the consequences that come with both arriving and leaving a party too soon.

Of course, if this was easy, everyone would do it.

Stay patient, stay focused.

Todd

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, KNA Capital Management, LLC and/or its clients do not own shares of any company mentioned.

Please see important disclaimers.

Really enjoyed the article. What would this mean for AI given the incredible capex plans from the hyperscalers this year?

Enjoyed the article and the examples. I love the Biblical verse to open up the article. Many investors underestimate the value of the Bible in understanding ourselves and the world in which we invest.