Flyover Stock: Knife River (KNF)

Spun off in 2023, the North Dakota-based construction materials and service business is worth a closer look today.

Back in November, I highlighted aggregates producer Knife River as a recent spin-off that was on my research radar.

Since the publication date, Knife River’s stock has dropped 23% while the S&P 500 (SPY) has gained 5.6% and the Materials SPDR (XLB) is down 2.4%, so it seemed a good time to take a closer look.

Here’s what I wrote in the previous article:

There aren’t many publicly-traded companies based in North Dakota, but each would qualify for a look at a newsletter called Flyover Stocks.

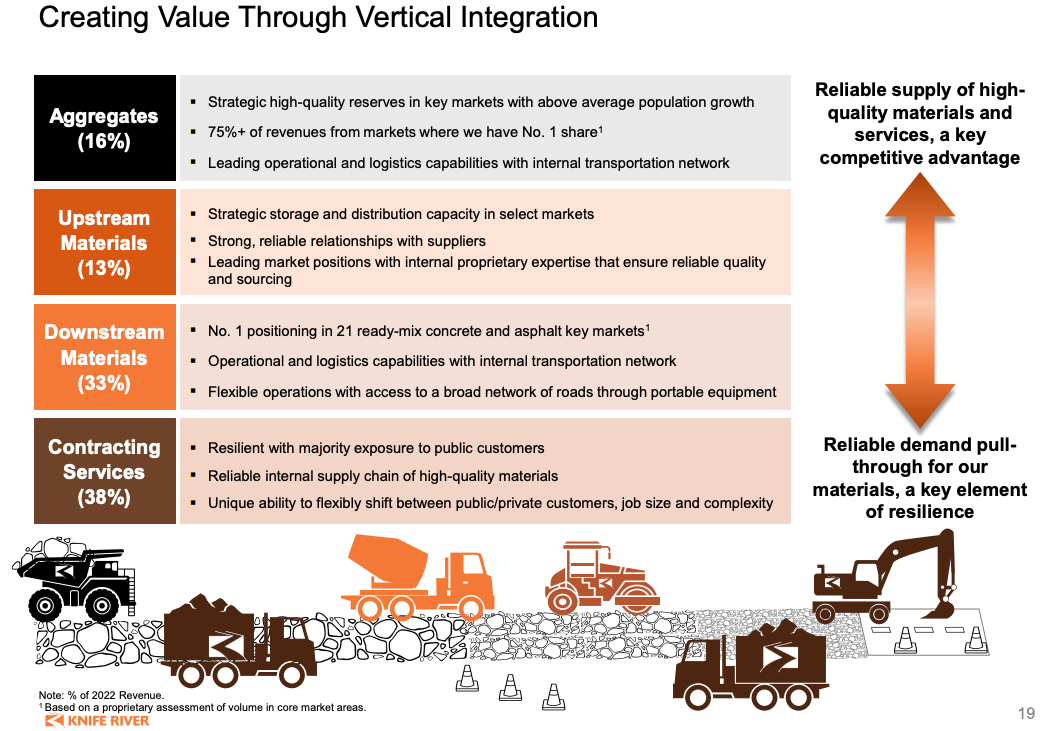

Spun out of MD[U] Resources in June 2023, Knife River is a vertically-integrated aggregates company that controls over 1 billion tons of reserves. It is the fourth-largest producer of sand and gravel in the United States and is geographically focused in the northern and northwestern U.S. states, with the exceptions of Hawaii and Texas.

In addition to aggregates, its downstream services include ready-mix concrete and liquid asphalt, culminating in contracting services that are primarily geared toward public sector projects like roads, bridges, and highways.

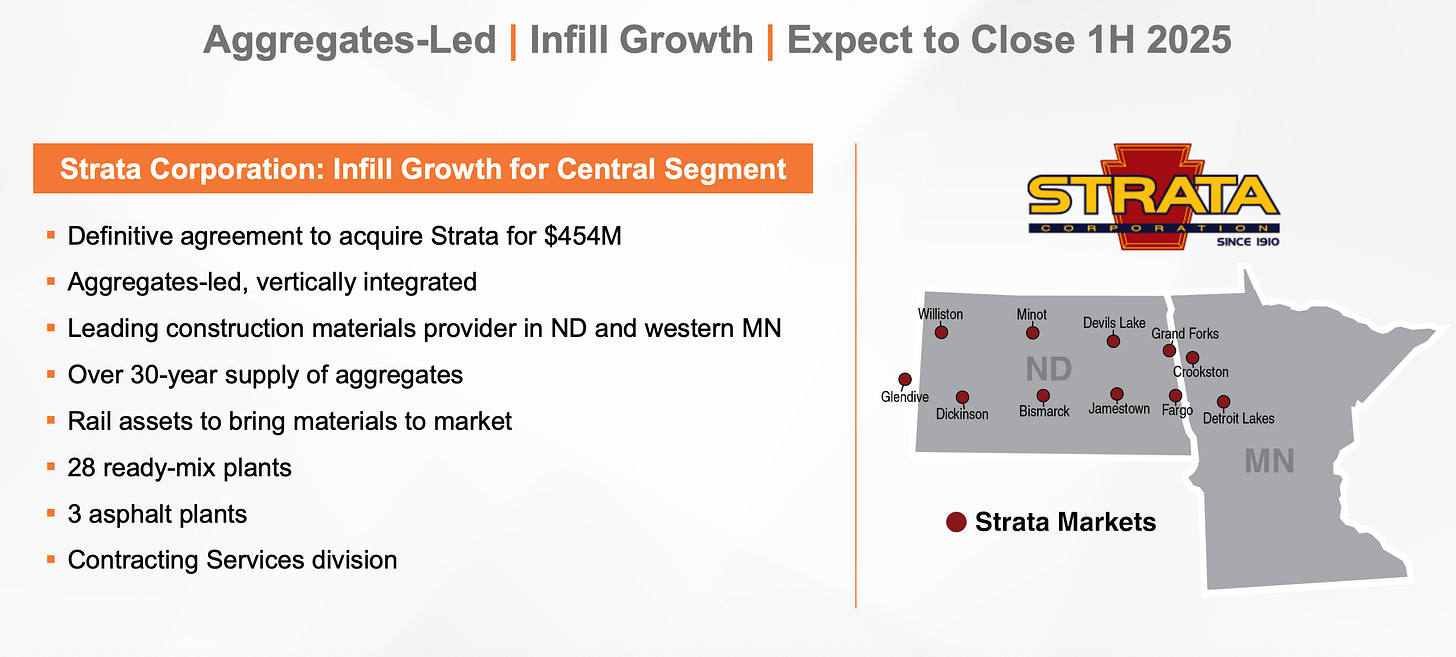

In the months after the article was published, Knife River did indeed expand its aggregates business by acquiring Strata Corporation, another North Dakota-based vertically integrated peer that helps Knife River consolidate its leadership in the region.

Here’s what Knife River CEO Brian Gray said about the acquisition logic in the Q4 2024 earnings call:

“[Strata is] in markets that we know really well. It's an infill into our markets. It's got a very qualified and high-quality well-respected management team, led by their owner, Jim Bradshaw. It's a cultural fit to Knife River. Our Life at Knife core values of people, safety, quality and environment are very much in line with theirs.”

I left off my previous summary on Knife River suggesting the next step in the company analysis is to dig into management’s acquisition and capital allocation skill, so we’ll dive into those topics here along with the regular moat and valuation analysis.

You can get access to the full report by clicking the button below and upgrading your subscription to paid. Your subscription also gives you full access to the 20+ previous company profiles.

Paid subscribers, your content continues below.