AI Policy; More Thoughts on Research Stages; YETI update

What are the downsides of investing more in companies you've followed for a long time?

AI Policy

I recently added an AI policy to my disclaimers page. AI advances have been significant and it’s not always clear if a human or AI wrote something.

It’s important for you to know how I use AI here at Flyover Stocks. Here’s the policy in full:

In an era where AI-generated content is becoming common, clarity and authenticity in investing research are more important than ever.

I’ve been writing publicly about investing since 2006. Writing is an integral part of my research process. I enjoy the craft of writing. I enjoy sharing my thoughts with you and learning from our conversations after publication. I value this process and have no intention of changing it.

AI is an important tool and has become increasingly valuable in my research process, as it has for many investors. I believe it’s akin to 20th century investors adopting computers and spreadsheets to accelerate and build upon their research. Sticking with a slide rule and hand-drawn charts may have appeared more artisanal or authentic, but were ultimately a lower return on the investor’s time.

As such, I may use AI tools to help generate ideas or discover research threads to pull, but I verify, build upon, and review all material.

I may ask AI to help me say something better. I have a bad habit of writing in the passive voice, for example, and AI helps me catch those mistakes so you don’t have to read them.

Additionally, I may use AI-generated research tools like Tenzing MEMO (which I also promote through a partnership), to help me get up to speed on new ideas. This saves me considerable time and better refines which research paths are worth exploring.

I stand behind everything written on Flyover Stocks.

More on Research Stages

I received some good questions and feedback on my post last weekend about using research stages - Starter, Research, and Core - as an input to portfolio weights.

As a recap, I suggested that, all else equal, the less experience with you have with a stock, the less you should allocate to that position, and vice versa. This is a way to control the risk of “unknown unknowns” in a newer idea while enabling you to take an action without having a fully developed idea.

One critique was that the longer you follow a company, the more biases you can develop. For example, if I’ve followed a company for ten years, made a lot of money on it, hold it up as an example of my process, etc., I may become blind to emerging risks. Consistency and commitment bias are powerful forces.

Another critique is that a handful of companies that you’ve followed for a long time might crowd out new ideas because they get a larger allocation in the portfolio.

Both critiques are fair and touch on an important point that I didn’t fully discuss in the original post: there should always be room for new Starter ideas in your portfolio. Maybe it’s 5%, maybe it’s 15%, of the portfolio but new ideas play two important roles in portfolio management.

First, researching new ideas is the lifeblood of being an analyst. As much as I like learning new angles to the companies I’ve followed for a long time, what really piques my interest is studying a new company, industry, or geography. That’s one of the reasons I write about a new company each month for Flyover Stocks. It forces me to keep turning over rocks, even if I’m happy with the companies I own.

Second, new ideas serve as opportunity cost for existing holdings in the portfolio. You often hear the reverse. A portfolio manager may say to an analyst, “Why should I buy that new idea instead of buying more of my #1 holding?”

Fair question of course, but it can also be inverted. “Why shouldn’t I sell some of my #1 holding to buy this new idea?” If the risk-adjusted return potential for the new idea is better than that of the largest position, some capital can be peeled off the large position to finance the new idea.

Both of these benefits of Starter positions offset some of the risk of confirmation and consistency bias. Ultimately, a portfolio manager needs to be aware of potential biases, actively seek out disconfirming evidence, and stay honest with themselves.

YETI Update

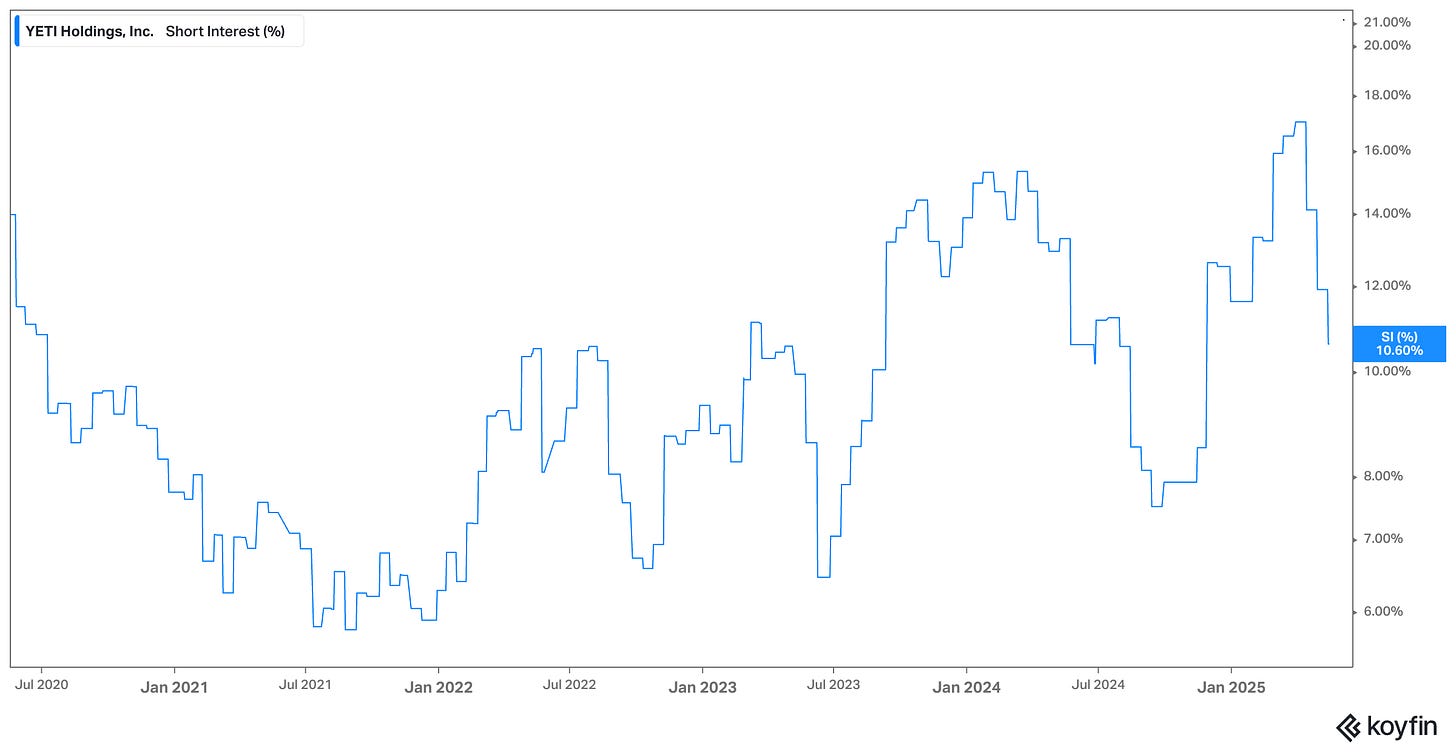

YETI has had considerable short interest in recent years, peaking in mid-April around 17%.

The bear case, in summary, is that the premium drinkware category in the U.S. has become oversupplied with fast followers, premium coolers are not regular purchases and are also facing competition, and its margins will suffer as it has to lower prices in the face of more competition and push more volume through Amazon.

To further complicate matters, YETI was directly impacted by the tariff announcements in April. In previous years, YETI had efficiently and presciently moved most of its supply chain out of China - only 5% of its COGS for U.S. sales are now products from China. But then the announced tariffs were applied to countries to which YETI moved manufacturing, such as Vietnam and Thailand. It’s still unclear how all of that plays out, but it looks brighter now than it did this time last month.

Given this backdrop, the stock naturally took a hit when management reduced guidance on May 8th. The stock has since recovered as tariff worries have cooled, but the long-term concerns remain in place.

But there are three things YETI can do to unlock long-term value and return to growth.

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, KNA Capital Management, LLC and/or its clients owned shares of YETI Holdings and Amazon.

Please see important disclaimers.