Two Spin-Offs on My Radar

Spin-offs can be a treasure trove of research ideas. The two SpinCos mentioned below are on the Flyover Stock watchlist.

Flipping through a list of recent spin-offs can be a great source of new research ideas.

Spin-offs typically occur when a parent company (“RemainCo”) decides it can create value by letting one of its existing units (“SpinCo”) become an independent company.

As a mature company’s growth slows, they might find that a legacy unit doesn’t fit with a new strategy to rejuvenate growth. This is what happened when Kellogg’s spun off Kellanova, for example.

Alternatively, the SpinCo might develop its own distinct growth strategy, as Valvoline did under Ashland's ownership, and pursue independence.

Spin-offs can happen for a variety of reasons, but they are all major capital allocation decisions worth paying attention to.

Opportunities for investors can present themselves when the spin-off requires a reshuffling of analyst coverage (e.g. the SpinCo is consumer while the RemainCo is industrial) or analysts had previously paid little attention to the SpinCo because the unit’s financials played a minor role in the RemainCo’s results.

What’s more, investors who wanted to own the RemainCo tend to sell their shares of the SpinCo when they are issued, potentially creating good buying opportunities for those who’ve done the research on the SpinCo.

My favorite spin-off situations are when the SpinCo is leaving a parent company known for having a good corporate culture and operating system. Those intangibles tend to persist post-spin and can be applied in new ways.

This was the case at HVAC and refrigerant company, Carrier Global, which was spun off of United Technologies in 2020 due to the planned merger of UTC and Raytheon.

Here’s what Carrier CEO Dave Gitlin said on the first call with shareholders:

We have implemented a new management system where we've aligned on our priorities. We've cascaded those. We have dashboards. We've put rigor around the management system and around the operating system.

The operating system is founded on ACE. Those of you that have covered UTC, you know that it's a great operating system for driving quality and lean. We've customized it a bit to make it more agile for a commercial-only division, and our foundation is the Carrier way. We took the opportunity to define a new culture.

Put differently, Carrier Global didn’t have to create from scratch a blueprint for operating success. The company already had a good foundation in UTC’s Kaizen-based ACE system and customized it to best serve Carrier’s needs as an independent company. Employees already knew ACE and didn’t have to completely uproot their way of doing things.

Today, we’ll look at two fairly recent spin-offs that are candidates for a full Flyover Stocks profile. To augment and accelerate my research, I’ll implement a new AI-driven research platform called Tenzing MEMO, which my friend Nick Kapur recently launched with Tom Saberhagen, a former partner and co-portfolio manager at Akre Capital.

In particular, Tenzing MEMO has a new valuation function that I’ve wanted to explore and will test out here.

Professional investors who are interested in a free trial to Tenzing Memo can register on the Tenzing MEMO website (all new users receive a generous, no commitment free trial to kick the tires of the software). Tip: register with your work email for expedited service.

As an added bonus, Tenzing is generously offering Flyover Stocks members an additional 10% off yearly subscriptions. Based on the pricing of various platforms I’ve been pitched over the years, their rates are quite reasonable given the breadth and depth of the available data.

You can sign up for a free trial here, and if you like it enough to buy it, reference code FLYWITHUS to receive the extra 10% off your annual subscription.

Phinia (PHIN)

Market cap: $2.3 billion

P/E (ntm): 12.1x

Dividend yield: 1.8%

Headquarters: Auburn Hills, MI

Phinia is an automotive parts company that was spun out of BorgWarner in July 2023. BorgWarner wanted to shift its focus to vehicle electrification while Phinia would focus on the legacy internal combustion engine (ICE) end markets.

Thus far, at least, Phinia’s stock has been the better choice.

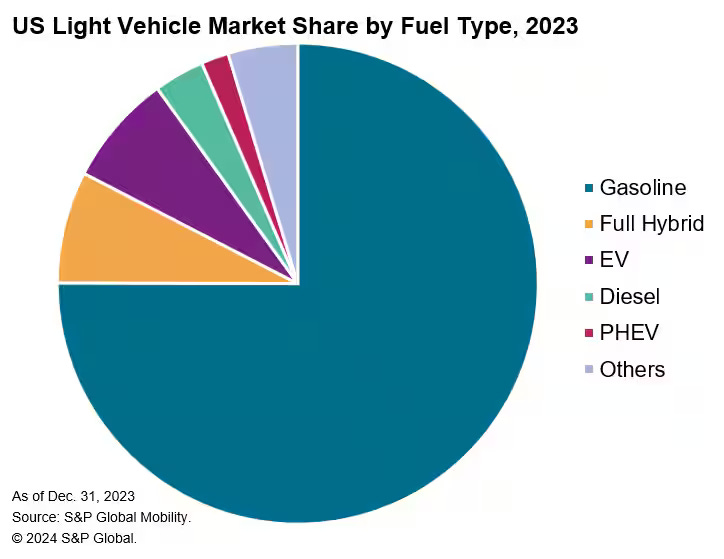

While the EV transition is happening, it’s a slower process than may have been feared (or hoped for) and hybrid (full and PHEV) are alternatives to ICE that still require ICE servicing and parts. Put differently, the relevance of Phinia’s products may last for well over a decade.

About 70% of Phinia’s revenue comes from its fuel injection systems business: ~25% to commercial vehicle and industrial applications and ~45% to light vehicles. The remaining ~30% comes from aftermarket part sales including well-known brands like Delphi (fuel systems) and Delco Remy (electrical components), both of which were formerly owned by GM.

The revenue base is also geographically diverse, with 29% of 2023 sales coming from the US. Europe accounted for 45% of 2023 revenue. GM, Phinia’s largest customer, accounted for 16% of 2023 sales.

Phinia’s capex is primarily maintenance rather than growth in nature, and, as a result, the company generates a considerable amount of free cash flow. The stock currently trades with a free cash flow yield of 7.7%.

Of course, the risk is long-term growth related to EVs taking share from traditional ICE vehicles. With most of a stock’s value coming from its terminal value in a DCF model, it make sense to pay attention to longer term impacts to growth and profitability.

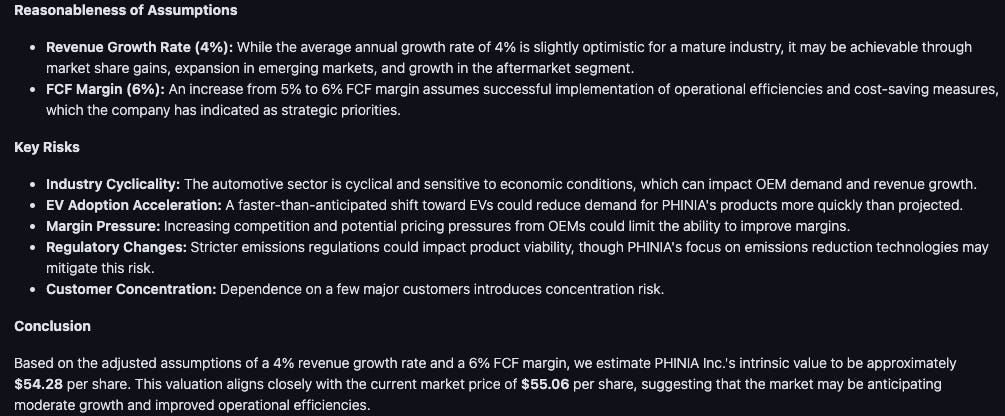

I asked Tenzing MEMO to run a valuation on Phinia. It takes a few minutes to generate and it gave me a breakdown of all the assumptions in its intentionally conservative five-year DCF model, including revenue growth (1%), FCF margin (5%), terminal value multiple (12x), and WACC (10.81%). Based on these assumptions, it spit out a valuation of about $33 per share - well below the current $55 price.

I then asked it to run a scenario in which revenue grew 3% annualized for the next five years, followed by 0% terminal growth, and a 25% tax rate rather than 30%. The result was marginally better.

It was time to run a reverse DCF. I entered the prompt: “holding the discount rate the same, include growth rates and margin assumptions to justify the current market price of $55 per share.”

Tenzing MEMO then ran a number of scenarios that could justify the current market price.

It then gave me a bull/base/bear case and the key assumptions of each:

And finally some items to consider regarding the reasonableness of the assumptions:

While a complete DCF would make more detailed forecasts for each segment and include some unit economics, Tenzing MEMO provided an initial framework that was much more useful than simply considering multiples or rules of thumb.

Your interest in Phinia will depend on your long-term view of EVs versus fuel-based vehicles, including ICE, hybrid, and plug-in hybrid, as the speed with which EVs take share (or don’t) will have a material impact on terminal growth rates and thus Phinia’s valuation.

Knife River (KNF)

Market cap: $5.8 billion

P/E (ntm): 26.2x

Dividend yield: N/A

Headquarters: Bismarck, ND

There aren’t many publicly-traded companies based in North Dakota, but each would qualify for a look at a newsletter called Flyover Stocks.

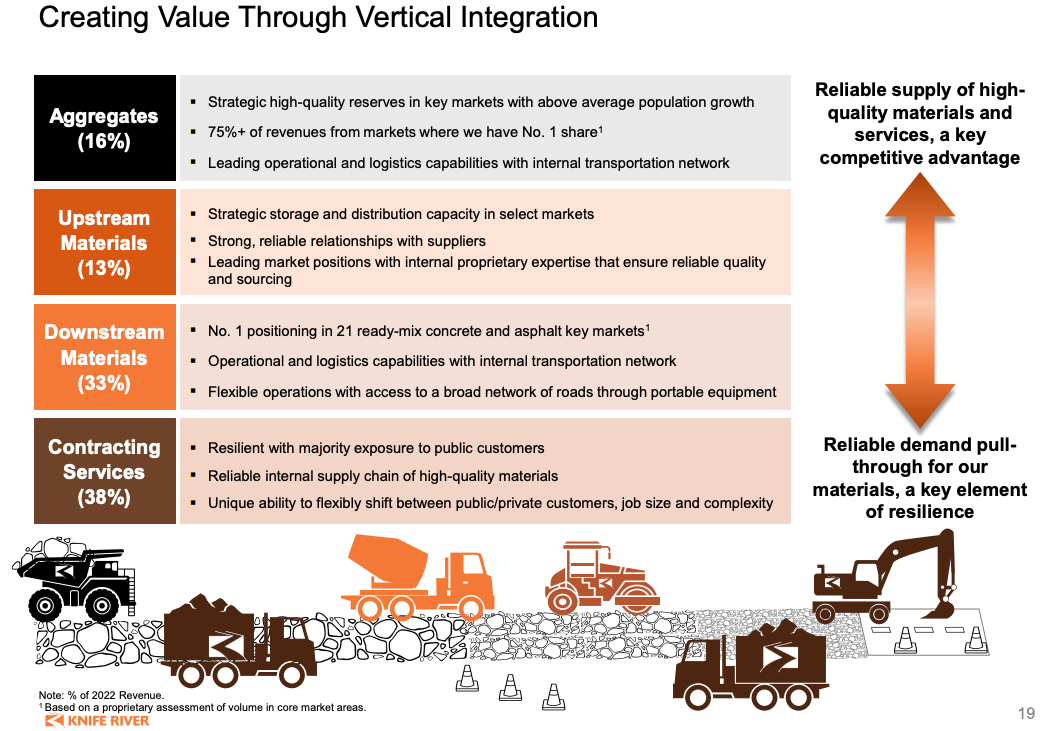

Spun out of MDC Resources in June 2023, Knife River is a vertically-integrated aggregates company that controls over 1 billion tons of reserves. It is the fourth-largest producer of sand and gravel in the United States and is geographically focused in the northern and northwestern U.S. states, with the exceptions of Hawaii and Texas.

In addition to aggregates, its downstream services include ready-mix concrete and liquid asphalt, culminating in contracting services that are primarily geared toward public sector projects like roads, bridges, and highways.

This is a much better business than I expected it to be and I was pleased to see that management is focused on expanding its aggregates business where there is potential for widening its low-cost production moat. Aggregates have a low value-to-weight ratio, providing cost advantages to producers that operate closer to end customer demand.

At 26 times next year’s earnings, though, perhaps the story is already fully appreciated.

Tenzing MEMO’s default conservative valuation of $51.30 was well off the current market price near $103 and used the following revenue and free cash flow assumptions:

Again, I asked the program to run a reverse DCF using a 10% discount rate and 3% terminal growth to better understand the assumptions priced into the stock today.

There appears to be a lot of growth and margin expansion already priced into the stock.

The bull case - still short of the current market price - assumes 10% annualized revenue growth from 2023 to 2028 and free cash flow margin improvement toward 11% in 2028, up from 5.8% over the trailing twelve months.

While it’s certainly possible for Knife River to achieve these goals, there doesn’t appear to be any material margin of safety at current prices. M&A will likely play an important role in the company’s future growth, so digging into management’s capital allocation skill and strategy is a critical next step in researching Knife River.

To be sure, Tenzing MEMO emphasizes that these valuations are initial drafts, but as was the case with Phinia above, the Knife River valuation gave me a relatively quick overview of the key valuation drivers and what I need to pay attention to if I want to do more work on the company.

Bottom line

Each of these companies are worth further research and are candidates for a full Flyover Stocks profile. Be sure to subscribe below to stay up to date on monthly Flyover Stocks profiles.

Stay patient, stay focused.

Todd

Additional disclosure: Tenzing MEMO provided financial compensation for this article. I only promote third-party products that I use and enjoy. Please see important disclaimers.

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC did not own shares of any company mentioned.

Please see important disclaimers.

This was agreed great read. I have had some spinoff’s which have been terrific holdings, but as usual there have also been a few clunkers.

I am familiar with $KNF but not the automotive spinoff. Typically, I don’t really follow that industry. However, I do feel more and more that hybrids are starting to gain more traction and seem like more logical approach given demographics, cities, etc. I will definitely take note and watch the stock. Thanks.

Keep up the good work.

I avoid spin-offs for one simple reason. Invariably it seems that RemainCo loads up SpinCo with non-recourse debt before SpinCo is separated. This shows up in SpinCo's balance sheet as a jump in long term debt.

RemainCo uses the funds to pay a dividend to itself or its shareholders. SpinCo now has a crushing debt load that it has to pay down, debt that does nothing to increase the company's asset base or competitive position.

As a potential investor in SpinCo, this is tantamount to paying child support for someone else's kid. I have no interest in this and move to the next investing lead.