3 Flyover Stocks on My Radar

Manufactured homes, horse racing, plumbing, and hospice care are on the docket today.

One of the problems with new ideas is that you don’t know what you don’t know. I’m not talking about trivial information like what kind of car the CEO drives - I’m talking about material information.

Is there a new competitor that’s slowly but surely taking share?

Does the board appear to be independent, but is really a group of the CEO’s acquaintances and friends?

Will AI solve the problem the company’s currently solving and do it faster, cheaper, and more consistently?

Building conviction is about eliminating blind spots. It takes time. Ultimately, you want to get to a point where you could theoretically go onto CNBC and debate a well-informed short-seller about the company and not be worried that you missed something important.

Most of the Flyover Stock profiles have been on companies where I started from scratch. Since my goal is to have each profile be “pitch ready” for a portfolio manager to make a decision, that’s meant an accelerated search for blind spots in my understanding of the companies.

Last year, Nick Kapur - a friend and former Motley Fool colleague - offered me a trial of a new AI-driven research platform called Tenzing MEMO, which he had recently launched with Tom Saberhagen, a former partner and co-portfolio manager at Akre Capital.

Basically, you type in a ticker and get an AI-generated analysis of the company, which includes business overview, key risks, valuation considerations, management backgrounds, and bull and bear cases. One of my favorite features is that it suggests follow up questions to ask yourself and/or management. You can ask Tenzing MEMO questions about the company, as well, and get an informative response.

While I’m intentionally reducing distractions in my research process, I’ve found that Tenzing MEMO has helped improve my early stage research and more quickly direct me to the key issues for each company.

Anyone interested in a free trial to Tenzing Memo can register on the Tenzing MEMO website (all new users receive a generous, no commitment free trial to kick the tires of the software). As an added bonus, Tenzing is generously offering Flyover Stocks members an additional 10% off yearly subscriptions. Based on the pricing of various platforms I’ve been pitched over the years, their rates are quite reasonable given the breadth and depth of the available data.

You can sign up for a free trial here, and if you like it enough to buy it, reference code FLYWITHUS to receive the extra 10% off your annual subscription.

In today’s post, I’ll discuss three Flyover Stocks on my radar - one of which I know well and the other two I’m starting from scratch.

Legacy Housing (LEGH)

Market cap: $609 million

P/E (ntm): 10.3x

Dividend yield: N/A

Like Jack Henry, Legacy Housing has a near-perfect profile of a Flyover Stock. Based in the Dallas suburb of Bedford, Texas, Legacy Housing has four sell-side analysts covering it, operates in a relatively dull industry (manufactured homes), and has a non-obvious name. And as an added bonus, one of its founders wears a cowboy hat in corporate photos. I just love that.

Founded in 2005, Legacy Housing builds small manufactured homes (illustrated below) and the company believes it is “one of the most vertically integrated in the manufactured housing industry.” Its products cost between $33,000 and $180,000 at retail and appeal to a variety of consumers, including first-time homebuyers, retirees looking to downsize, and lower-income households. Build-to-rent developers are also drawn to Legacy’s models to fill out new communities.

Legacy can assemble a home in three to six days across its three facilities (two in Texas and one in Georgia) and respond quickly to changes in market demand. It has 13 retail showrooms around the Southern U.S. through which it has direct sales contact with prospective buyers.

As of the latest proxy, insiders own about 32% of the company - most of it held by the two co-founders, both of whom remain active as executive chairman and executive vice president. This suggests that company leadership takes a long-term perspective, aligned with shareholder interests.

Given Buffett’s purchase of Clayton Homes in 2003 - the largest manufactured homebuilder - there may be some moat characteristics worth exploring in this industry. Since going public in 2018, ROIC has averaged 13% - not inconsistent with large public homebuilders.

Legacy’s vertical integration in manufacturing, sales, and financing may offer some low-cost advantages, particularly regionally. There are also some regulatory barriers with manufactured housing, which are required to comply with U.S. Department of Housing and Urban Development (HUD) standards.

Churchill Downs (CHDN)

Market cap: $10.3 billion

P/E (ntm): 20.0x

Dividend yield: 0.3%

Kentucky horse country is about 90 minutes from my home and it’s a place we regularly take out-of-town visitors. It doesn’t hurt that it is also bourbon country, but horse country is spectacular in itself.

Nestled in Kentucky horse country is the world-famous Churchill Downs racetrack in Louisville, home of the Kentucky Derby. Even if you’re not into horse racing, Churchill Downs is a sight to see and the adjacent Kentucky Derby museum is worth a visit.

The Kentucky Derby and the racetrack are both owned by publicly-traded, Churchill Downs Incorporated, or CDI. In doing this initial research, I was surprised to learn that it’s been publicly traded since 1958. I would have thought it would have drawn my attention at some point in the last 21 years.

Today’s CDI is involved across a variety of horse-racing and gambling products and services.

CDI’s 10-year ROIC average is surprisingly low at 8.2%, which prompted me to consult Tenzing MEMO. When I asked “Why has CHDN's return on invested capital been so low over the last decade?” it returned the following:

I’m not quite as concerned about the third reason as I consider the Derby to be a timeless, economically irreplaceable asset. The first two, however, piqued my interest.

CDI has aggressively invested in recent years, growing its invested capital base from $1.46 billion at the end of 2014 to $5.95 billion at the end of the third quarter 2024. NOPAT grew slightly faster, but it only increased ROIC by about 230 basis points to 9.4%.

Given CDI’s high leverage (4x net) and non-investment grade credit rating, that ROIC likely approximates the cost of capital. The next step before doing a full profile would be to better understand management’s capital allocation acumen and strategy.

TenZING also offered some thoughts on CDI’s regulatory challenges:

While regulatory barriers keep new competitors at bay, they can also limit the incumbents’ profitability if and when legal winds change. CDI has made large investments in historical horse racing machines, for example, and if states follow Louisiana’s lead that HRMs can only be allowed after local voter approval, it could impair the profitability of that segment.

Chemed (CHE)

Market cap: $9.0 billion

P/E (ntm): 24.5x

Dividend yield: 0.3%

Like Cintas, Chemed is another Cincinnati-based company that I wish I’d better understood a decade ago. Over the last ten years, Chemed has generated 509% total returns versus the SPY ETF at 252%. Sometimes, the best investment opportunities are under your nose and it pays to consider local companies in your research.

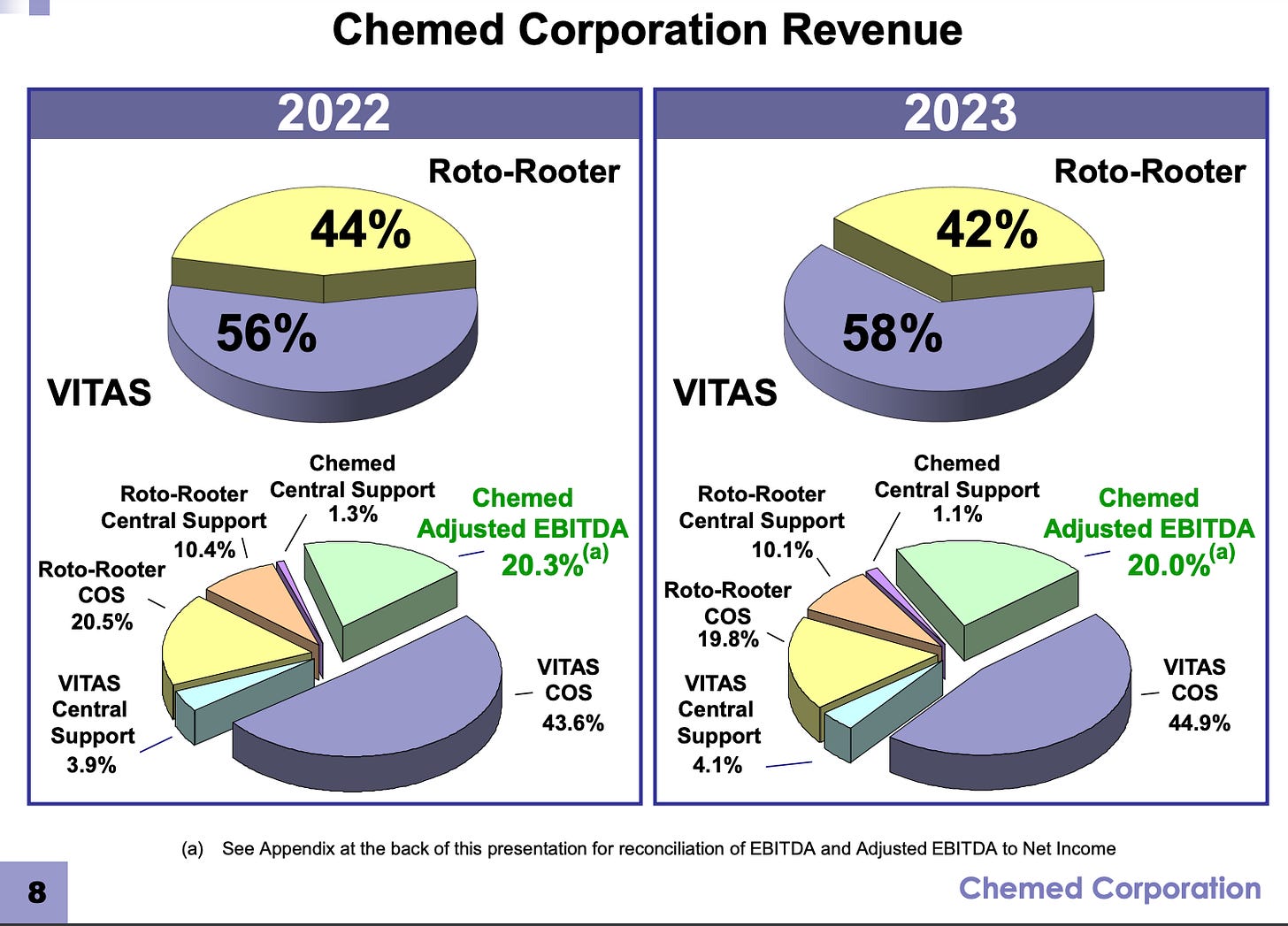

Chemed is a true idiosyncratic company that doesn’t have a good apples-to-apples peer, as it straddles two very different industries: hospice care (VITAS) and plumbing (Roto Rooter).

Roto Rooter is the largest plumbing and drain cleaning brand in North America, but both end markets are highly fragmented markets. What’s more, local rather than national dynamics are more important to customers. There are low barriers to entry in plumbing and low incentives to achieve national scale. Nevertheless, Roto Rooter is a national brand and may benefit from having search cost advantages when desperate homeowners in an emergency are in search of a same-day plumber.

While Roto Rooter’s franchised operations are fairly easy to understand, I have less of a background in hospice care and the dynamics around it.

Tenzing MEMO helped me understand the potential impacts of Medicare and Medicaid reimbursement for VITAS:

“Changes in Medicare reimbursement rates can significantly impact VITAS's revenue and profitability, given its heavy reliance on government programs. VITAS, a segment of Chemed Corporation, derives over 95% of its revenue from Medicare and Medicaid. Here are some specific ways these changes might affect VITAS:

Revenue Impact: Medicare reimbursement rates directly influence VITAS's revenue. For instance, a reduction in these rates would decrease the revenue per patient day, affecting overall revenue. Conversely, an increase in rates could boost revenue, as seen with the recent 2.5% increase in the geographically weighted average Medicare reimbursement rate, which contributed to a 16.7% revenue increase in Q2 2024.

Profitability: Profitability is closely tied to reimbursement rates. If rates decrease, VITAS may struggle to maintain its profit margins unless it can offset the reduction through cost efficiencies or increased patient volumes. The adjusted EBITDA margin for VITAS excluding Medicare Cap was 17.8% in Q2 2024, showing improvement partly due to increased reimbursement rates.

Medicare Cap: The Medicare Cap limits the total payments a hospice provider can receive per patient. If VITAS exceeds this cap, it must refund the excess, which can negatively impact profitability. In Q2 2024, VITAS accrued $1.4 million in Medicare Cap billing limitations, highlighting the financial impact of this cap.

Operational Adjustments: Changes in reimbursement rates may necessitate operational adjustments, such as altering the mix of services provided or focusing on more profitable care levels. For example, VITAS has seen a shift in acuity mix, which can affect revenue growth.

Strategic Planning: Anticipating changes in reimbursement rates is crucial for strategic planning. VITAS's management must continuously assess the potential impact of rate changes on its financial performance and adjust its strategies accordingly.

Overall, while VITAS has shown resilience and growth, changes in Medicare reimbursement rates remain a critical factor influencing its financial health.”

While that explanation itself isn’t sufficient for full conviction, it provided a number of useful threads to pull for further research.

And it seems Chemed is one worth further research, as it’s generated an average ROIC of 24% over the last decade and has a net cash balance sheet today.

Bottom line

All three of these companies are worth further research and are candidates for a full Flyover Stocks profile. Be sure to subscribe below to stay up to date on monthly Flyover Stocks profiles.

Stay patient, stay focused.

Todd

Additional disclosure: Tenzing MEMO provided financial compensation for this article. I only promote third-party products that I use and enjoy. Please see important disclaimers.

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC own shares of Jack Henry.

Please see important disclaimers.

Thanks for the interesting ideas Todd.

A note - "They've invested a lot of capital" is not a sufficient explanation as to why Churchill Downs' return on that invested capital has been poor - sorry MEMO. The real reason is very obvious if you look at their financials for a few seconds - a massive goodwill account, principally assumed in 2022 when I'm guessing they made a major acquisition for a fairly high multiple. I'm sure I don't need to explain this, but if you have a shell company which pays 20x earnings to acquire a business, the ROIC will (initially) be 5% - even if the underlying business earns a 50% ROIC.