AI Terminal Value Risks & Opportunities

Things I think I think about the future

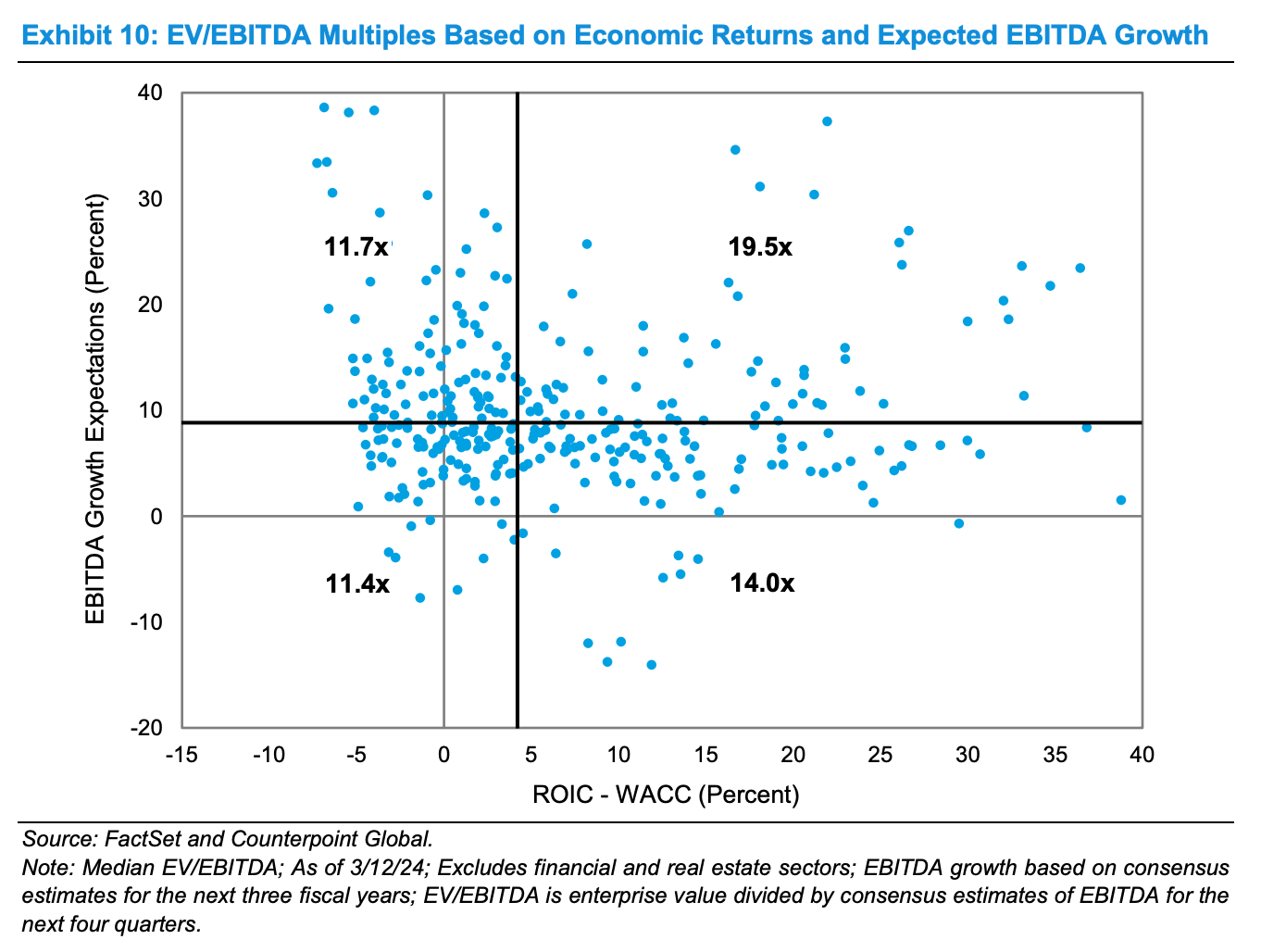

While market commentators quibble about the next quarter or two, the majority of a company’s fair value is determined in the terminal period - the assumptions underlying growth and profitability beyond five years.

Even if you’re using an exit multiple like EV/EBITDA or P/E, those multiples still imply a certain level of growth and value creation.

Consequently, long-term investors should fix their gaze on the horizon and regularly reevaluate their companies’ prospects in the next five years and beyond.

Will the company’s products be more or less relevant?

Is the company’s moat getting wider or narrower?

Does management have the capital allocation skill to navigate the tricky waters that are sure to arrive at some point?

AI’s rapid advancements have generated a new host of terminal risks and opportunities. Here are a few that I’ve been thinking about and how they might impact the companies I’m following.

1.) Autonomous Vehicles (AVs)

I wrote about AVs last year, but given Waymo’s rapid advances since then - particularly beyond city centers and into regional travel - it’s worth a revisit.

As Waymo’s geographic reach goes beyond city limits and starts connecting cities, network effects can take hold and have exponential effects not currently understood by consumers or investors.