Why Network Effects Unravel

For network effects to occur, the product or service has to be highly relevant to its users. When relevance fades, network effects quickly unravel.

Audio version:

“Cities are emergent complex adaptive social network systems resulting from the continuous transactions among their inhabitants, enhanced and facilitated by the feedback mechanisms provided by urban life.” - Geoffrey West

A recent Twitter thread got me thinking about what unravels the network effect moat source.

Sinstockpapi’s astute comment about cities and network effects struck a chord because it reminded me of my research into Cincinnati’s early history.

Cincinnati was America’s first “boom town” and, within 50 years of its founding, was one of the largest cities in the United States. This feat attracted the likes of Charles Dickens and the Prince of Wales (future Edward VII) to the shores of the Ohio River to see the phenomenon in person.

You can see the positive network effects in action. As economic opportunities abounded in the city, more arrivals followed. The arrivals created more businesses and economic opportunities, and the cycle continued. Indeed, it was during this period in Cincinnati’s history that William Procter and James Gamble started a soap and candle company.

Between 1840 and 1860, in particular, Cincinnati’s network effects were in full swing, leading many prognosticators to conclude that Cincinnati would be the major inland city in the United States. At the time, it was hard to believe otherwise.

And yet. Further westward expansion in the United States took economic opportunities beyond the Mississippi River. Railroads also disrupted Cincinnati’s advantaged position along the river and canal system.

In stepped Chicago, and you can see how Cincinnati’s network effects unraveled while Chicago’s took off through the end of the 19th century.

What happened to Cincinnati in the 19th century is that it became less relevant. Not fully irrelevant, just less relevant relative to other options. And that was enough to unravel the network effects that fueled its exponential growth. The city and surrounding area continued to grow, but it wouldn’t become the Midwestern metropolis as had been expected.

Strongest moat?

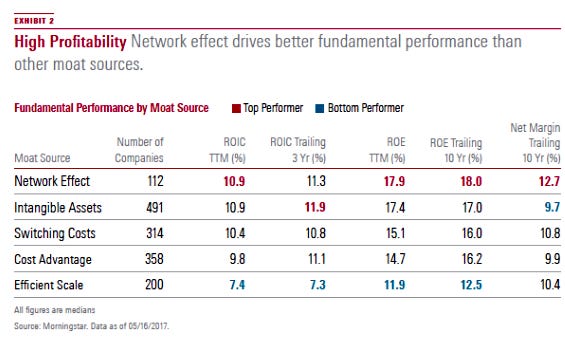

Network effects can be a powerful moat source. Indeed, Morningstar found that the network effects moat source was the rarest type in its coverage universe and had the best fundamental performance.

One of the significant benefits of network effects is that it allows a company to scale quickly. Facebook is a perfect example. It grew from a small network of college students in the early 2000s to the dominant global social media platform less than 20 years later.

The relevance of Facebook’s offering is what drove its network effects. Someone who joined the network along the way had access to not just billions of people worldwide but, more importantly, access to people and organizations in their local communities in ways that weren't possible before.

In contrast, MySpace - which, for a time in 2006, was the most popular website in the U.S. - lost relevance with its users for various reasons. Consequently, its network effects unwound, hastening its journey into obscurity.

Companies with network effect advantages and products/services growing in relevance are nearly impossible to disrupt. That’s because as the size of the network grows with new enthusiastic participants, revenue grows more rapidly than costs, and margins expand, allowing the incumbent to reinvest and further widen the lead against competition.

This assumes that management reinvests in a manner that maintains or increases its product’s relevance to the network. It’s notable in the above chart that Facebook's monthly unique visitors only took off when MySpace's monthly unique visitors began to flatten.

Tangible asset networks

When discussing network effects, we tend to think of intangible asset-based platform businesses like eBay, Etsy, and Meta/Facebook, but you can also have tangible asset-based network effects. While tangible-asset-based network effects may have lower ROICs than their intangible counterparts and be more capital-intensive, the barriers to entry are typically higher. The advantages take longer to chip away.

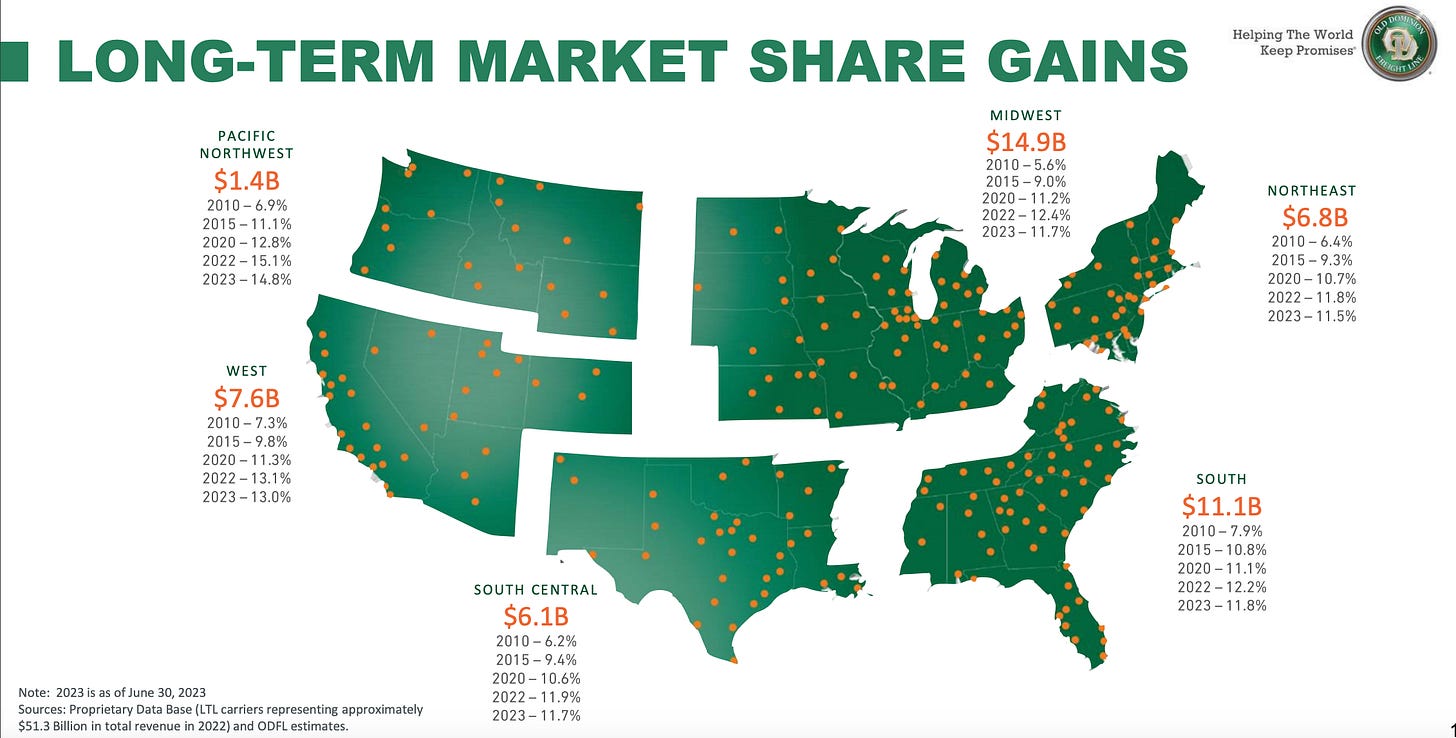

An example is Old Dominion Freight Lines (ODFL) in the less-than-truckload (LTL) industry. As the chart below illustrates, ODFL has an expanding national network of service centers, and they’ve taken market share in every region since 2015.

Each new node in the network gets them closer to both ends of the shipment - the customer putting items on the truck and the receiver of those items. The better ODFL’s network is at servicing customers on both sides, the more business flows through the ODFL network, the stronger ODFL’s margins, and the more they can reinvest in the business.

However, having the network of service centers isn’t enough. One of ODFL's major competitors, Yellow, had a more extensive national network and recently filed for bankruptcy.

Instead, ODFL’s superior service quality, as evidenced by a low percentage of cargo claims (0.2% of revenue) and a high percentage (99%+) of on-time deliveries, enables its network to be vibrant and value-enhancing.

Suppose ODFL's service quality starts to slip for one reason or another. In that case, that's when you would begin to worry that the relevance of its offering to customers is on the decline, and the network effects may start to unravel.

Relevance vs. Recognizability

When evaluating a network effects advantage and considering the relevance of a company’s product or service, look for indications that the “offer” for joining the network is getting better - or at least not getting worse - relative to other options.

Products that have lost relevance can still be recognizable. Groupon is still recognizable, but it’s far less relevant than a decade ago. Recognizable isn’t the same thing as relevance.

Relevance is best thought of as mind-share or, even better, wallet-share. Are users transacting more or less frequently over time? Are they using the service more or less overall? Relevance begets pricing power and a continuation of the network effects.

The network effects benefits peak when the incremental user moves from enthusiasm to indifference. Sooner or later, the user will find value and opportunity in another network. When those continuous transactions and feedback mechanisms that Geoffrey West noted in the opening quote about networks start to fade, that’s when you should reassess your thesis and forecast.

Stay patient, stay focused.

Todd

Disclaimer:

This material is published by W8 Group, LLC and is for informational, entertainment, and educational purposes only and is not financial advice or a solicitation to deal in any of the securities mentioned. All investments carry risks, including the risk of losing all your investment. Investors should carefully consider the risks involved before making any investment decision. Be sure to do your own due diligence before making an investment of any kind.

At time of publication, the author or his family may have an interest in the securities mentioned or discussed. Any ownership of this kind will be disclosed at the time of publication, but may not be updated if ownership of a particular security changes after publication.

Information presented may be sourced from third parties and public filings. Any links to these sources are included for convenience only and are not endorsements, sponsorships, or recommendations of any opinions expressed or services offered by those third parties.

Michael Kao likes to point out that the sword of inelastic supply cuts both ways. By the same token, the sword of network effects cuts both ways: if the network shrinks, the value destruction is disprortionate.

Thank you for sharing your thoughts on this, Todd.

To play devil’s advocate: The example of Cincinnati can be turned around to show that even though the main reason for the (population) growth diminished due to competitors (other cities) with clear advantages (location).

Still the city didn’t seize to exist and is today 3x the size of the boom times.

Myspace at its peak had 100 million users. Last figures I found from 2019 there were still 7 million users active.

To your example of ODFL vs. Yellow. I would argue the utility of a network is not purely a function of number of nodes. Just as Facebooks utility diminished for users with less people posting stuff, even though the absolut number of users kept growing.

Network effects are not infallible, but I would argue the competitors couldn’t compete without network effects themselves. The competitors were able to compete based on value add + their own network effect. Where the real size of the network and the extrapolation of current trends come into effect.

Network effects come in shades of different strengths and with/without exponential, linear, or asymptotic value add properties. Physical networks being anchored in the real world with substitution costs being more permanent than purely digital.

The original network effect of providing additional benefits (opportunities) to customers can still exist but is outweighed by other factors. In case of Myspace multi-tenant is coming to mind. In case of cities, I would argue the benefits are asymptotic, where the additional benefits diminish after a certain size. In 19th century this size was probably even smaller than today due to mobility and communication limits.

I really like the differentiation between types of network effects done here: https://www.nfx.com/post/network-effects-manual