Flyover Stock: Franklin Electric (FELE)

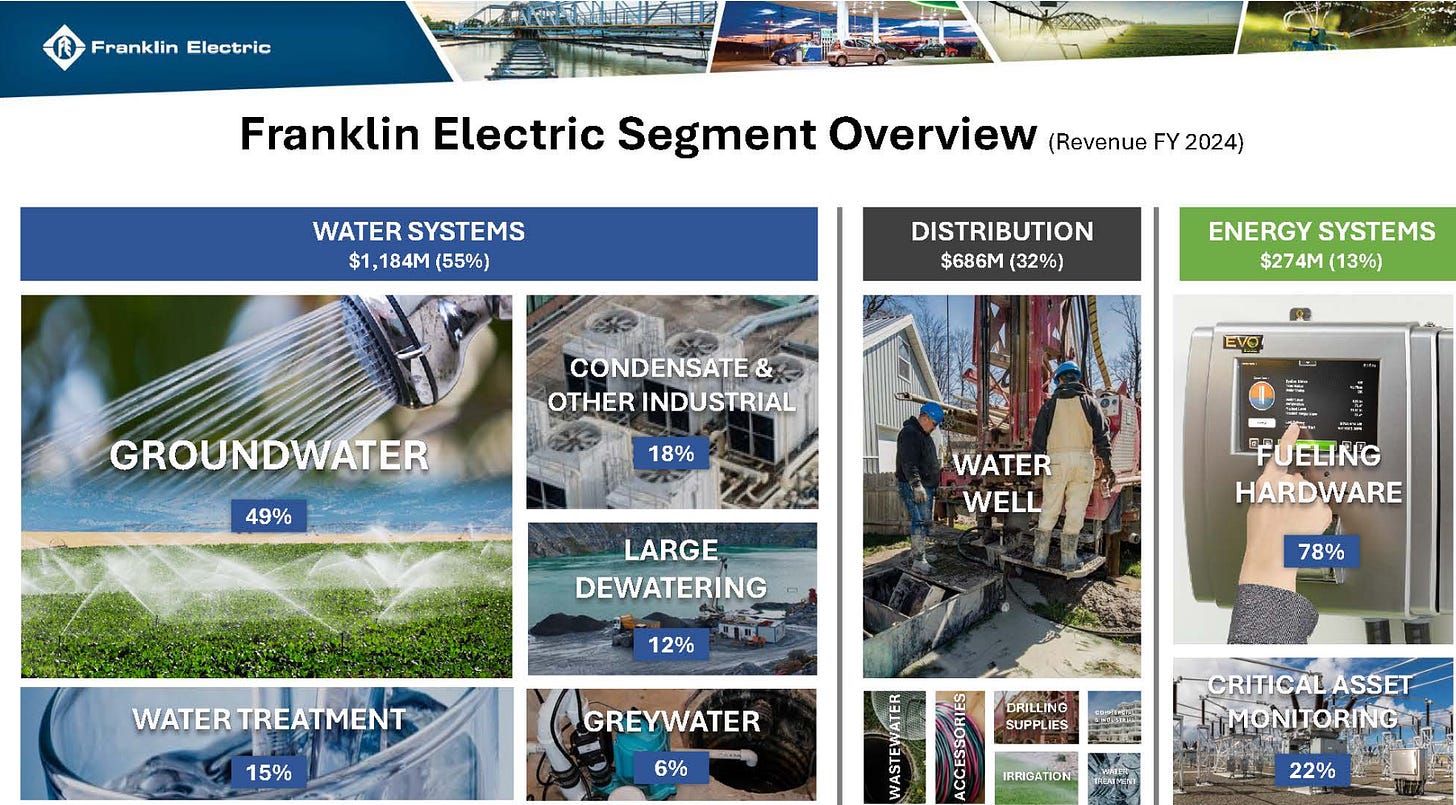

A closer look at Franklin Electric's high-margin energy business and growth in water systems.

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC or its clients owned shares of Ferguson.

Please see important disclaimers.

It doesn’t get more “Flyover Stock” than a company based in Fort Wayne, Indiana that was named after a Founding Father, and deals in unglamorous but mission-critical products.

Say hello to Franklin Electric!

Franklin Electric was founded in 1944 during World War II by T. Wayne Kehoe and Edward J. Schaefer. It initially produced backpack generators that powered radio communications used by assault troops on the front.

After the war, Franklin Electric focused on moving and managing water via electric pump. In 1953, the company patented and sold the first commercially-viable submersible motor able to pump water from deep wells to the surface.

This water pump innovation had a profound impact on agriculture and rural communities by providing a more efficient and dependable water source. By extension, the impacts are felt globally through improved crop yields and better food and water security.

What’s more, housing could be built in areas that didn’t have access to city water and supported the boom in suburban and exurban construction.

Today, the bulk of Franklin’s business remains tied to Water Systems - more on that in a moment - but it also entered the fueling business in 1988 after developing a submersible fuel pump to be used in gas stations. It turned out to be great timing. In the late 1980s, there were a series of regulations passed regarding gas stations that required massive amounts of investment by gas station owners to improve the environmental impacts and reduce risks associated with the fueling process.

Over time, Franklin went beyond the submersible turbine pumps (STPs) in the underground storage tank (branded FE Petro) to also managing the entire fuel delivery ecosystem through the secure underground piping and containment systems (UPP and APT), all the way to fuel dispensing and regulatory compliance equipment, including vapor recovery technology (Healy).

While Energy Systems is the smallest segment by revenue, accounting for about 13% of revenue, it sports 30%+ operating margins and represents over 30% of operating income. We’ll discuss this segment in more depth, as well.

Whether it’s water or fuel, Franklin Electric’s products move and manage critical fluids to where they need to be. This is no small task and helps keep the economy running smoothly.

As we discussed in our profiles of Core & Main, Hawkins, and Ferguson, there are a number of secular tailwinds behind water that have piqued my interest. One water-related opportunity we haven’t explored yet is the demand for “dewatering” in large projects. When a mining company needs to clear large pools of water from a shaft or a construction company needs to remove water to build a foundation, they often turn to Franklin Electric’s dewatering solutions, like the product seen below.

Let’s take a closer look at Franklin Electric’s moat, management, and valuation.