Projection vs. Perspective; Games Workshop Update

Investors need to be on guard against projecting personal beliefs and biases into their business analyses

Compounders Podcast

I recently appeared on Ben Claremon’s Compounders podcast, where we discussed a variety of topics including why I started KNA Capital Management, the importance of economic moats in my investment process, and the benefits of teaching finance and investing to university students.

You can listen or watch the episode wherever you get your podcasts, or find the links on the KNA Capital website. It was a fun conversation and I hope you enjoy listening to it.

Projection vs. Perspective

"It is a capital mistake to theorize before one has data. Insensibly, one begins to twist facts to suit theories, instead of theories to suit facts."

- Sir Arthur Conan Doyle, Sherlock Holmes: A Scandal in Bohemia

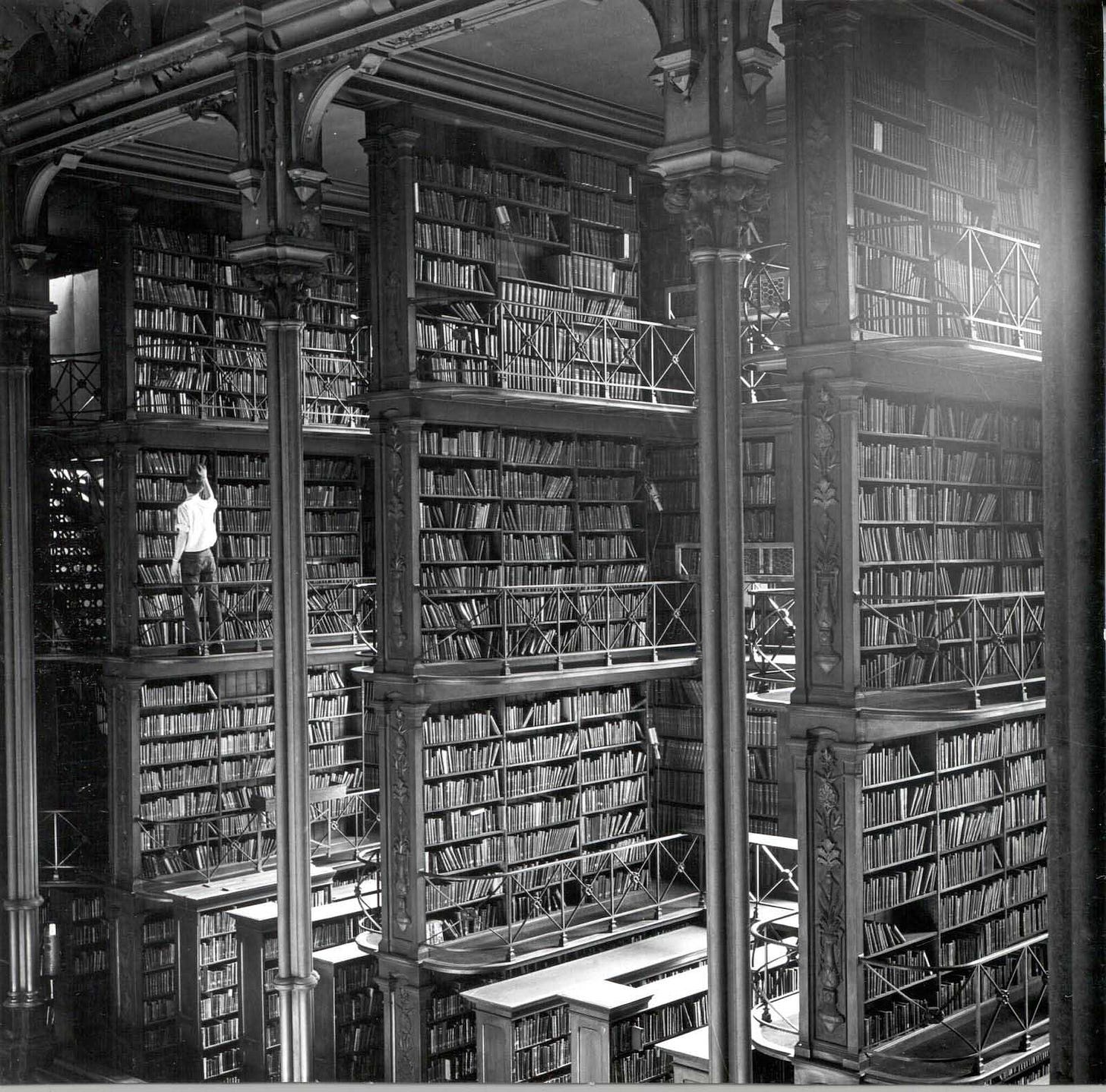

Every few months, the picture below lands on my X feed. It’s a picture of the “Old Main” Cincinnati Public Library, which was demolished in 1955.

Old Main was purchased from a bankrupt opera company while under construction, making it a unique setting with high ceilings and wrought-iron railings. The Cincinnati Public Library moved into the building in 1870.

The picture is indeed striking, but that’s not what makes it go viral. What makes it go viral is people commenting about the shortsightedness of demolishing it, lamenting the loss of historical treasures, and mocking the fact the building is now a parking lot.

Look, as a book lover, history nerd, and Cincinnati native, I would have loved for it to be around today, too. But in reality, Old Main was kind of a dump - not to mention a safety hazard.

Moreover, the Cincinnati Public Library simply outgrew the space. (Today, the Public Library of Cincinnati and Hamilton County has the second highest circulation of any public library in the U.S.)

A Cincinnati Enquirer article from November 1944 noted, “It is humiliating for a Cincinnatian to visit libraries in other cities and to compare them with (Old Main).”

As the Old Main example shows, it’s easier to project our beliefs and biases onto an idea than to seek the perspective to truly understand it. Perspective requires you to step outside of yourself and consider all the angles to gain a 360-degree understanding.

Gaining perspective as to why Old Main was demolished doesn’t make for a viral social media post - but it is the better approach if you care to understand its history.

Investors - individually and as a group - can fall into the projection trap just as easily. Theranos, WeWork, Enron, and Wirecard are a few classic examples where investors bought into narratives that didn’t paint accurate pictures of the businesses.

In the case of Theranos, stakeholders wanted so desperately to believe that Elizabeth Holmes was the next Steve Jobs and was revolutionizing healthcare that they missed the fact that the blood testing product simply didn’t work. With Wirecard, German regulators and other stakeholders thought they had found a European fintech champion to rival American giants, and overlooked or ignored some of the red flags.

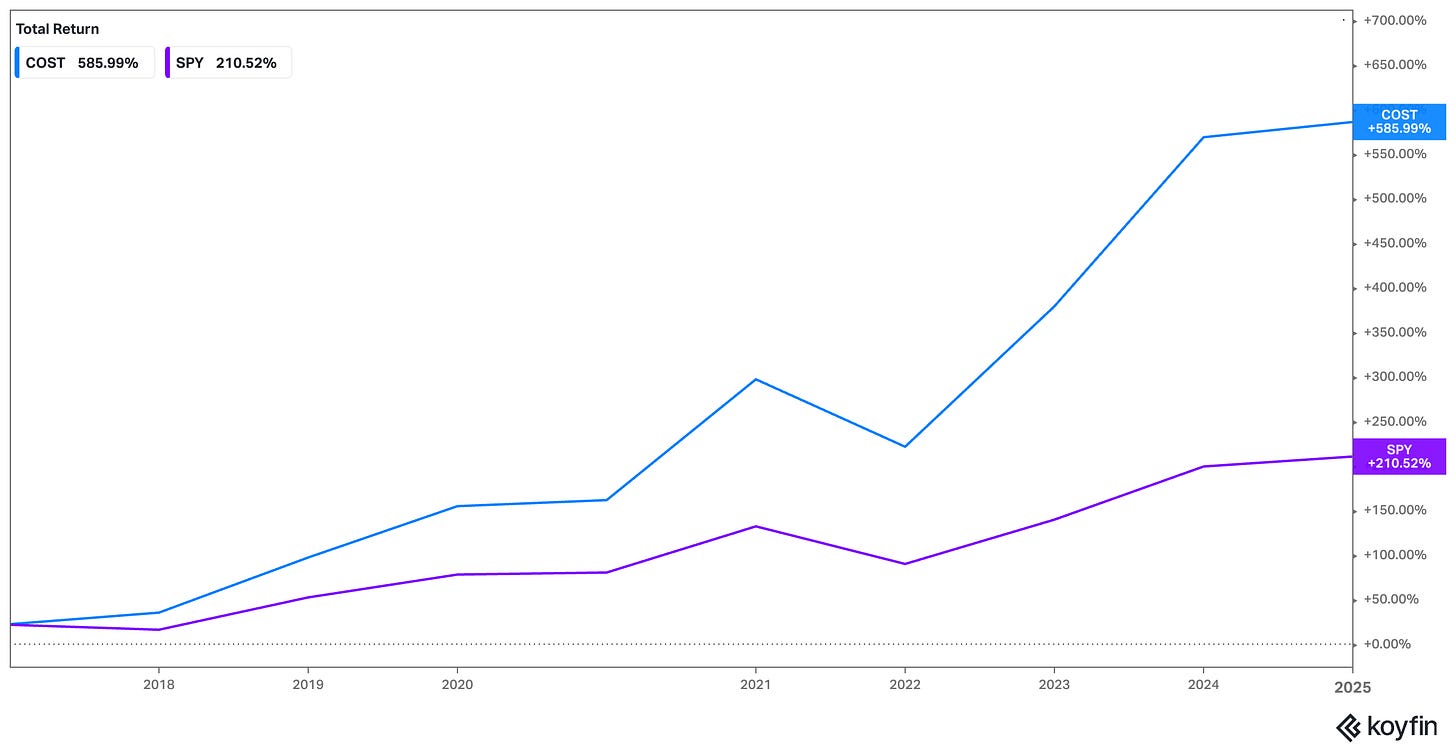

The costs of projection can be to the downside or to the upside. For example, when Amazon bought Whole Foods in June 2017, Costco’s stock price fell about 20% on fears that Amazon Prime would undercut the relevance of Costco’s membership model.

The projection was that Amazon + Whole Foods, fueled by better e-commerce and technology capabilities, would be a more convenient grocery option for consumers.

Gaining proper perspective in June 2017 should have included speaking with core Costco customers and asking them if they would change their shopping behavior now that Amazon bought Whole Foods, if delivered perishables were equivalent to hand-selected perishables at the store, and if online grocery shopping really saved consumers time.

The kneejerk response to selling Costco proved to be an expensive mistake.

So, how can we defend ourselves against projection and ensure we’re seeking perspective? Here are a few ideas:

Be mindful of emotions: If you find yourself getting emotionally excited about a company’s potential, it’s time to pause and reflect. If you’re feeling this way, others are likely doing the same and your emotions may be overriding your reasoning. Long-term investors should build conviction, but it should be done so dispassionately.

Be wary of compelling narratives: Humans are hardwired to think in stories and good stories can have a powerful impact on our behaviors. This is particularly true when the narratives support our priors.

Seek disconfirming evidence: Part of building conviction - the kind that will keep you from bailing out at exactly the wrong time - is studying and appreciating the opposite case. This will also help you gain the necessary perspective and reduce the risk of projecting.

Ultimately, the goal is to develop the most accurate understanding of a company’s present and future. Projecting our existing beliefs onto an investment can warp that understanding or limit our ability to appreciate all angles.

Games Workshop update

Paid subscribers to Flyover Stocks: the content continues below

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC or its clients owned shares of Amazon.

Please see important disclaimers.