Wild Market Week, YAV Podcast Appearance, GO Store Visit, FWRG Traffic Improvement

Some weekend thoughts and recommendations

Podcast

Earlier this week, I was a guest on Andrew Walker’s excellent Yet Another Value Podcast where I discussed Ecolab, a KNA Capital holding. I haven’t profiled Ecolab on Flyover Stocks yet, but it’s a classic example of a successful Flyover Stock.

In the meantime, you can hear my thoughts on Ecolab by listening to the podcast episode. Andrew is a well-informed host who asked challenging and thoughtful questions.

As for the Flyover Stocks Podcast, it will be updated in December with new episodes.

What a week

Well, it’s been an interesting week in America - and in American markets.

As the below chart shows, US indices - Nasdaq (QQQ), S&P 500 (SPY), and Russell 2000 (IWM) - jumped after the US election results. By comparison, the FTSE All-World ex-US, as measured by the VEU ETF, fell 1%.

I won’t add to the political discourse here - we’ve all had our fill - but I found the market reactions to be notable.

Looking back five years from now, I’m not sure they’ll be indicative of anything, but reduced uncertainty around corporate tax rates, regulations, and anti-trust enforcement likely contributed to this week’s rally in domestic-focused businesses and small caps.

Whether or not those factors offset increased uncertainties elsewhere remains to be seen, but some of your companies and my companies could face new challenges in the next few years.

One of my investing beliefs is that great companies adapt and get better during challenges, so I intentionally set a high bar for the companies I want to own. This was reinforced to me during March 2020 when I saw how the effectiveness and execution at great companies in those first weeks of COVID quarantines stood apart and above from the middling ones.

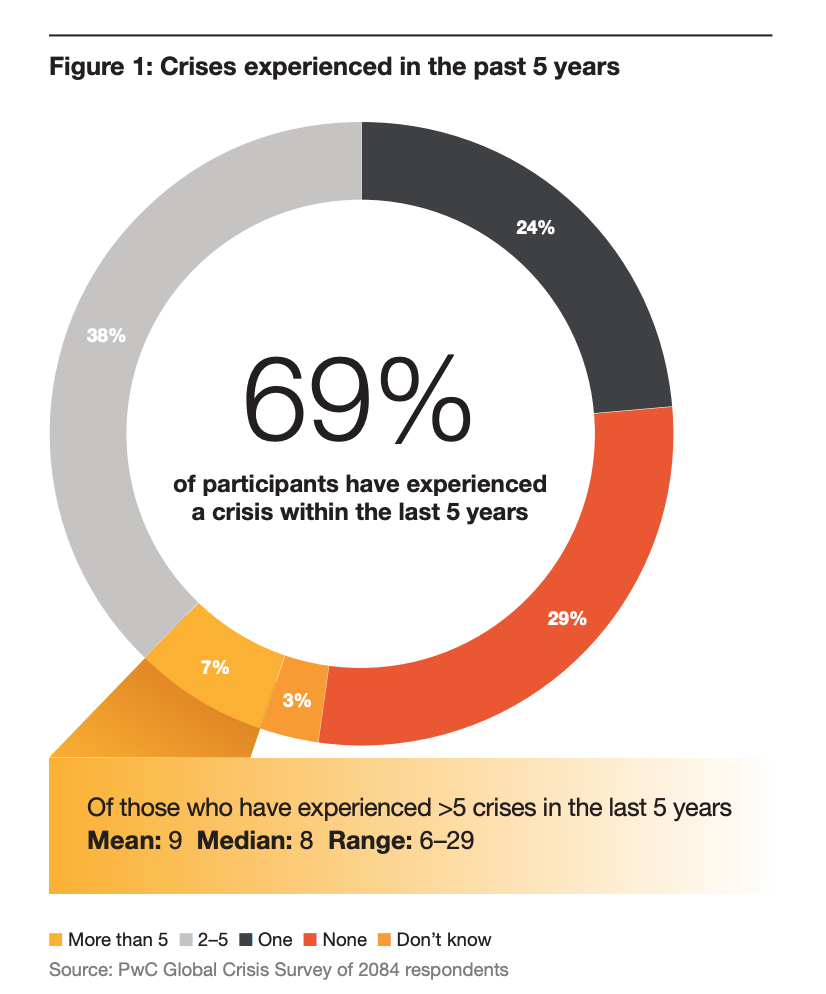

If you aim to hold a stock for more than five years, the odds are that the company will face at least one enterprise-level challenge. The challenge can come from a variety of angles - financial, geopolitical, technological, etc. - but what matters is how the company responds to it.

If you don’t have faith (or conviction) in a company’s ability to adapt and “do the right thing” for shareholders and stakeholders during one of these challenges, you’ll be shaken out of the investment at the first sign of trouble.

Book recommendation

I’m currently reading and enjoying The War Below: Lithium, Copper, and the Global Battle to Power Our Lives by Ernest Scheyder. Scheyder is a good writer who communicates a complex subject in understandable terms.

A fun fact I learned was that the lithium-ion battery was invented in 1977 by an Exxon scientist named Stanley Whittingham. Whittingham later won the 2019 Nobel Prize in Chemistry. It wasn’t until 1990 when Sony figured out how to mitigate the risks of spontaneous combustion of lithium-ion batteries by adding cobalt to the mix that the batteries became commercially viable and led to many of the portable devices we enjoy today.

The War Below is complementary to another book I’ve recommended - Material World by Ed Conway - as it looks the “dirty work” necessary to fuel the energy transition and the environmental, social, and geopolitical risks it brings.

Regardless of who the American president is, the energy transition will continue and it’s important for investors to understand all that is at play.

Here are some updated thoughts on Flyover Stock companies:

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC own shares of Ecolab and First Watch Restaurant Group.

Please see important disclaimers.