Flyover Stock: Hawkins (HWKN)

This 86-year-old chemical distributor is the most overlooked and under-covered company we've profiled at Flyover Stocks.

Executive summary

Despite crushing the S&P 500 and Russell 2000 over the last 5, 10, and 20-year periods, Hawkins is woefully underfollowed with just one sell-side analyst.

Chemical distribution is fragmented and in the early stages of consolidation as building new storage facilities and warehouses near population centers has become increasingly difficult and expensive due to regulations and NIMBYism.

Hawkins management is prudently allocating growth capex toward its highest return and highest growth segment.

Kids’ books today are so much more informative than I remember mine being in the ‘80s.

Did you know, for example, that a rainbow is a circle? Or that the Titanic had a fourth funnel on top of the ship that was only used to maintain visual symmetry?

Another of my son’s books was on sewers and water treatment. As described in my Core & Main profile, it’s a system that we really do take for granted.

As recently as the mid-19th century, major cities lacked wastewater sewers and water treatment, which bred cholera and other diseases as populations grew. It’s a modern marvel that we can move wastewater to locations where it can then be treated and safely recirculated back into the environment.

Water also must be treated in industrial, agricultural, commercial, and municipal settings. Well water, as shown below, may not be clean enough to supply livestock without treatment.

Even previously treated water may not fit the needs of all end markets. Municipal swimming pools need chlorine added, for example, and breweries may want to adjust their tap water chemistry to make their beers taste better.

Enter Hawkins. Founded in 1938 by Howard “Curly” Hawkins as a local chemical distribution business in the suburbs of the Twin Cities, the company today serves a wide variety of end-markets (grouped into Industrial, Water, and Health & Nutrition segments) by providing chemical and ingredient distribution, formulation, and manufacturing services.

Despite approaching $1 billion in revenue, Hawkins only has one sell-side analyst, doesn’t hold conference calls, and from what I’ve learned, its ticker isn’t included in the nightly Minneapolis business news reports, pushed out by local heavyweights like Ecolab, 3M, and Target.

In short: a classic Flyover Stock.

One of my favorite indicators of a special company is when there’s a book written about the founder. Whether it’s You Don’t Know Jack…or Jerry about Jack Henry and Jerry Hall (Jack Henry & Associates), From Junk to Gold by Willis Johnson (Copart), or Kitchens, or Sink by Mathew Ingle (Howdens Joinery), there seems to be a positive correlation between books about founders and virtuous corporate cultures.

My theory on this is that these founders typically took a unique approach and (just as importantly) were well liked enough by their employees and other stakeholders to justify selling more than a dozen copies.

Companies founded by these type of leaders often benefit from what I call a “founder’s pedigree” - even if the founder is no longer with the company, their core principles live on in the way the company does the small things.

Published in 1996, Life in a Putty-knife Factory was Curly Hawkins’ autobiography and provides some insights into the company’s culture.

Two quotes stood out to me. The first had to do with Hawkins’ approach to competing on price versus service:

“We have never tried to undercut or low-ball the competition. That seemed then and it still seems today a good way to make a few bucks in the short run, but a bad way to grow a company intended to be around for a while. Judging by the number of distributors that have come and gone in the past fifty years…I’d have to say our service-and-innovation strategy was the better choice.”

And on the company’s approach to communicating with the financial markets:

“We’ve never felt compelled to put on a dog-and-pony show for the financial community. We believed then and we believe today that if the company serves its customers and takes care of business, the stock will take care of itself.”

Not a bad strategy, it seems. The stock has handily outperformed both the S&P 500 and Russell 2000 over most long stretches, including the last 20 years.

Let’s take a closer look into what makes Hawkins a special business.

Business overview

Key facts

Market cap: $1.3 billion

Revenue TTM: $925 million

P/E Ratio (forward): 20x

Number of analysts covering: 1

All market data as of February 23, 2024

Hawkins started operations serving local Minnesota industrial customers including 3M by acquiring, storing, and distributing chemicals. From the beginning, Hawkins focused on service as it lacked the scale or bargaining power with its suppliers.

Through the 1972 acquisitions of Feed-Rite Controls and Lynde, Hawkins entered the water treatment business. It was fortunate timing, as the Clean Water Act of 1972 meant federal dollars would support ongoing investment in water treatment to prevent waterway pollution.

Today’s industrial segment distributes bulk chemicals such as liquid caustic soda, ammonia, and sulfuric acid that are used in a wide range of end markets such as energy, agriculture, and electronics. It also manufactures some chemicals including bleach, liquid phosphates, and food-grade and pharmaceutical-grade salts and ingredients. Additionally, Hawkins Industrial blends and repackages chemicals to meet customer needs.

Over the years, Hawkins has patented some of its formulas including (my favorite) Cheese-Phos®, which helps dairies make a more consistent cheese.

Having physical proximity to customers is the key factor in industrial chemicals distribution and most of Hawkins’ industrial storage facilities are in the Midwest. It’s not easy from a regulatory standpoint to open new chemical storage facilities, not to mention the “not in my backyard” or NIMBY effect of residents not wanting tanks of potentially harmful chemicals near where the children are playing.

Transporting chemicals to their destination is expensive, so having physical proximity to customers is a structural low-cost advantage. Hawkins also has five locations with both rail and barge access and another nine with rail access to receive bulk chemicals from suppliers. This adds to a low-cost advantage that is difficult to replicate, particularly by small, independent firms.

The Water Treatment segment is what made me interested in Hawkins, due primarily to its route-based sales system and expansion opportunities. Hawkins’ water business currently has 46 warehouse-branch locations, from which they serve customers in an average radius of 100 miles. That footprint allows them to serve customers in 24 U.S. states.

Though the company doesn’t provide the customer breakdown within the segment, municipal water customers (e.g. drinking water, wastewater, swimming pools, etc.) have the highest share of the mix. It also serves the heating and cooling, industrial, agricultural, and brewery/winery end markets.

What’s intriguing about the segment’s model is that the drivers are also trained technicians and salespeople who own their book of business. They’re incentivized on gross profit, which incentivizes them to not concede too much on price to win or retain business. Further, that means they must earn their sometimes-premium price with exceptional service.

As the video below shows, once a Hawkins technician installs a water treatment system, the customer’s switching costs increase.

Since fiscal 2019, Hawkins increased its water warehouse-branch total from 29 to 46 and has been actively acquiring local independent water treatment businesses. Like the Hawkins model, many of these small operators competed on service rather than price. Now under the Hawkins umbrella, they can continue to focus on service while being armed with Hawkins’ purchasing power and technical resources.

As newly-acquired locations mature and adopt the Hawkins approach, their margins should begin to move higher toward the historical 12-14% range. Indeed, they are already at 14% over the trailing twelve months - and have room to move even higher.

The more routes that can be run from the water treatment branches, the more efficient the network will become, which should further lift margins.

The Health & Nutrition segment originated with the 2015 acquisition of Stauber. It has locations in New York and California and provides its food & beverage, nutraceutical, and dietary supplement customers with product formulation, distribution, and blending services. While the business has had a tailwind since COVID as demand for health-related supplements and vitamins surged, I’m the least enthusiastic about this segment from a moat perspective.

It should continue to see demand as Boomers push further into retirement and Millennials start being more health-conscious as they move into their 40s, but from a structural advantage standpoint I’m not sure what separates Hawkins Health & Nutrition from other competitors.

Health & Nutrition is the smallest of the three segments in terms of revenue and operating profit, so its lack of moat doesn’t disqualify Hawkins from having a moat.

Moat Width

Score: 1/5

Hawkins moat is narrow, but touches on a number of moat sources.

It likely has some switching cost advantages related to custom-blended chemicals and systems made specifically for the customer. If the customized product is meeting your needs, there’s little reason to switch to a competitor who would have to reformulate the mix and potentially disrupt your operations.

There are also some low-cost production advantages. A chemicals distribution business wants to store chemicals near areas with population density, but residents don’t want to live near chemical storage. This NIMBY effect – in addition to stricter regulations today - makes greenfield construction more challenging and makes legacy chemical storage facilities, many of which have had populations grow around it, more valuable.

Hawkins has rail and barge access to acquire bulk chemicals, including the terminal shown below in St. Paul, Minnesota on the Mississippi River. This provides them with a low-cost sourcing advantage relative to smaller peers.

Hawkins’ mix of low-margin bulk chemical sales as a percentage of total sales has decreased in recent years, while the mix of higher-margin customized chemicals has increased. Distributed specialty sales are primarily related to Health & Nutrition.

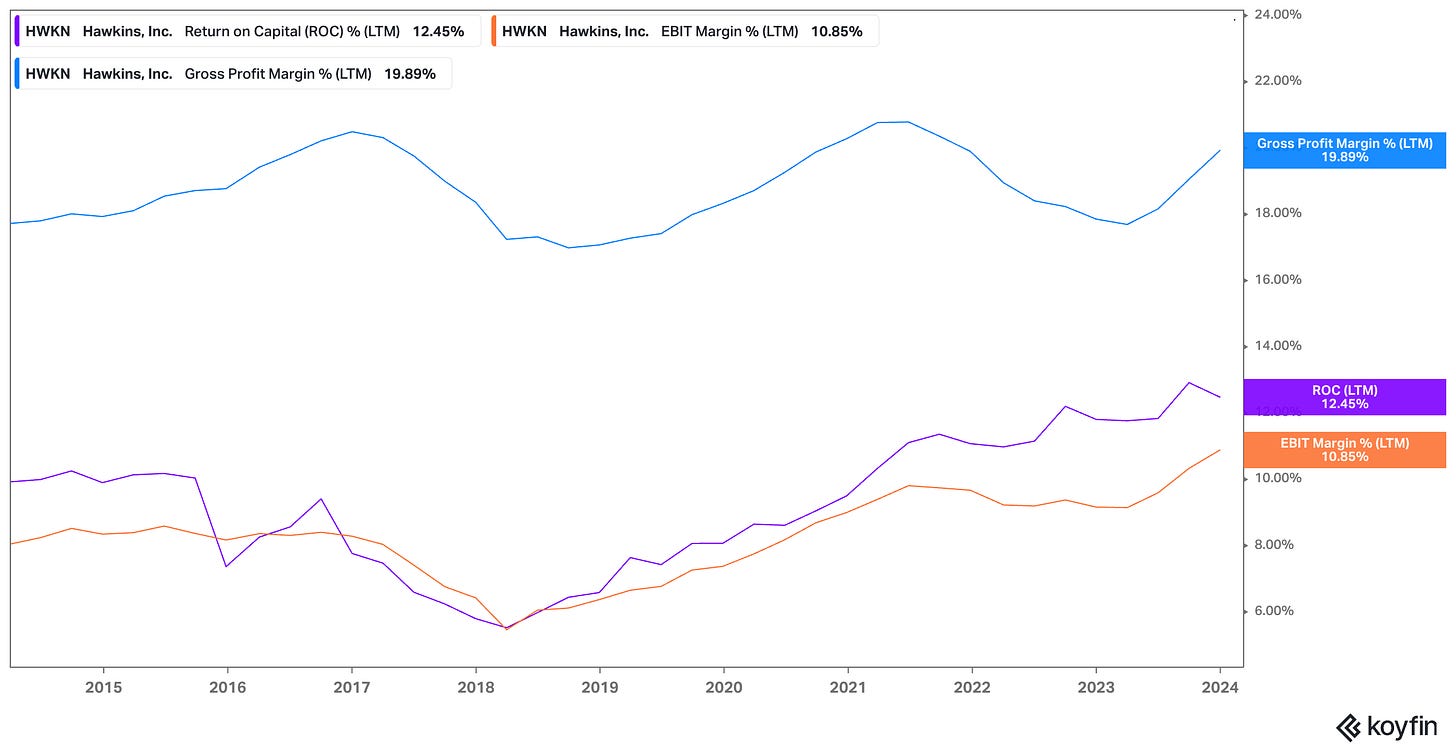

Hawkins historical returns on invested capital have hovered around 12% - indicating that it can consistently out-earn its cost of capital, but not by much. This is quantitative support for a narrow, rather than wide, moat.

From a competition standpoint, Hawkins’ larger competitors like Brenntag AG, Univar Solutions (acquired by Apollo in 2023), and Helm are either headquartered outside the US or have extensive international operations to consider. Their offerings also don’t perfectly overlap.

The industry remains highly-fragmented, but it is consolidating. According to a 2023 Brenntag presentation, the top 10 global industrial-focused distributors accounted for 30% of the market and just 15% of the specialty-chemical distribution. Despite being the world’s largest chemical distributor by revenue, Brenntag’s market share is only 7%.

So while Hawkins will compete with much bigger rivals in some cases, the industry remains diverse enough where Hawkins can still compete on price to beat smaller rivals while delivering service levels of a small operator.

Moat durability

Score: 4/5

Distribution businesses, particularly if they provide value-add services, tend to be naturally durable. This is because they have earned their customers’ trust over many years and service becomes more of a factor than price alone.

Hawkins’ core products should remain highly relevant in the coming decade as customers in water, food, agriculture, pharmaceuticals, and industrial end markets will continuously need chemical solutions to serve their own customers.

Moat trend

Score: 4/5

Hawkins’ focus on the water treatment business should support a positive moat trend over the next 3-5 years. Relative to Industrial and Health and Nutrition, Water Treatment has the highest return on assets and has the most attractive business model, rooted in its route-based ownership and incentive structure.

As Hawkins acquires new water treatment facilities and integrates the company into the Hawkins’ way of doing business, I expect segment margins to improve back to the mid-teens and support the company’s overall margin expansion.

Supporting this trend is increased attention being paid toward removing water contaminants like lead and PFAS from municipal water. In addition, reshoring of manufacturing will lead to greater industrial demand.

Stewardship

Score: 3/5

In true form, Hawkins does not host quarterly conference calls, but it recently posted an investor presentation and a helpful investor video, which as of this writing has 50 views on YouTube.

I’m encouraged by the Hawkins family legacy continuing to lead the business. At 52, Patrick Hawkins owns 1.5% of the shares and is positioned to lead the company for at least another decade. The executive team at large owns 3.6% of the business and employees (via the employee stock option plan) own 5.1%. It’s encouraging to see ownership spread across the business and not centered on one individual.

From a governance perspective, it’s good to see the chairman and CEO roles split. It is uncommon to see family-influenced businesses divide that role today, but it has been the case since 2005 when former CEO John Hawkins (Patrick’s uncle) relinquished the chairman role to improve corporate governance.

To management’s credit, Hawkins is regularly voted to best places to work lists and median employee tenure is over 7 years when the chemical industry median (according to BLS) is 5 years. It’s also recently been named one of America’s Most Responsible Companies by Newsweek.

On capital allocation, the biggest blemish on management’s track record is the 2015 acquisition of Stauber Performance Ingredients, which established the Health & Nutrition segment at Hawkins. Hawkins paid $156.7 million for Stauber, which worked out to 1.33x sales, and took a $39.1 million impairment charge less than three years later.

To be fair, the Health & Nutrition business has perked up in recent years in the back of a boom in vitamins and supplements on the back of COVID, but the initial years post-acquisition were lean and the deal appears to be driven by diversification purposes rather than value creation.

The recent acquisition spending in water treatment strikes me as much more thoughtful and value enhancing for the reasons noted elsewhere.

Management has done a good job of maintaining low leverage and has paid a dividend for 38 years. Notably, it didn’t cut its payout during the financial crisis years. Buybacks are done to offset dilution from employee stock options and are not opportunistic.

Executives are primarily incentivized based on pre-tax income, which I consider generally aligned with shareholder interests. If it had a return on invested capital component to motivate management to grow profits only if it increases shareholder value, I would have given it top marks on incentives.

Simplicity

Score 3/5

Hawkins is a business that’s relatively easy to understand. Its latest annual report totaled just 68 pages and can be read over a pot of coffee.

The complicating factors are understanding the various chemicals and how their price fluctuations can impact Hawkins’ results. With more time following the company, I believe this can be better understood.

Forecastability

Score 2/5

Hawkins is less cyclical than you might think. It remained quite profitable during the financial crisis and despite declining sales in fiscal 2010 (year ended March 2010), margins didn’t collapse. In fact, margins improved. The company’s relentless focus on preserving gross profit dollars has proven to be the right incentive.

Because of the mission-critical nature of its products to its customers and its developed relationships with those customers, we can gain some confidence that Hawkins won’t have to compete on price and put margins at risk in the next downturn.

Still the volatile raw materials prices and uncertain M&A cadence present some challenges for forecasting.

Flyover Stock ranking

Here’s a breakdown of the above scores, alongside my scores for the other companies profiled thus far at Flyover Stocks.

Risks & opportunities

Beyond the obvious risks to the business, which are outlined in the 10-K and include raw material price volatility, product liability, and economic uncertainty, my biggest concern would be another “transformational” acquisition that distracts management from executing the established blueprint for success.

Rolling-up water treatment businesses is an attractive route for Hawkins, but they may run into culture clashes where existing technicians are resistant to adopting the Hawkins route model where they are expected to do proactive selling in addition to providing regular service to established customers.

A single roll-up water treatment acquisition is not particularly high risk, but if Hawkins is undisciplined value-wise on enough of them, it could snowball into a low ROIC endeavor.

As previously noted, Hawkins has a big opportunity to offer water treatment customers better prices while keeping a high level of service. This may help them win business from larger competitors who can win on price but don’t provide the same level of service.

Valuation

Hawkins’ stock has been on a strong run over the last three years – up 135% since February 19, 2021 versus the S&P 500 up 34%. Naturally with this sort of business, the concern would be buying near the top of the cycle. As such, we need to determine what a “normalized” earnings per share figure might be.

One way to do this is to average the last seven years of return on equity and multiply it by book value per share. In doing so, we get 14% ROE x $18.94, which gives us a “normalized” EPS of $2.65 versus the trailing $3.48. With the stock trading near $70 as of this writing, that equates to a trailing P/E of 26x versus the reported 20x.

Hawkins’ P/E touched 26x in 2013 and 2017, but those marked high points in the decade. Some valuation caution, therefore, is warranted today.

That said, Hawkins’ is also posting its strongest operational numbers of the decade, so the premium multiple is supported by fundamentals.

We have a recent major acquisition in the space, too. Apollo purchased Univar Solutions in early 2023 for 8.6-times EV/EBITDA; a deal that was encouraged by shareholders after Brenntag initially expressed interest. Applying that multiple to Hawkins’ expected fiscal 2024 figures puts the stock near $55 today. And Apollo’s multiple may have proven to be a timely bargain, as Brenntag’s median 10-year EV/EBITDA is 11.5x and Hawkins’ is 9.3x.

Given the consolidating activity in the sector, Hawkins may be an attractive acquisition candidate.

Using an “expectations investing” based DCF to back into the current market price, you need approximately 9% annualized NOPAT growth from fiscal 2023-2028, which assumes about 7% revenue growth and 9% EBIT growth. This is consistent with Brenntag’s medium-term outlook for the sector. I assume a 9.6% cost of capital and an EV/EBIT exit multiple of 14x, which is consistent with the 10-year median.

I considered what that expectations-based forecast would mean for the three segments. For Industrial, I used 6% annual revenue and 3% EBIT growth over the five-year period to account for some reversion to the historical mean on EBIT margins. Pre-COVID, Industrial EBIT margins averaged around 6% and are up to 10% in the last twelve months. I assume it normalizes at 8%.

For Water, I assume 10% revenue growth and 17% EBIT growth, supported by margins recovering to pre-acquisition spending levels. Indeed, trailing EBIT margins have bounced up to 14% from 10% in fiscal 2023. I assume they hold at 14% during the forecasted period, with top-line growth supported by acquisitions and greenfield construction, government spending on water treatments for PFAS and lead removal, along with increased water treatment demand related to agricultural, industrial, and commercial needs.

Health & Nutrition I assumed will grow 5% revenue and 3% EBIT through 2028, which accounts for GDP-like growth and margin reversion toward 8% from 10-11% in fiscal 2021/22.

What will make these figures look conservative with hindsight is if the re-shoring of manufacturing supply chains drives more demand for industrial chemicals or if the Industrial or Health & Nutrition margins don’t revert closer to historical levels. Alternatively, the company may see Water Treatment margins widen beyond historical ranges due to newfound economies of scale/scope related to entering new geographies.

Putting the implied expectations to the side, I expect water operating margins to widen to 16%. As the chart below shows, gross profit margin per warehouse has room to grow to reach pre-COVID levels and operating expense margin per warehouse has trended lower as the company added new nodes.

By increasing the exit year EBIT margin for Water to 16% and assuming Industrial margins normalize at 9%, my fair value for Hawkins is near $81.

Based on all the above, I’m comfortable with a base fair value range of $75-$85.

Bottom line

Hawkins is a classic Flyover Stock setup. It’s overlooked, it has a moat, and management and employees have an ownership mentality. It’s also well positioned to benefit from a number of secular trends including reshoring and government investment and incentives related to clean water.

Stay patient, stay focused.

Todd

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC owned shares of Howden Joinery. As of December 11, 2024 when the paywall for this article was removed, Howden Joinery, Jack Henry, Ecolab, and Copart were owned by one or all of the groups listed.

Please see important disclaimers.