Two Types of Drawdowns

Before you take the leap on a beaten-up stock, understand what game you're playing.

Academic finance posits there are two types of risk: systematic and idiosyncratic.

Systematic risk is unavoidable market risk. It can’t be diversified away and it’s the only type of risk that you get paid for taking.

Idiosyncratic risk, on the other hand, is company-specific risk. And because you can cheaply buy a diversified portfolio of uncorrelated businesses, you don’t get paid for taking this risk.

We can debate modern portfolio theory some other time, but the systematic-idiosyncratic framework is helpful for understanding different types of drawdowns - the percentage decline from an investment's peak to trough - and how we as investors should size up the opportunities.

From the time we pick up our first value investing book, we’re taught to take advantage of the despondent Mr. Market when stocks are selling off. If we keep our head while he’s losing his, we’ll prove our mettle as stoic value investors.

But all drawdowns are not the same. Some are market driven (systematic), while others are company specific (idiosyncratic). And before you hit the bid, you need to know which type you’re looking at.

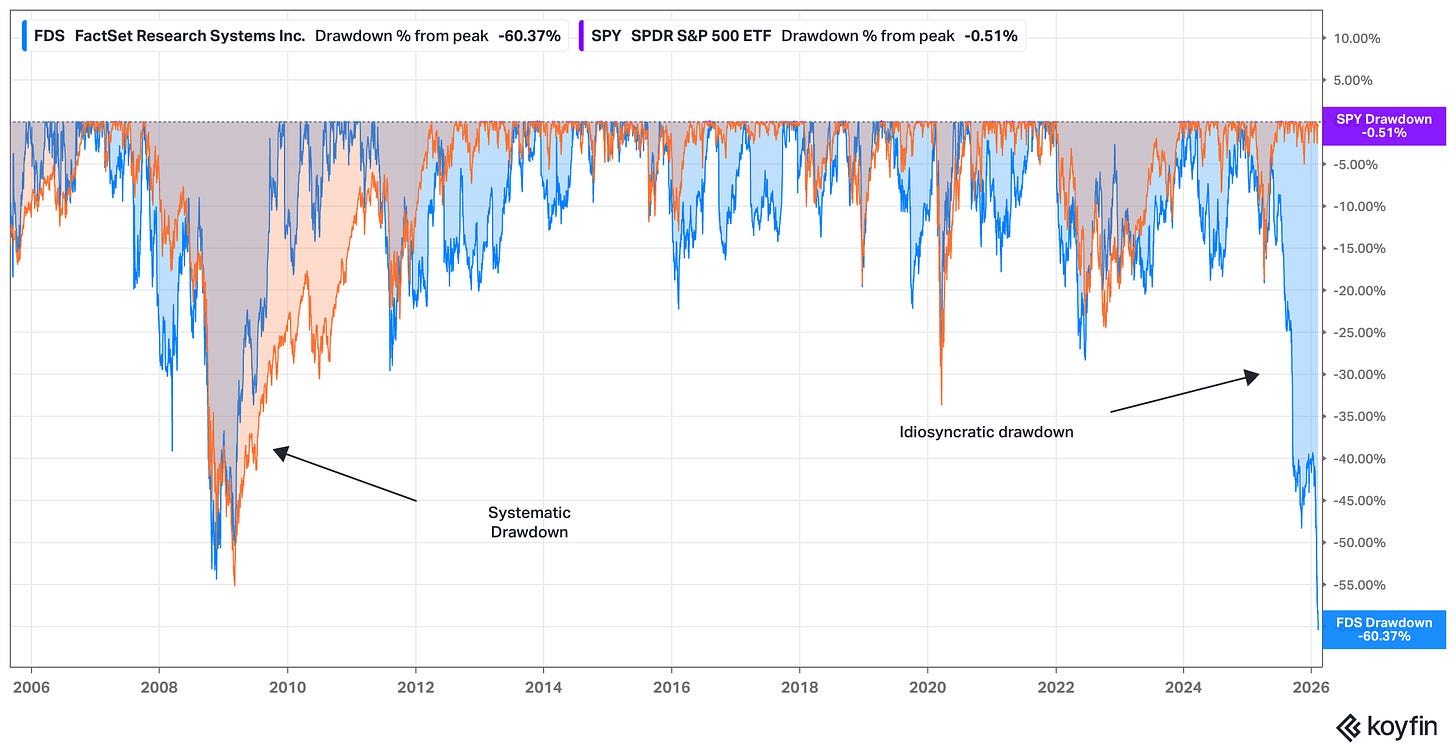

The recent selloff in software stocks due to AI worries illustrates this point. Let’s look at 20 years of drawdown history between FactSet (FDS, in blue) and the S&P 500 (as measured by the SPY ETF, in orange).

FactSet’s drawdown during the financial crisis was primarily systematic in nature. In 2008/09, the entire market was concerned about the durability of the financial system and FactSet was not immune to those concerns, especially since it sells its products to financial professionals.

At the time, the stock’s drawdown had far less to do with FactSet’s economic moat and more to do with whether FactSet’s moat mattered at all if the financial system was collapsing.

The 2025/26 FactSet drawdown is the opposite case. Here, the concern is almost entirely on FactSet’s moat and growth runway, along with general worries about accelerating AI capabilities disrupting the software industry’s pricing power.

In a systematic drawdown, you can more reasonably make a time arbitrage bet. History suggests that markets tend to bounce back and a company with an intact moat might even emerge stronger than before, so if you are willing and able to be patient while others are panicking, you can use a strong stomach to capitalize on a behavioral advantage.

With an idiosyncratic drawdown, however, the market is telling you something is wrong with the business itself. In particular, it’s implying that the terminal value of the business is increasingly uncertain.

If you hope to capitalize on an idiosyncratic drawdown, then, you need to have an analytical advantage in addition to a behavioral advantage.

To succeed, you need to have a more accurate vision of what the company looks like ten years from now than what the market price currently implies.

Even if you know a company well, that’s not easy to do. Stocks don’t normally drop 50% versus the market for no reason. A lot of once-steady owners - maybe even some investors that you respect for their deep research - have had to capitulate for it to happen.

If you’re going to step in as a buyer during an idiosyncratic drawdown, you need to have an answer for why these otherwise well-informed and thoughtful investors were wrong to sell and why your vision is correct.

There’s a fine line between conviction and arrogance.

Whether you own a stock in a drawdown or you’re looking to start a new position in one, it’s important that you understand what type of bet you’re making.

Idiosyncratic drawdowns can entice value investors to start poking around for opportunities. Before you take the leap, make sure you aren't using a blunt behavioral solution for a nuanced analytical problem.

Stay patient, stay focused.

Todd

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, KNA Capital Management, LLC and/or its clients do not own shares of any company mentioned.

Please see important disclaimers.

Where do you draw the line for idio vs systematic? The drawdown chart might look a bit more systematic if compared to other data cos / software etc? Definitely appreciate the point you're making and agree to a large extent, but drawdowns for a sector / broad peer group can also have a systematic element to them where the opportunity is the proverbial baby in the bathwater? (Not that Factset would necessarily be said baby in the current drawdown, mind...)