Flyover Stock: Howdens Joinery

Heading across the Pond to profile a UK-based building materials distributor with a unique business model and expanding network of efficiently-run depots.

Audio version:

Executive summary

UK-based building supplier has a unique business model that reminds me of other successful distribution and logistics network models, including Old Dominion, Fastenal, and Domino’s Pizza.

By selling only to professional installers, Howdens has stickier customer relationships and can better serve their customers’ needs rather than trying to delight both professional and retail customers.

Howdens sits between a fragmented 300+ supplier base and a 500,000+ customer network and has a vertically-integrated manufacturing footprint to keep costs low and increase bargaining power with suppliers.

There are some great UK and European businesses that moat-focused investors should get to know. Howdens Joinery (LON: HWDN) is one of them.

Howdens may not be a flyover stock to UK readers – 16 analysts are covering it now after it’s posted some of the best returns in the UK market over the last 15 years.

That said, Howdens is an unknown name in the US. If you own Home Depot, Lowe’s, or Floor and Decor, however, it’s a name you need to know, as Howdens has a ton of potential growth runway. One of its UK competitors, Wren Kitchens, has already made landfall in the US.

Business overview

Market cap: £ 4 billion ($5 billion)

Revenue TTM: £ 2.3 billion ($2.9 billion)

Net cash: £ 118 million ($149 million); no financial debt

Dividend yield: 2.2%

Number of analysts covering: 16

All market data as of September 1, 2023

The best way to conceptualize a Howdens location is to think about a shrunk-down Home Depot or Lowe’s that only serves professional (or “trade” as they say in the UK) customers. It’s the number one trade-only kitchen materials supplier in the UK and sells joinery (e.g., doors, trim, etc.), hardware, flooring, and appliances through depots spread across its key markets in the UK and France.

Howdens depots are compact. The average size is 10,000 square feet or roughly the size of a US dollar store. Given its diminutive stature, a depot costs around £350,000 to build (and £300-400,000 in inventory), and they have quick payback periods. Last year, the average Howdens depot posted £2.7 million (or $3.4 million) in revenue. That works out to $340 per square foot, which puts it higher than Floor & Décor ($283 per square foot in 2022). EBITDA margins were 20% in 2022, equating to about £540,000 per depot.

The depots are tradesperson-friendly, and there are docking bays for loading heavy items into vans. We’ll talk more about the depot network in a moment, but an essential feature for tradespeople is the ability to get in and out as efficiently as possible.

As of the half-year report, Howdens operated 816 depots in the UK and 66 depots outside the UK, mainly in France. Management believes the company can eventually reach 1,000 depots in the UK. This year, they aim to build 33 new UK depots, revamp 90 existing UK depots, and add new depots in France and the Republic of Ireland where their model is building traction.

Each depot is managed locally through a decentralized model that allows the depot manager to maximize store-level pre-tax profitability, make pricing and hiring decisions, and establish and foster local relationships with builders.

90% of Howdens’ revenue comes from residential end markets, and 95% of projects are repair, maintenance, and improvement. There’s little exposure to homebuilding.

Howdens’ emphasis on selling only to professionals is a crucial differentiator from its competition, which includes Wren Kitchens, Magnet, and Wickes. They note on the website that:

“We only sell to the trade, rather than the public, to ensure our products are installed to the highest possible standard. In turn, by using a trade professional, you can be sure that your products are built to last and are fitted exactly the way you want them.”

This enables Howdens to focus on delighting the professional customer rather than balancing priorities of professional and DIY customers like most home improvement stores do. Howdens adds in the annual report:

“We make the builder’s life simpler. We help them to achieve exceptional results for their customers, and to profit from it. We succeed by helping our customers succeed.”

One example of this is with financing. Howdens offers tradespeople 60 days of credit to help them manage their working capital. Bad debts totaled £7.9 million in 2022 and £5.6 million in 2021, or about £10-15 per trade account, on average. In contrast, competitors that sell to retail customers typically arrange financing with the consumer and the tradesperson is left to self-finance working capital.

That said, Howdens isn’t disregarding the end customer’s needs. As this InPractise interview with a Howdens competitor illustrates, the builder can market their ability to acquire the materials for a kitchen remodel at wholesale prices rather than full retail through a DIY shop.

“You start getting a few quotes and then you want to talk to a builder and he will step in, at that stage, and say, the good news is, I can get you want you want, at trade prices. Here’s a Howdens brochure; have a look through there, choose what you want and I can get it for you at a trade price. The consumer feels as if they are getting a good deal and the tradesman is fulfilling his role in helping the customer make an easy decision.”

Because Howdens only works with trade customers, they have more control over pricing. The more volume a builder does with a Howdens depot, the more likely they are to get better prices, the more likely they are to win more projects, and the more likely they are to return to Howdens.

Another differentiator is that Howdens is vertically integrated and makes some of its supply through wholly-owned factories. They make 100% of the cabinets they sell and some of the worktops and skirting boards on offer.

From an InPractise interview with a competitor:

“There’s a greater in-house capability to manufacture, at Howdens. They’re doing more things, so they will make worktops, for example, whereas Magnet don’t make worktops. They just have more capacity to do more things, at Howdens. Also scale. If you can go to a factory in Europe and say, I want to buy a million doors a year, as opposed to 10,000, that’s an awful lot of buying power and you’re going to get the best price, because of that. Scale is definitely an advantage. If you are buying chipboard for your factory, you’ve got that tremendous scale to buy better than smaller competitors. Howdens huge advantage is that scale that they have; they have tremendous power, in that respect.”

The lower the price of inventory, the more flexibility the depot manager has in price discounting while making sure to profit targets.

Regarding price points, Howdens offers a “good-better-best” selection, from the entry-level to the luxury category. It has historically done best in the lower end of the market – it’s particularly popular among landlords looking for quick, reliable, and economical installations.

Moat

The first thing that piqued my interest in Howdens was its increasing network of small and efficient depots. Having researched the likes of Copart, Domino’s Pizza, and Old Dominion Freight Lines, I’ve come to appreciate the value of physical network effects.

When a new node is added to the network, it brings in more customers and makes acquiring and distributing products more efficient. Items that once had to be shipped 50 miles can now be shipped 10 miles, for example.

Transportation of goods – especially last-mile delivery – has become increasingly expensive in recent years and shows no signs of slowing down. Today, 85% of UK customers live within 5 miles of a Howdens. From the tradesperson’s perspective, having a Howdens depot nearby makes it easy to get an extra part or replace a damaged part to ensure an efficient installation.

Howdens management understands this advantage and is pressing the gas.

From the 2022 annual report:

“Our model is difficult to replicate and compete with, and we have initiatives in place to make it more so, in markets where the longer-term opportunities for us are larger than we previously thought. We are prioritising investment in the business on this basis.”

To illustrate, they rolled out a regional cross-docking center (XDC) initiative to supplement deliveries to their depots to ensure they are always well stocked.

Sitting between a fragmented supplier and customer base has historically been a profitable place for distributors to be. Fastenal and Pool Corporation are two examples of this in the US market. Howdens’ vertical integration provides additional bargaining power with suppliers. If suppliers can’t provide them with attractive prices, they can make it themselves in-house.

Focusing solely on the professional customer also creates stickier, longer-term relationships than can be had with retail customers. Similar to how Sherwin-Williams paints help professional painters save time on each job and get more jobs done each year, Howdens’ offer can help kitchen installers finish more jobs by having items in stock, ready to ship, and at attractive prices.

This creates a positive feedback loop, as illustrated below.

From a competitive standpoint, this is a difficult position to attack from the ground up, as it requires significant capital investment and building local relationships with tradespeople, which takes time. For an existing competitor like a Wren’s (108 locations in the UK) to compete on trade accounts, they would have to run a parallel trade-only business and open dozens of depots per year for a decade to approach Howdens’ network density. Moreover, offering trade-only pricing may inadvertently compete with their retail pricing.

This isn’t to say that Wren’s or someone else can’t challenge Howdens’ model, but replicating its network – and its cost advantage - will be challenging.

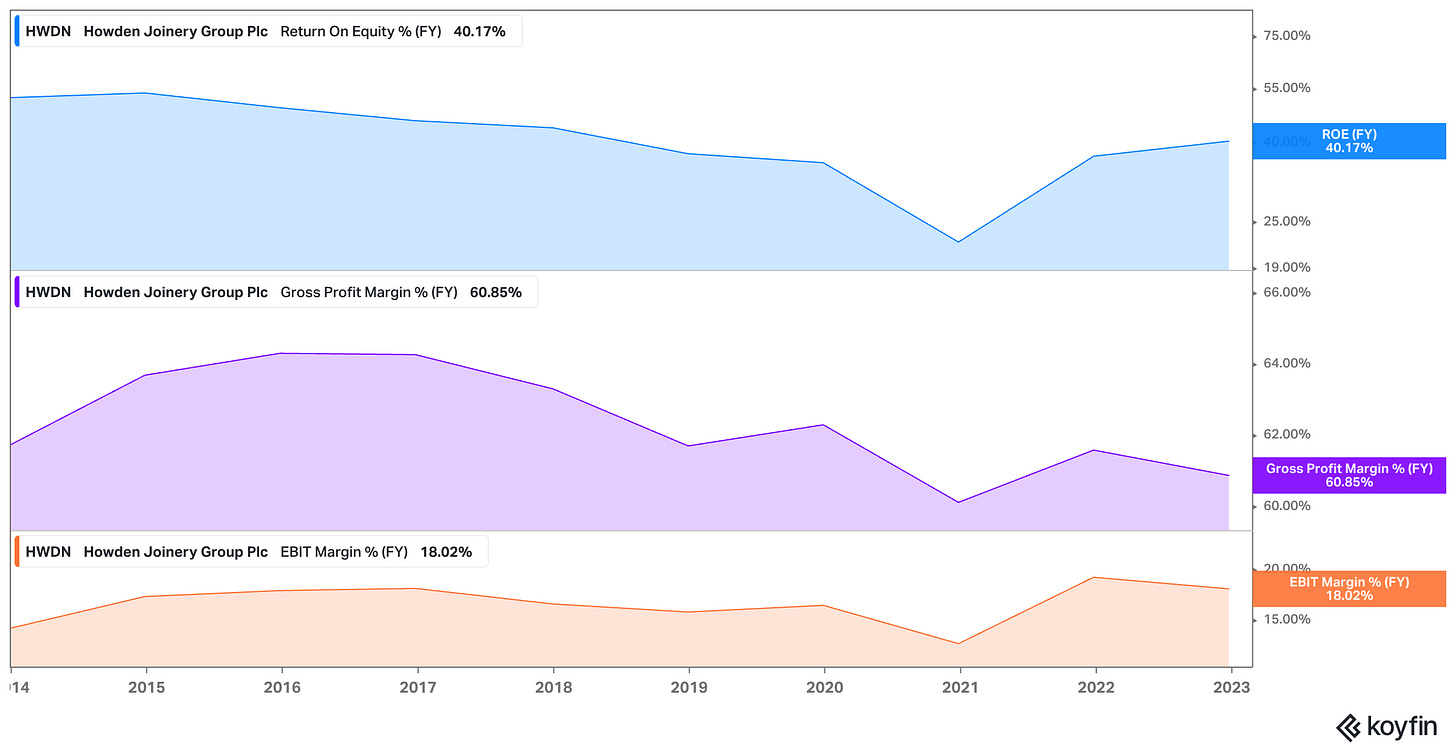

There’s quantitative support for Howdens’ moat, as seen in its consistently high return on equity and profit margins.

Investors should track a number of metrics when following Howdens’ moat, including revenue, operating expenses, and pre-tax profit per depot. If new Howdens depots are not performing as well as existing depots, it will drag down revenue per depot and pre-tax profit per depot, and could indicate a weakening moat. An explanation of recent trends can be found below in the valuation section.

Finally, Howdens received a Royal Warrant in 2015. A Royal Warrant means that the company has supplied royal households for at least five years and demonstrated a high level of quality. Approximately 800 companies have a Royal Warrant. It is a minor part of the moat thesis, but it is an economically-beneficial recognition that the company is a trustworthy operator.

Management

Howdens isn’t a founder or family-ownership story. Its founder, Matthew Ingle, stepped down from his CEO and board roles in 2018 after 23 years at the helm.

Its current CEO Andrew Livingston, took the role in 2018 in what appears to have been a well-planned transition. Livingston was previously the CEO of Screwfix, a division of Kingfisher, and has done a fine job steering Howdens through a turbulent five-year period while continuing to reinvest in the business and expand internationally.

Management is financially incentivized on pre-tax profit and cash flow for its annual bonus and its performance share plan is based on pre-tax profit, relative shareholder return, return on capital employed, and an environmental measure. 30% of the annual bonus is paid in shares and vests over two years and any shares that vest under the PSP must be held for two years. These are appropriate metrics for the business and align management’s financial incentives with shareholder interests.

Over the last decade, Howdens has taken a balanced capital allocation approach between dividends, share buybacks, and capital expenditures. The dividend is based on a well-covered target of 2.5-3x earnings. Howdens skipped the 2020 interim dividend payment account of unpredictability related to COVID quarantines, but was paid as a special dividend in 2021. That is a shareholder-friendly decision.

To management’s credit, Howdens is regularly voted a top place to work in the UK and is known for giving back to its communities. 100% of employees are shareholders, supporting an ownership mindset across the organization. Having a strong ecosystem with win-win relationships helps make a company more resilient in the face of challenges.

Finally - and importantly - Howdens has one of the best annual reports I’ve ever read, which I view as a positive sign for shareholders.

Howden Joinery’s annual report is a masterclass on how it should be done. Having only heard about the company second-hand, I set down the annual report having a solid understanding of how the business works, its core KPI metrics by which it judges its products, and the risks and opportunities looking forward.

The annual report is beautifully illustrated, and I’ve used some of the drawings in my commentary here, but I can’t recommend reading the full annual report enough.

Valuation

Consensus is expecting a flat topline in 2023 after a bumper year in 2022. Margins are expected to contract due to continued investments in depots and technology (read: not a bad thing!), and earnings per share are expected to decline.

The stock is trading with a 15x forward price-earnings ratio and a 6% free cash flow yield. At first glance, given the business quality, as discussed above, and the opportunity for further depot network expansion, this is an attractive setup over a 5-10 year time horizon.

With a target of 1,000 UK depots versus 816 today and ample runway in France and the Republic of Ireland, 3-4% annual depot growth over the next five years is reasonable. To exclude potential noise from COVID, revenue per depot from 2014-2019 grew 3.5% per year on average; including results through 2022, revenue per depot grew 5.3% per year on average.

What might the market be pricing in at ~740p today? Here’s one estimate:

In this exercise, I assumed a tough 2023 for Howdens on account of the continued investments via the income statement and a higher effective tax rate due to a change that went into effect in April 2023 for UK-listed corporations. Beyond 2023, I’m assuming 6% topline growth (4% from new depots and 2% growth in revenue per depot. Operating margins return to 18%. I’m assuming perpetuity growth with 2% inflation in the terminal value calculation.** The discount rate is 10%, a function of 11% cost of equity and 6% pre-tax cost on the lease-adjusted debt.

The market is anticipating slow kitchen remodel activity in the UK, France, and the Republic of Ireland in the next five years. Assuming 2% revenue per depot growth and that you think Howdens can pass on 2% inflation to its customers implies zero growth in transactions per depot versus 2023 as a base year.

An alternative case is that sales growth is stronger than in the above case, but operating margins contract to the low-to-mid teens. I don’t view this as a likely outcome because Howdens should have more bargaining power with suppliers as its network expands; operating expense growth should moderate as it finishes revamping older UK depots.

In sum, Howdens isn’t attractively priced today if you’re bearish on the UK consumer or housing market. It’s worth a closer look if you’re more optimistic.

Risks / Opportunities

In addition to the risks laid out by the company in its annual report, here are a few to keep in mind.

Investing in a consumer business that operates in a culture that’s not your own is an added risk. Things can change regarding consumer tastes, trends, or through government actions before you are aware of them.

While demand for Howdens’ products has been relatively stable over the past 17 years (see below), inflation, falling rents and home values, or rising interest rates could make it more challenging for homeowners and landlords to justify new kitchens. In most cases, kitchen upgrades are discretionary purchases.

We may have just come through a period where the stars aligned for kitchen remodels – people spending more time at home (quarantines and work-from-home arrangements), low-interest rates, and 15-20 years since the previous housing boom (kitchens get replaced every 15-20 years, on average).

Further, Howdens’ consistently high ROIC has not gone unnoticed by its competitors, and we should expect continued efforts to eat away at its profitability.

On the opportunity side, the upside surprises will likely come from international expansion. Howdens has succeeded in France and built some early traction in the Republic of Ireland. The big long-term opportunity is the United States. A few years ago, Wren’s opened stores in the Northeast US and continues to invest here.

This is pure speculation, but if Howdens were to try a move to the US, one region it may consider is the Mid-Atlantic (Maryland, DC, and Virginia). The region has access to Atlantic shipping ports, has densely populated cities with a large mix of rentals, and is not far from the Southeastern “wood basket” that supplies 60% of the timber harvested in the US each year. It would be an attractive place for Howdens to set up vertical integration for cabinetry.

Of course, there is a long and littered path of UK retailers that tried to enter the US market – and vice versa. What seems like it should be an easy transition often proves anything but. Despite a (mostly) similar language, there are significant differences in how consumers on either side of the Pond operate.

As such, I would not build US expansion into a Howdens forecast yet, but its model could work well in the US with proper execution.

Bottom line

It’s important to build a roster of great companies in your mind, regardless of valuation. For one, you never know when you might get an opportunity to pounce on short-term weakness. You can’t build conviction in a name when things get tough – you can only do it beforehand, so best be prepared. Second, learning about new businesses improves pattern recognition skills to help you find new ideas.

By all accounts, Howdens is a great company you should get to know. You may not be comfortable understanding UK or European home improvement trends, but Howdens’ network of small depots that are focused exclusively on a professional trade customer is a tough one to compete against and has the potential to reach into new markets.

** If you assume a higher inflation rate – say, 3% - and you think Howdens’ cash flows can grow 3% nominally in the perpetuity calculation, it increases the fair value estimate.

Disclosure: At the time of publication, Todd and his family own shares of Sherwin Williams.

Disclaimer:

This material is published by W8 Group, LLC and is for informational, entertainment, and educational purposes only and is not financial advice or a solicitation to deal in any of the securities mentioned. All investments carry risks, including the risk of losing all your investment. Investors should carefully consider the risks involved before making any investment decision. Be sure to do your own due diligence before making an investment of any kind.

At time of publication, the author or his family may have an interest in the securities mentioned or discussed. Any ownership of this kind will be disclosed at the time of publication, but may not be updated if ownership of a particular security changes after publication.

Information presented may be sourced from third parties and public filings. Any links to these sources are included for convenience only and are not endorsements, sponsorships, or recommendations of any opinions expressed or services offered by those third parties.

Hi Todd, This is a higher quality business than people appreciate and I agree that the reporting/management communication is excellent. Worth noting that Matthew Ingle has family pedigree in the joinery/timber trade- while it's not a family owned business there are cultural similarities. His book, Kitchens, or Sink, is worth reading.

FWIW, I don't see them attempting a US expansion. Management are a conservative bunch and they see the French expansion as a learning exercise. If it really gains traction there, that would keep them busy for 10+ years anyway.

Finally, it's worth noting that the depots take about 7 years to reach maturity. If they were to stop expanding the network and allow the existing depots to mature operating margins would easily trend towards the high teens.

I'm quite bullish on this business- there's a nice balance here between growth, dividends and buybacks and management and strategy are both proven. My best bet is that UK consumer confidence improves over the next couple of years, but regardless this is a business with a proven ability to weather a cycle and the balance sheet is very strong.

This is a great write-up.

The annual report is indeed wonderful and should be a model for many companies.

This is neither an “owner-operator" model neither a family-owned company but they managed to create and maintain a great culture.

The name was mentioned by Meryl Witmer in a Barron's Roundtable in 2017.