Flyover Stock: YETI Holdings (YETI)

Despite competitive threats, YETI's brand strength shouldn't be underestimated

Executive summary

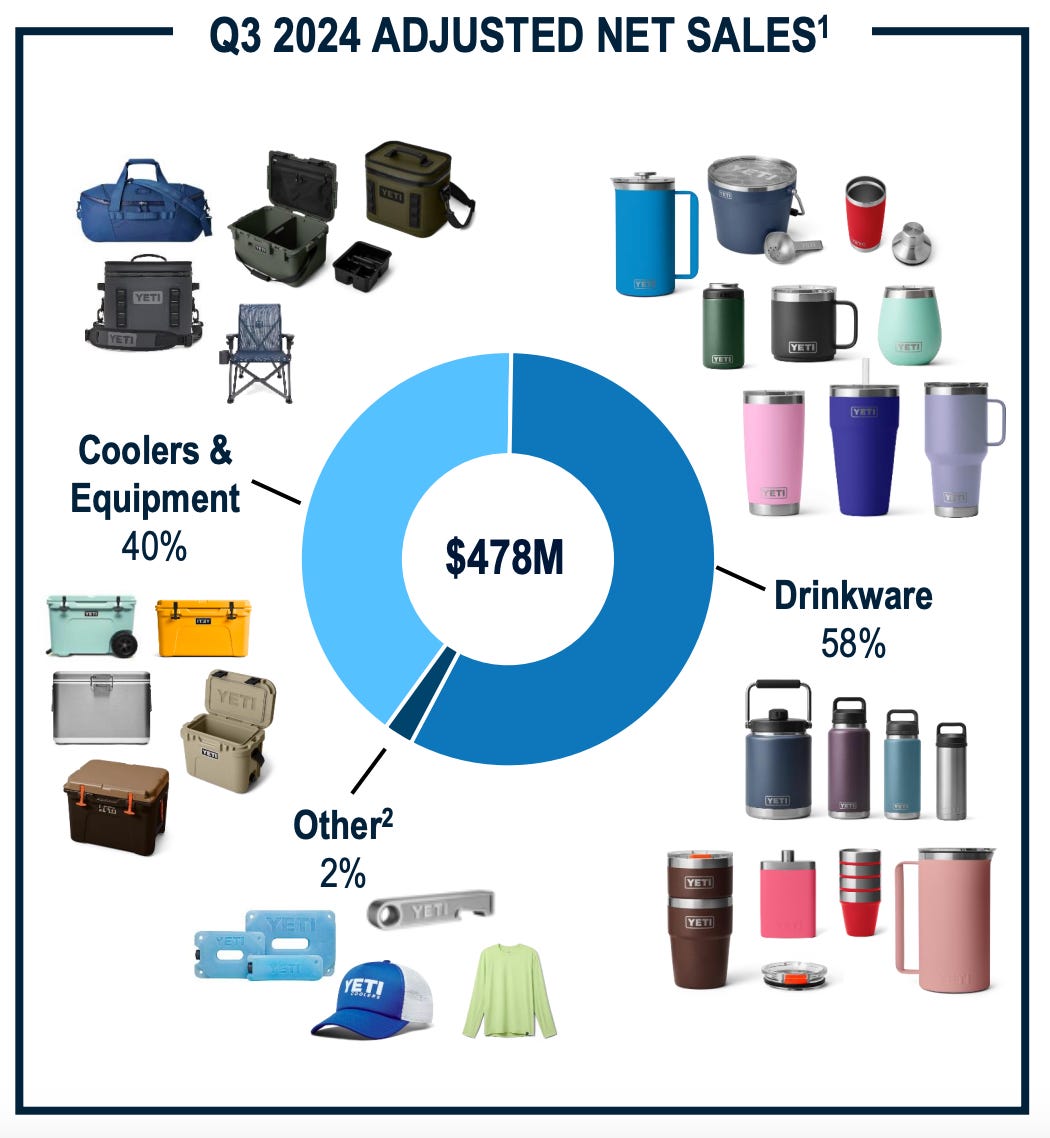

Founded in Austin, Texas in 2006, YETI produces over-engineered, premium-priced drinkware, coolers, luggage, and cookware.

Despite increased competition, revenues in both segments are rising, gross margins are steady, and international sales have grown over 30% year-over-year for four consecutive quarters.

YETI is trading near 16-times trailing P/E with a 5% free cash flow yield and a net cash balance sheet.

Background

One of my favorite investors, Nick Train of Lindsell Train, has a great line:

“Never invest in any company that makes anything out of metal.”

That’s generally good investing advice. For one, metal products like dishwashers or cars don’t need to be replaced often. A customer might transact with the company once a decade.

All else equal, it’s preferable to sell a regularly consumed product so the customer stays engaged with the brand.

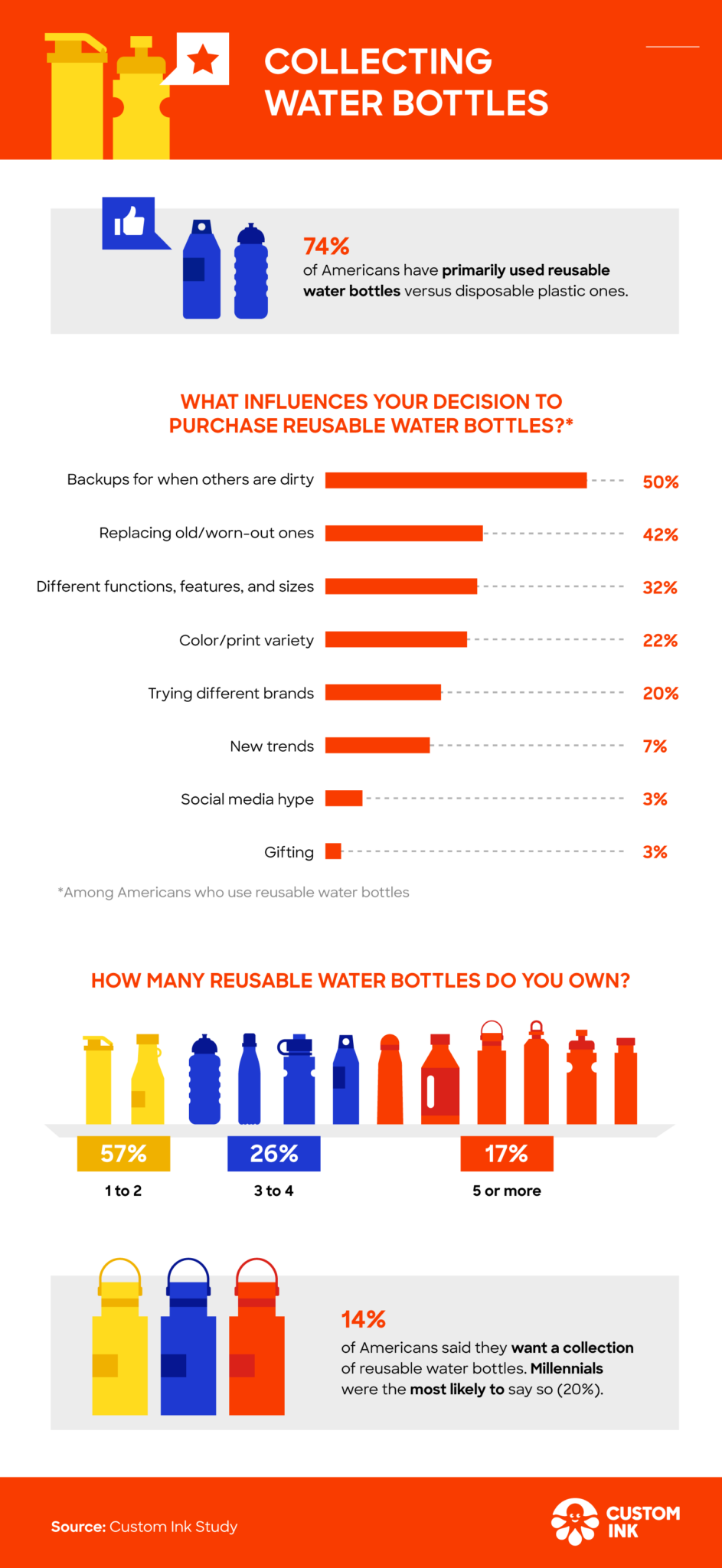

Judging by the state of the stainless steel drinkware in my kitchen cabinet, however, YETI may have cracked the code. Over a decade or so, I have bought more sizes, shapes, and colors of YETI drinkware than I care to admit.

At least I’m not alone…

Suffice it to say that I come to this month’s profile with some personal bias favoring YETI, but I also appreciate the bear case on the company, which I’ll summarize here:

“YETI successfully created premium brands in dull end markets like coolers and drinkware, but competitors like Stanley and Hydro Flask have caught up and introduced their own premium drinkware options. Fast-followers like RTIC and SharkNinja are good competitors in the cooler space.

Price conscious consumers now have more lower-priced options and there are only so many cups and coolers a household needs. If consumer spending tightens, demand for YETI’s higher-priced options will be the first to drop.

To drive growth, YETI will need to lower prices, push sales through lower-margin wholesale partners like Amazon, or venture overseas where its brand may not resonate as well as it does with American consumers.”

At least, this is the logic that’s kept me from owning shares thus far. I’m no longer sure it’s entirely correct.

The drinkware competition is indeed real - most of my college students have Stanley or other non-YETI drinkware on their desks, for example - but I would have thought these competitive pressures would have had a greater impact on revenue and margins by now. That hasn’t been the case.

Drinkware growth has slowed, but it’s still positive. In the most recent quarter, drinkware sales were up 9% year-over-year.

After a tough few quarters, the Coolers & Equipment segment has come back to life, as well.

Further, as the five-year Google Trends chart shows, searches for “YETI” during the two major demand seasons - summer and Christmas - do not appear to be losing steam.

YETI may be covered by 17 sell-side analysts, but I still think there’s something investors are missing about the brand. It may have to do something with its cultural appeal in flyover country.

According to Google Trends, here are the US cities where “Yeti” had the highest proportion of local searches over the past year:

Whether it’s hunting, fishing, boating, hiking, or camping, outdoor activity is a common theme among these cities.

On the other hand, of the 206 available US cities, New York was the second lowest behind Las Vegas, where attention is elsewhere.

All this is to say that I think there’s a higher probability that an analyst in Lower Manhattan underappreciates what makes YETI’s brand appealing to its core customers.

Even outside of New York, it can be challenging to understand why YETI has been able to remain relevant as long as it has.

This 2023 Wired article addresses this:

“Bar none, there is no company that’s easier to make fun of than Texas-based Yeti. My house is full of hilariously overengineered, overpriced products. The problem starts when these products become the most useful items I own.

…

I even forced my husband to make a pilgrimage to the Yeti flagship store in Austin, Texas. On one level, I find it repulsive to make such an ostentatious production out of spending so much money on the company's signature cooler. A cooler! It's just something to put your Coke and bait in! Yet everything was so exquisite, so heavy, in just the right colors. As I wandered the aisles picking things up and putting them down again, I felt a deep, primal yearning for a Ford F150 and a fly-fishing vest.” (My emphasis)

Or consider this article from Texas Monthly ahead of Yeti’s 2018 IPO:

“Yetis, in other words, are coolers for people who care deeply about coolers—primarily die-hard outdoorsmen but also those who simply want to be mistaken for die-hard outdoorsmen. Even in the suburban enclaves of the Gulf Coast, a Yeti cooler may be the greatest source of weekender braggadocio since the Big Green Egg smoker.

Yeti’s value stems not just from the quality of its products but from the image that its brand projects. In just a few years, Yeti has established itself as what marketing experts call an “aspirational brand,” meaning that some people will pay a premium for the name, even if they can find a similar no-name product for less. “Aspirational brands provide a signal to everyone around us,” says Kevin Williams, a senior lecturer in marketing at UT’s McCombs School of Business. “It’s not just about being better in terms of engineering metrics. It’s about ‘Hey, I’ve got a Yeti and you don’t.’ ” (my emphasis)

Both snippets touch on important aspects of YETI’s brand appeal.

First, YETI products are well made and well reviewed. The coolers can keep ice for days, the drinkware keeps beverages hot or cold for hours and customers have come to trust its quality. These attributes are especially appealing today when there seems to be a growing amount of junky, cheap products out there.

Second, YETI’s marketing is brilliant and it has connected the brand with the “outdoor lifestyle” which is increasingly appealing in a world increasingly dominated by screen time.

Perhaps as a result of digital distractions, industry data show that more Americans than ever are participating in outdoor activities, which introduces more consumers to outdoor lifestyle brands like YETI.

YETI’s advertising has a consistent aesthetic and makes emotional connections to authenticity, quality time with friends and family, and sustainability.

These consistent investments in connecting the brand with a narrative help maintain pricing power and margins.

Finally, because of the price point, YETI communicates to others that you have the disposable income to afford a $300 camping chair when there are plenty of $25 alternatives. (I haven’t brought myself to buy one of these - yet - but I’ve had to throw away enough junky chairs that I’m beginning to think the investment might have been worth it.)

Given the above, and with the stock trading with a 16x trailing P/E, a 5% free cash flow yield, and a net cash balance sheet, it’s a good time to take a closer look at YETI’s moat, management, and valuation.

Let’s get started…

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC did not own shares of any company mentioned.

Please see important disclaimers.