Did Something Break, Moats, and Liberal Arts

What to make of the large cap growth outperformance, and more.

The next Flyover Stock company profile is coming up in a few weeks. Please subscribe to be notified when the profile is published or upgrade to a paid subscription to get access to the full report, which includes moat, management, risks/opportunities, and valuation analysis.

Happy Saturday, everyone.

Did something break?

I don’t often comment on the market. Despite financial media’s efforts to convince us otherwise, there’s usually not much to talk about. It’s companies being companies and markets being markets.

Having experienced a number of exceptional market environments over the last 20 years, however, this moment feels noteworthy.

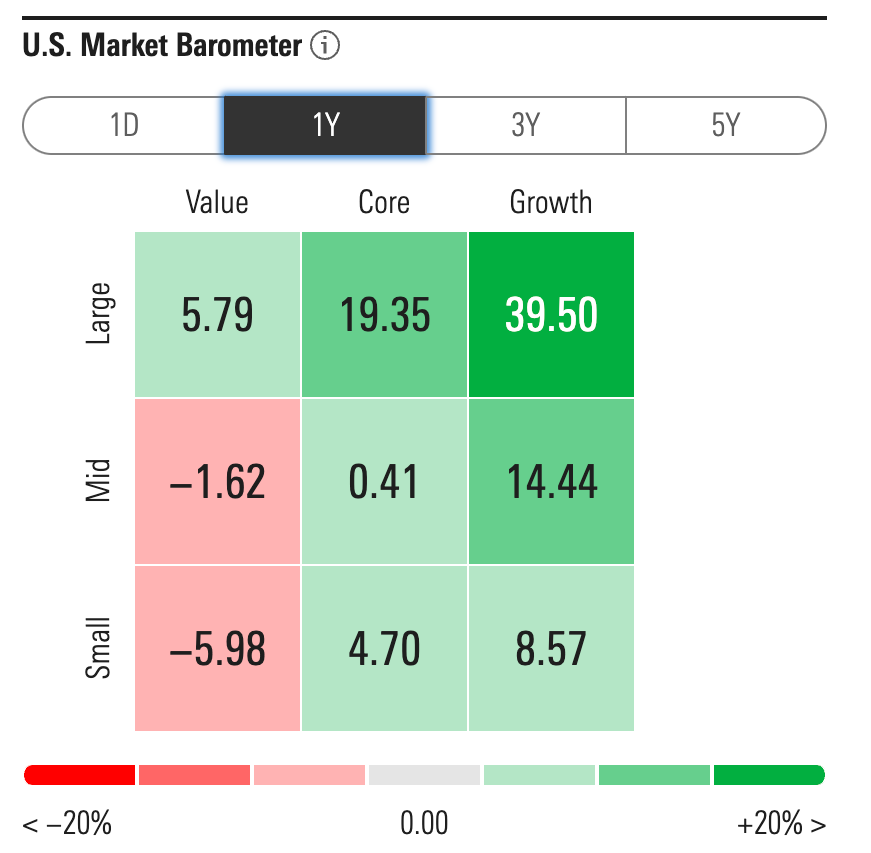

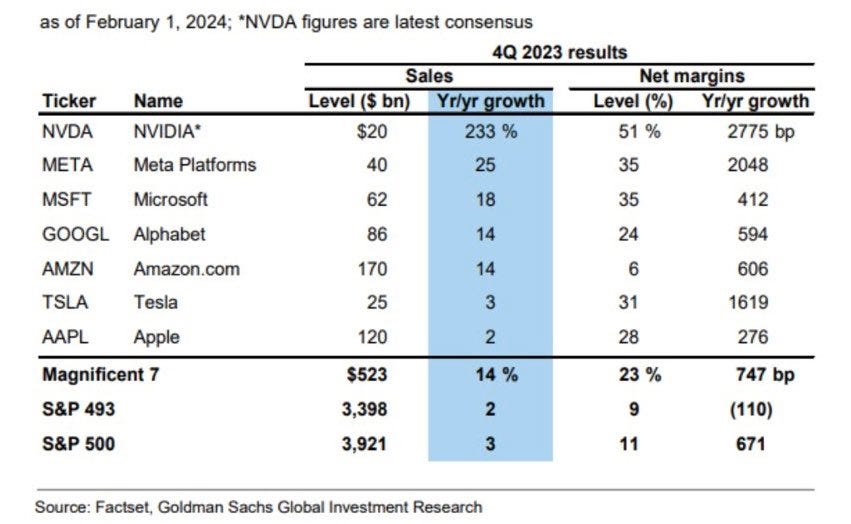

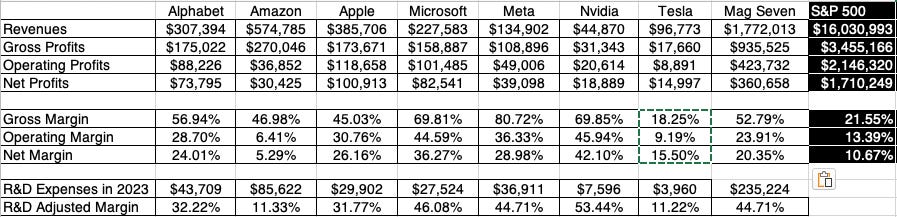

The Magnificent Seven, as they’ve come to be known, have dominated the market and broken base rates that suggest the largest companies are unlikely to grow at high rates.

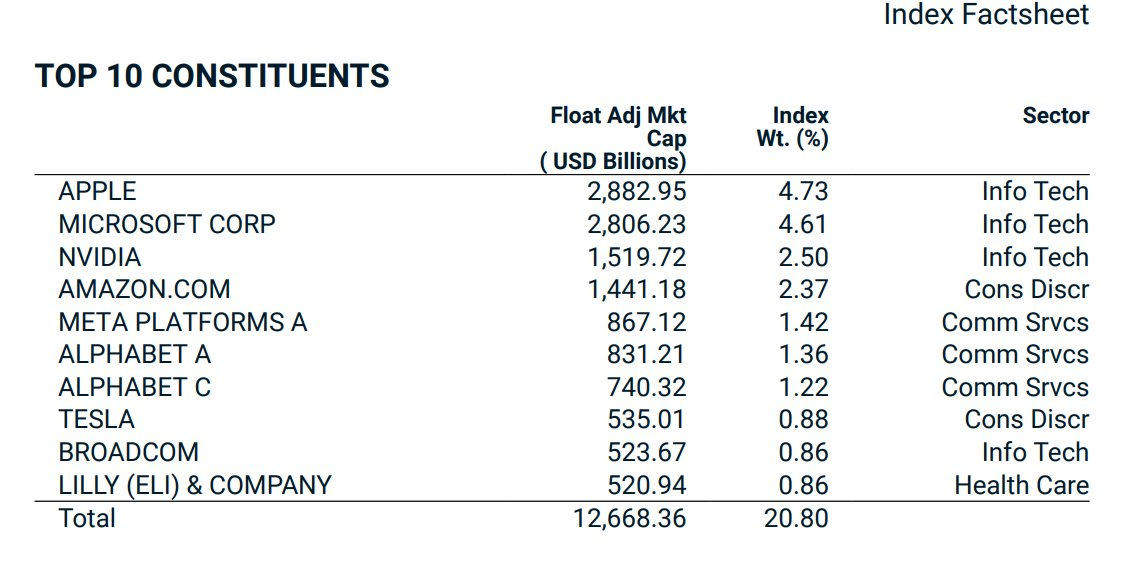

On the back of the Magnificent Seven and other large cap growth stocks, the US market has grown to account for 70% of the MSCI World Index and account for all of the index’s top 10 constituents.

So it’s reasonable to ask: “Did something break?”

Could it be the markets? Could it be value investing?

The rise of the intangible asset economy has been well documented and Michael Mauboussin and Dan Callahan, who published a set of historical base rates, illustrated how intangible asset-based companies can perform differently than the longer-term base rates suggest because they include a more tangible-asset heavy past.

But this most recent market surge, which began with the public launch of ChatGPT in November 2022 and accelerated with the cooling of year-over-year inflation and a pause in rate increases in 2023, feels different.

A good argument I’ve heard to support Mag 7 market values is that if an alien dropped in and observed what we do every day, they would see our businesses relying on AWS, Google Cloud, and Azure. They’d also see us spending about a third of our waking hours on our smartphones (iPhone/Android), most of which is spent consuming media via YouTube, Instagram, and other social sites. And so on.

From a relevance standpoint, these companies are firing on all cylinders.

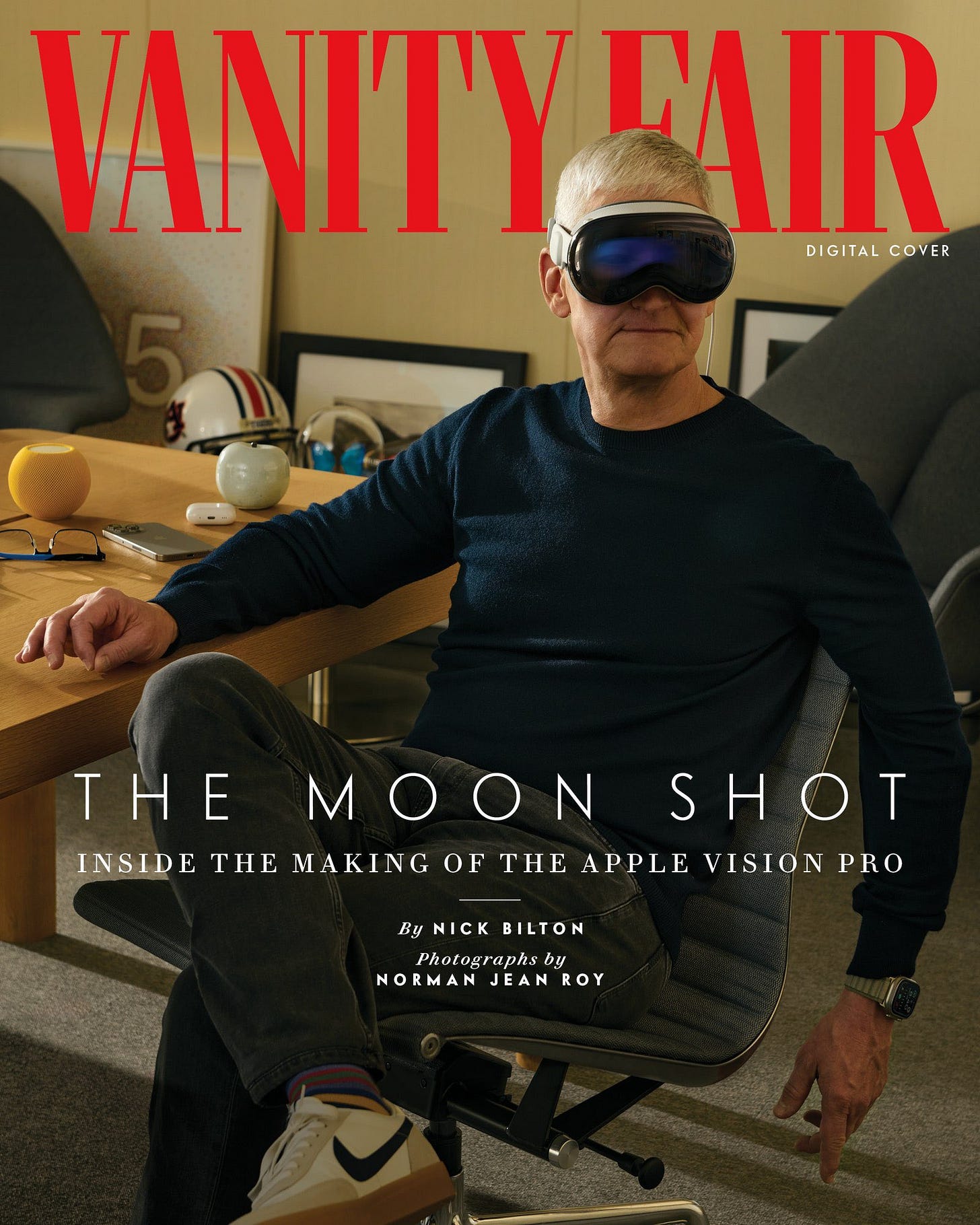

The expansion of AI, the thinking goes, will only increase our leisure time to consume digital media. All the easier when the screen is attached to your face, it seems.

What’s more, some of these companies are operating in “winner take all” markets. They have wide moats and are aggressively reinvesting their massive cash flows into further widening their innovation and infrastructure lead against would-be competition.

Unlike the dotcom bubble, there isn’t as much speculation as to who might be the winners of these exciting technologies. It’s more a question of what won’t the Mag 7 take for themselves?

Indeed, earnings growth has accounted for much of their stock gains as a group. It isn’t just pure multiple expansion driving their gains.

As Aswath Damodaran shared in his excellent post this week, their multiple premiums (as a group) may be explained by superior relative operating performance.

In all, there’s a reasonable case to be made for Mag 7/large cap growth stock performance that doesn’t rest on mere speculation and multiple expansion.

And yet.

As students of market history and human history, we know to be cautious in moments like this. Capital cycles ebb and flow. Excitement leads to over-investment, which leads to a sharp pullback in investment, and the cycle repeats. Governments may step in on anti-trust concerns. We don’t know for sure how or when it will end - or at least cool off - but history suggests that it will eventually. (Otherwise, something really did break!)

As investors, FOMO is real and watching the market’s taillights now and then is not enjoyable. There’s temptation to jump in so you don’t get left behind. But if you didn’t know to get in ahead of the trend, you’re unlikely to know when to get out. Tread carefully.

Of course, there’s a fine line in investing between patience and laziness. Just as the dotcom boom was a signal to learn more about the internet, today’s Mag 7/large cap growth rally is a signal to learn about the innovations sure to impact our lives and our companies over the next decade.

Though this is an exceptional market, I don’t think anything broke. We just need to take care that we don’t.

Moats

In recent weeks, I’ve seen a number of Twitter posts from various accounts criticizing company moat analyses done five or ten years ago where the stock subsequently performed poorly. The conclusions were that because of the poor subsequent performance, the original moat analyses were flawed.

The posts unintentionally made a key point. A company can have a moat and still be a crappy stock. What matters is the moat trend and whether the company’s ROIC performance beats the market-implied fade toward cost of capital.

This is why when I do company profiles, I split up the analysis for moat width, durability, and trend. Each plays an important and independent role. You want to see that there’s an existing moat, its products/services are likely to remain relevant, and its competitive advantages are strengthening over time.

Liberal Arts

I’ve enjoyed the feedback from my article on how liberal arts majors can break into the investing industry.

I was reminded that Chuck Akre was an English major. Akre shared these thoughts in his appearance on the Invest Like the Best podcast:

“I had no background whatsoever in the business world; I was an English major and I’d been a pre-med student and had no courses in business whatsoever. So I had a clean canvas and a willingness and a desire to learn and so my voyage was: ‘What makes a good investor, what makes a good investment?’” (my emphasis)

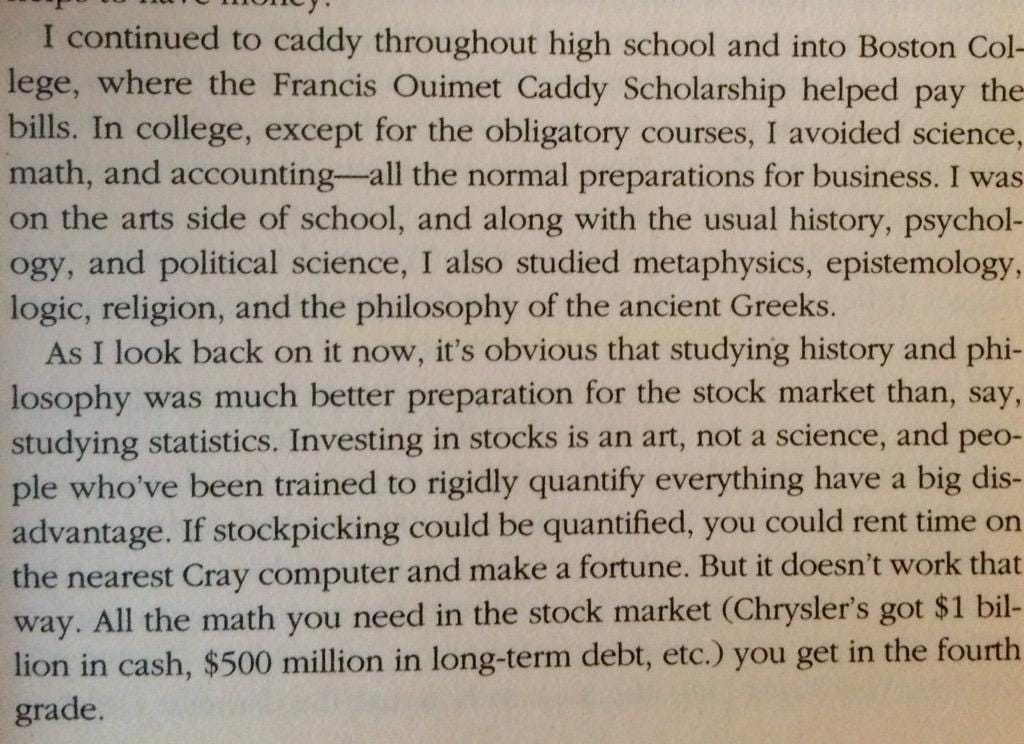

And no less than Peter Lynch studied history, philosophy, and psychology at Boston College. This, from One Up on Wall Street.

As Devin LaSarre reminded me:

Stay patient, stay focused.

Todd

At the time of publication, Todd and/or his family owned shares of Amazon.

Disclaimer:

This material is published by W8 Group, LLC and is for informational, entertainment, and educational purposes only and is not financial advice or a solicitation to deal in any of the securities mentioned. All investments carry risks, including the risk of losing all your investment. Investors should carefully consider the risks involved before making any investment decision. Be sure to do your own due diligence before making an investment of any kind.

At time of publication, the author or his family may have an interest in the securities mentioned or discussed. Any ownership of this kind will be disclosed at the time of publication, but may not be updated if ownership of a particular security changes after publication.

This newsletter does not provide buy or sell recommendations and articles should not be interpreted this way.

Information presented may be sourced from third parties and public filings. Unless otherwise specified, any links to these sources are included for convenience only and are not endorsements, sponsorships, or recommendations of any opinions expressed or services offered by those third parties.

Flyover Stocks has partnered with Koyfin to provide a discount to Koyfin’s services for Flyover Stocks readers. The W8 Group, LLC, which publishes Flyover Stocks, may receive a commission from a reader’s purchase of products linked from this page as part of an affiliate program.

This was a great read, Todd!

I like how you interpreted the moat critical twitter posts. It helped me better understand the dispersion between how some moaty companies can be undervalued while others can be overvalued.

I had two thoughts around the broken market commentary.

You mentioned that it isn’t just speculation driving price returns in Big Tech, but it has also helped me to be reminded that Big Tech’s outperformance over the past year or so should always be compared to its massive underperformance 2 years ago, when many of its constituents were down around 50%.

I wonder if part of the angst that a lot of conventional value investors feel is that there has been a bit of a seismic shift in the investing landscape. My working hypothesis is that the value and size factors have been fundamentally broken due to: 1. Companies staying private for longer (due to venture and private funding). 2. The most undervalued small companies being taken under by private equity. 3. Government intolerance of corporate failure, which prevents the reallocation of resources from underperforming companies in industries to the outperformers. (Government intervention such as ZIRP has allowed resources to be hovered up by “zombie” firms who don’t fail during cyclical declines due to government bailouts which prevents industry consolidation in better run firms. Big Tech doesn’t have this issue because their industries are naturally winner take all.) My guess is that these 3 things have been of a significantly larger note over the past 4 years (really since the GFC cough ZIRP cough) and it has frustrated investors who are running playbooks that made more sense before the tectonic plates shifted into their current positions.