Post-Thanksgiving Thoughts

A brief commentary on various topics that came up over the past week

I hope everyone had a nice Thanksgiving, filled with football, family, and food. We hosted 11 out-of-town family members for the extended weekend and had a great time showing them around Cincinnati.

A few items and thoughts from the week that was.

First, thanks to Bogumil Baranowski for hosting me on his Talking Billions podcast. Bogumil asked great questions, including my story about how seashell hunting is a good analogy for finding investment ideas. You can give our discussion a listen using the link below or wherever you get your podcasts.

A friend recently shared a digital inventory of his library and it’s proven a great resource for finding new material and holiday gift ideas. Incidentally, I was cleaning up my home office and did the same thing with my investing and business books. You can view my bookshelf here.

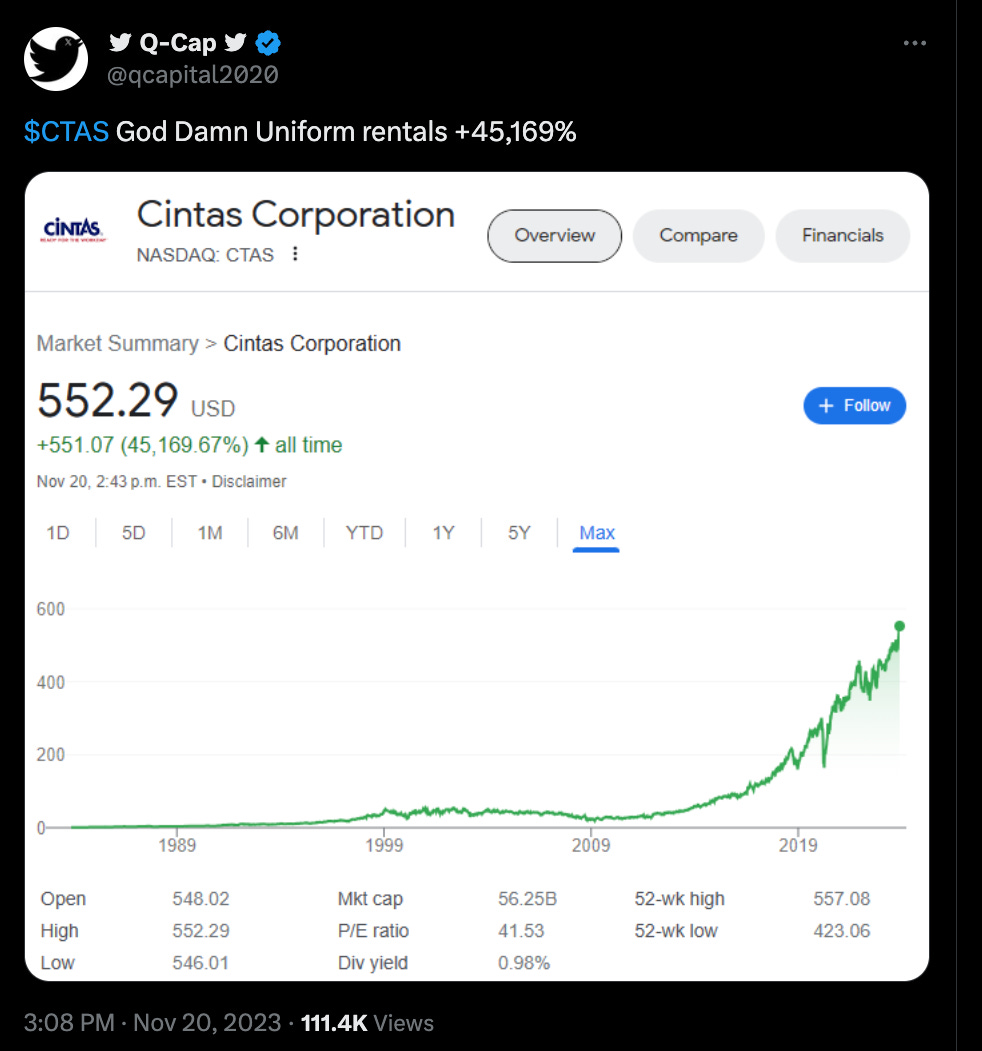

This tweet from Qcapital2020 on Twitter showing the long-term performance of Cintas (CTAS) reminded me that sometimes the best stock ideas are right under your nose. Indeed, had I focused my research on other Cincinnati-based companies like Medpace (MEDP) and Chemed (CHE), I would have been better off! Home bias, it turns out, isn’t always a bad thing. Don’t forget to look local as well as far afield for ideas.

Another chart was posted on Twitter, this one of Microsoft’s long-term performance. The commentator used it as evidence of Nadella’s leadership being superior to Ballmer’s. Nadella may indeed be a better CEO, but using stock performance is not a sufficient metric to make that judgement. Under Ballmer, Microsoft multiplied its revenue and earnings per share, but when your starting P/E is 65x, you’re working against a mighty headwind in terms of stock performance. By comparison, Nadella started with a P/E of 14x. As readers of this article understand, that makes a big difference.

My friends at Stockopedia hosted a webinar on their research into UK-based multibagger stocks of the last decade. Stockopedia ranks companies on quality, momentum, and value metrics and showed how the rankings of the cohort of top performers changed over the decade. Perhaps not surprisingly, the group started off cheap. It also featured strong quality and positive momentum rankings. (I’m not focused on momentum in my philosophy, but I do think there’s some merit to it.) What I like about the below chart is that it shows how quality rankings started and remained strong. Indeed, it improved over time, which helped re-rate the multiples higher. While I don’t intentionally look for multi-baggers - I look to hit line drive singles and doubles, knowing that sometimes they sail over the fence - I found Stockopedia’s research useful to visualize future winners on quality, value, and momentum metrics.

There’s a new Flyover Stocks company profile coming in early December. Stay tuned!

Stay patient, stay focused.

Todd

At the time of publication, Todd and/or his family did not have an ownership position in the companies mentioned above.

Disclaimer:

This material is published by W8 Group, LLC and is for informational, entertainment, and educational purposes only and is not financial advice or a solicitation to deal in any of the securities mentioned. All investments carry risks, including the risk of losing all your investment. Investors should carefully consider the risks involved before making any investment decision. Be sure to do your own due diligence before making an investment of any kind.

At time of publication, the author or his family may have an interest in the securities mentioned or discussed. Any ownership of this kind will be disclosed at the time of publication, but may not be updated if ownership of a particular security changes after publication.

This newsletter does not provide buy or sell recommendations and articles should not be interpreted this way.

Information presented may be sourced from third parties and public filings. Unless otherwise specified, any links to these sources are included for convenience only and are not endorsements, sponsorships, or recommendations of any opinions expressed or services offered by those third parties.

Flyover Stocks has partnered with Koyfin to provide a discount to Koyfin’s services for Flyover Stocks readers. The W8 Group, LLC, which publishes Flyover Stocks, may receive a commission from a reader’s purchase of Koyfin services.