Buffett's Aim Small, Miss Small Approach

Neutralizing the impact of sentiment changes allows the business fundamentals to drive the bulk of the investment returns over the long run

Audio version:

At the 2022 Graham & Dodd Annual Breakfast, Berkshire Hathaway investment manager Todd Combs shared the following story about what he and Warren Buffett ask each other when looking for investment ideas:

“How many names in the S&P are going to be 15x earnings in the next 12 months? How many are going to earn more in five years (using a 90% confidence interval), and how many will compound at 7% (using a 50% confidence interval)?”

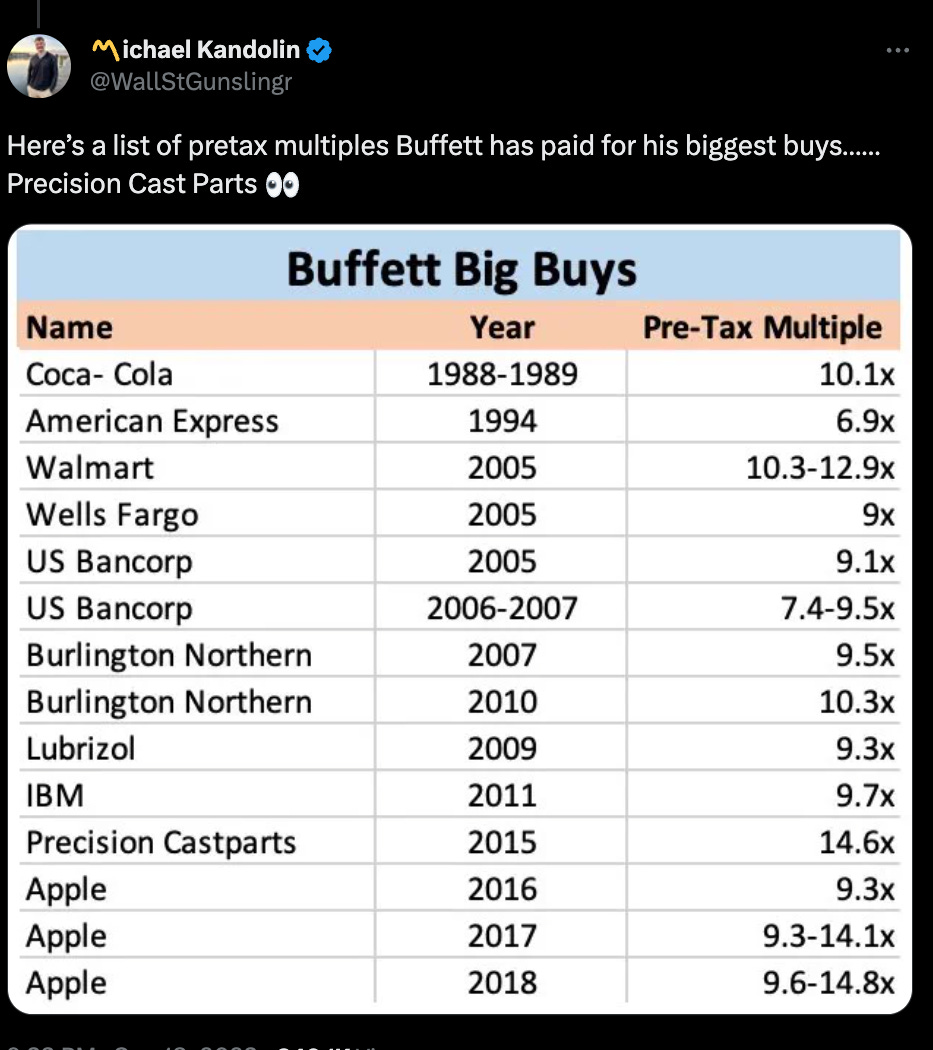

Indeed, this is consistent with the pre-tax multiples Berkshire has paid for some of its most significant investments in recent decades, as illustrated in this post from @wallstgunslingr.

Why do Buffett and Combs use 15 times earnings as a starting point?

Without being able to ask them directly, here are two potential reasons why they use 15 times earnings.

First, the long-term historical average and median S&P 500 P/E is between 15 and 16 times. Finding companies with these multiples allows your investment returns to be dictated by business performance rather than changes in market sentiment.

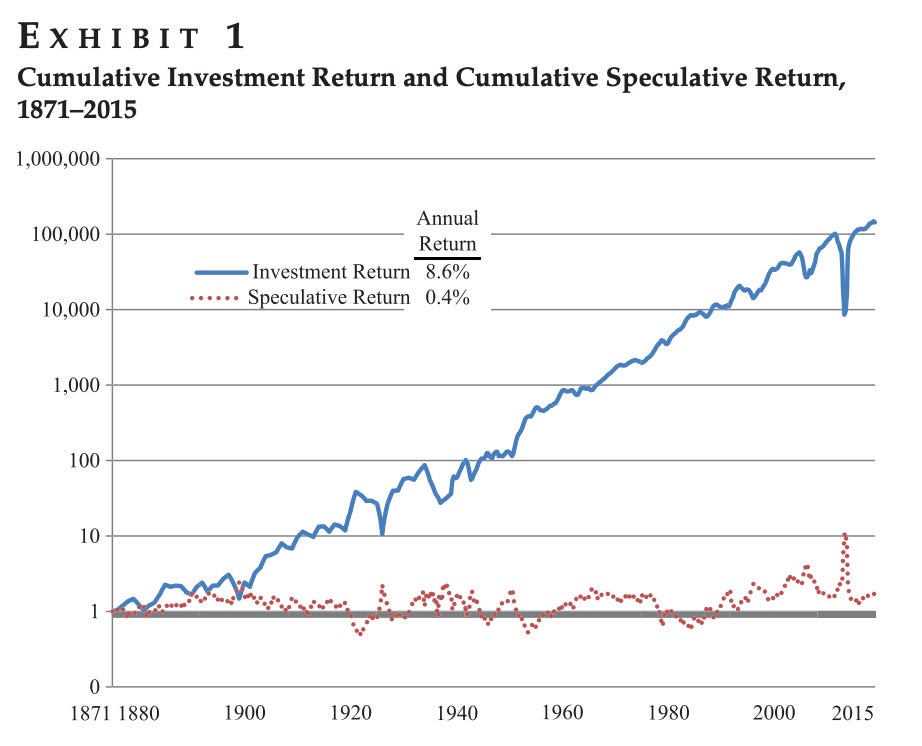

Here’s what I mean. In an excellent 2015 paper in the Journal of Portfolio Management, Vanguard founder Jack Bogle proposed that returns are a combination of “investment returns,” or dividend yield plus earnings growth, and “speculative returns,” or price/earnings multiple changes. Using this formula, he showed that nearly all of the market’s returns from 1871 to 2015 resulted from investment rather than speculative returns.

If your favorite holding period is forever and you believe in reversion to the mean, you want to minimize your reliance on speculative returns. To illustrate, if you invested in a company a decade ago with a starting dividend yield of 2% that grew earnings by 10% per annum - a solid “investment” return – but if it started with a 30x P/E and ended with a 15x P/E, your returns would be roughly 12% + (-6.7%), or 5.3%, weighed down by the speculative returns.

Second, the inverse of 15 times earnings – the earnings yield – is 6.7%. Assuming the company converts ~100% of its earnings to free cash flow and you have 90% confidence that the company will earn “at least as much” in five years, assuming no change to the multiple, your expected return is about 6.7% (using a back-of-the-envelope “free cash flow yield + free cash flow growth” equation).

Nothing to write home about, but a reasonable return nonetheless. And more importantly, not an impairment of capital.

But if you have 50% confidence that the 15x P/E company will compound at 7% or higher, your expected return increases to 10.2%, as the equation becomes 6.7% + (0.5 * 7%). And if the market re-rates the multiple higher, that’s an added bonus.

In marksmanship, the phrase “aim small, miss small” refers to the approach that if you aim at the broader target, you’re more likely to miss it altogether. If you aim for the bullseye and miss, however, you’re more likely to hit the target.

Not all of Buffett’s investments in the above table proved to be winners, but the misses were small enough, relative to his available capital, that he could fight another day. And ultimately, you need capital to compound capital.

Is Buffett’s rule of thumb right for every investor? Not necessarily. Some exceptional businesses command P/E multiples well above 15x for extended periods and “earn” their premium valuation. It’s also possible that historical multiples, which were more reflective of a tangible asset-based economy, are not the proper reference class for today’s more intangible asset-based economy.

Even so, for companies to earn premium multiples, they need to continue delivering premium results. That requires the company to maintain and ideally widen its moat and for management to make wise capital allocation decisions over time. It’s easier said than done but achievable for some companies.

That said, Buffett’s framework is helpful for investors to consider. When you find quality businesses trading around 15 times earnings and have confidence in the company’s ability to generate high-single-digit earnings growth over the next five years (this requires qualitative research), the risk-reward balance tilts in your favor. Not all of them will be hit the bullseye, but the result should be favorable over enough iterations.

Stay patient, stay focused.

Todd

At the time of publication, Todd and/or his immediate family owned shares of Berkshire Hathaway.

Disclaimer:

This material is published by W8 Group, LLC and is for informational, entertainment, and educational purposes only and is not financial advice or a solicitation to deal in any of the securities mentioned. All investments carry risks, including the risk of losing all your investment. Investors should carefully consider the risks involved before making any investment decision. Be sure to do your own due diligence before making an investment of any kind.

At time of publication, the author or his family may have an interest in the securities mentioned or discussed. Any ownership of this kind will be disclosed at the time of publication, but may not be updated if ownership of a particular security changes after publication.

Information presented may be sourced from third parties and public filings. Any links to these sources are included for convenience only and are not endorsements, sponsorships, or recommendations of any opinions expressed or services offered by those third parties.

Always great stuff, Todd. The nice part is the multiple ("speculative") piece tends to go up as earnings compound, it's just I prefer to get it for free.

Everything is easier said than done, of course.