Powerful Experiences, Considering Momentum, and Casino-Like Markets

Please note: I recently added a tab at the top of the Flyover Stocks page that contains a list of the previously-profiled companies. Now that they’re all in one place, they’ll be easier to find and reference as needed!

Audio version:

Powerful experiences

It’s not often that you have two powerful life experiences in a matter of two weeks, but that was fortunately the case for me and my family recently.

In late March, we traveled to Alabama for some time on the beautiful Lewis Smith Lake. We stopped by the U.S. Space and Rocket Center in Huntsville, which brought back a ton of 80s/90s nostalgia as it is the home of “Space Camp” - the big prize in many American kids’ game shows of the era.

While walking under a Saturn V rocket and seeing a Moon rock was pretty cool, the most impactful part of the trip was visiting Civil Rights locations in Birmingham, Selma, and Montgomery.

As we toured the various sites, I kept thinking about Paul’s admonition in Romans to “not be overcome by evil, but overcome evil with good.” I’m in awe of the faith they had in each other and in God to face what they did. It was also a stark reminder of what humans are capable of when we deny the humanity and dignity of others.

The second powerful experience was witnessing totality during the recent solar eclipse that passed through Ohio. My family and I watched it at The University of Dayton campus, alongside a few hundred Flyers. I’d seen a partial solar eclipse a few years earlier and thought it was neat, but this was a different ballgame.

Day turned into dusk for two minutes, the temperature plunged, and in that moment you could look directly at the sun, ringed by the white glow of the corona. Birds fell silent, thinking it was night time. Planets could be seen. It was surreal.

Totality must have been a terrifying sight to those who didn’t understand the science behind it, but knowing what’s going on turns it into a beautiful sight. I can understand why people chase totality around the globe to get that feeling again.

Considering momentum

As I’ve discussed elsewhere, quality traps - strong current/historical fundamentals, expensive price, and eroding moat - are the Achilles heel of long-term, business-focused investors. In these situations, investors are hit with the double-whammy of slowing or declining earnings and multiple compression as ROIC declines.

As such, we should be on guard against quality traps.

Momentum is one factor that I consider, especially when initiating a new position in an optically-strong business.

Unless you’ve followed a company for a number of years, you will have far less conviction in your starter positions than your legacy positions. Now, you might reasonably protest that you shouldn’t commit any capital until you have sufficient conviction, but it can also be difficult to build conviction until you have some skin in the game. Each investor has a different threshold.

Generally speaking, in the starter position stage, there remain important valuation and business risk factors that you may not yet fully appreciate.

A stock price contains implicit expectations about future cash flows and risk. Poor momentum can therefore indicate underlying concerns about the business. Those concerns may be overblown, but until you have sufficient understanding and conviction, you may not know enough to disagree with the market’s assessment.

As such, poor momentum in a high quality, premium-multiple stock is a yellow flag that you need to do more work. It could be an early sign of a quality trap taking shape. (Conversely, strong momentum in a high quality, cheap stock can be an indicator that there may be long-term growth opportunities that you haven’t fully considered.)

It doesn’t mean that you won’t eventually invest into poor momentum, but it’s best to double-check for loose ends in your research.

Considering momentum isn’t the same thing as watching daily stock prices, which I don’t recommend doing. Stocks with strong momentum can have down days and stocks with poor momentum can have up days. Instead, momentum looks at price trends and earnings revisions over recent months.

These considerations are consistent with a long-term, business-focused approach. In fact, I’ve found they’ve led to more fundamental research than I might have done otherwise.

It’s true that the market can be a giant distraction to the business of investing (as Bogle put it), but it can also be a useful tool when viewed as reflecting changes in implied expectations about businesses. Our job as investors is to determine whether we agree with those implied expectations and invest (or not) accordingly.

Casino-like markets

Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than when I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants. - Warren Buffett

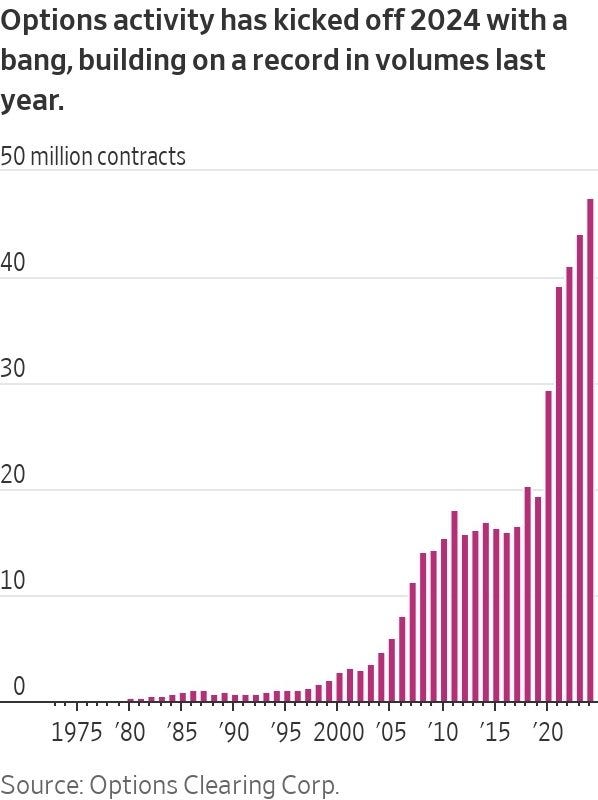

Early in my career, I came across New York Stock Exchange turnover data going back to the 1950s (similar to the chart below) and noticed that the average holding period on NYSE stocks had shrunk from a decade to months.

Appalled, I concluded that the shrinking holding period was a reflection of our culture’s growing need for instant gratification. Earlier generations were clearly more patient. Or so I thought.

What I didn’t realize was that if you zoomed out on the NYSE data, it shows that impatience is not a modern phenomenon at all.

Casino-like behavior, as Buffett put it, is not new in markets. If anything, the period between 1940 and 1970 was likely the exception rather than the rule.

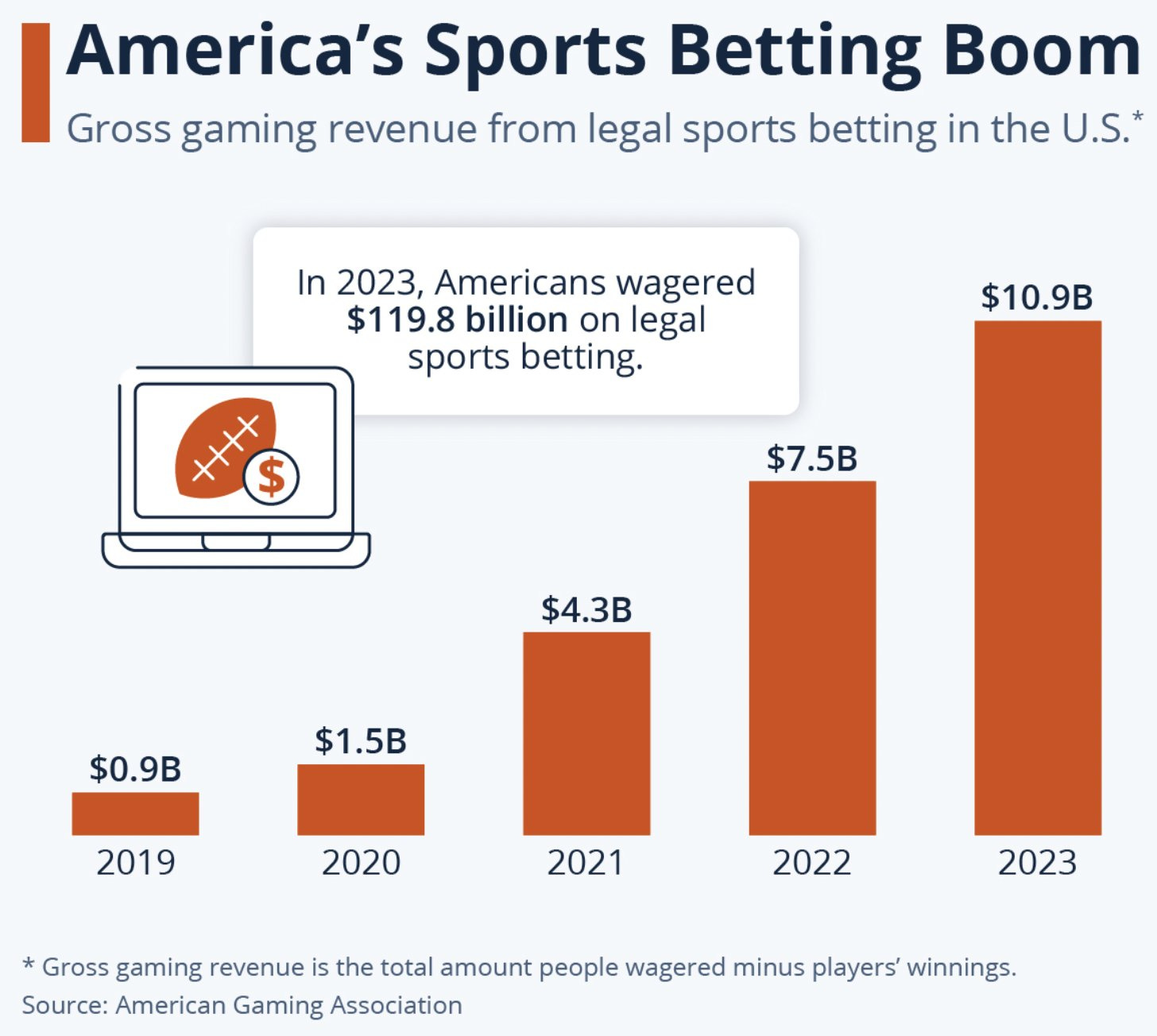

Whether it’s the proliferation of legal sports betting or trading stocks and options through gamified smartphone apps, gambling and speculation are alive and well today.

I recently finished Edward Chancellor’s excellent book, Devil Take the Hindmost, which filled in some gaps in my understanding of historical stock market speculation.

A recurring theme in Devil Take the Hindmost is understanding the difference between investing, speculation, and gambling. Though there are shades of gray between the three, in general, investing can be viewed as a defensive use of capital, gambling a reckless use of capital, and speculation somewhere in between.

Chancellor highlights, for example, the post-Civil War speculation boom coincided not only with the United States becoming a developed nation, but also with rapid technological advances like the railroad, ticker tape, and the telegraph, which connected people with information and access to financial markets in new ways.

This speculative phase helped fuel American growth and would remain in place until the Depression.

Following the Depression and World War II, a striking cultural change took place. Chancellor notes:

In the postwar world, the businessman was no longer flattered and admired as he had been in the 1920s…This change of style was accompanied by a shift in corporate priorities. Other goals, such as stability, continuity, and responsibility to community, predominated over the simple profit motive.

In his book Tribe, Sebastian Junger talks about how shared hardship leads to a greater perception of community and equality. It would make sense, then, that over a decade of hardship would forge a more egalitarian perspective on business.

There were economic reasons for the shift away from stock market speculation, as well. A January 6, 1952 article in the New York Times called “Trading in Stocks Undergoes Change” read:

Once the annual turnover on the New York Stock Exchange was equivalent to 319 per cent of the number of shares listed. That was in 1901. Last year the figure was 18 per cent - and annual volume was only twice that of the earlier year.

It is no longer possible to ignore the fact that the years since 1934 have seen changes in the market that have almost completely altered its nature. Some of these changes have been caused by taxes. People are obliged to hold stocks longer because of the laws on capital gains. Others have been caused by the gradual awakening to the facts of life about inflation…

Because of inflationary forces, a greater and greater proportion of common stocks is being held by people who intend to hold on to them regardless of ups and downs

Whether you think the change was primarily driven by cultural or economic causes, there’s no question that this era had a prolonged period of low trading activity.

It’s notable that this is the world in which legends like Buffett, Munger, and Fisher came of age. Indeed, Buffett is correct in saying that markets didn’t exhibit today’s casino-like behavior when he was young. When he turned 18, the average holding period was about 6 1/2 years.

Perhaps the placid trading activity of the 40s and 50s created more analytical-driven alpha opportunities for business-focused investors. Investors who, as the NYT article suggests, held just to avoid capital gains taxes or as a hedge against inflation were not regularly updating their thesis on a company. Those who were willing to put in the work could therefore gain an edge.

Ben Graham alluded to this in a 1976 interview, which he gave shortly before his death.

In the old days any well-trained security analyst could do a good professional job of selecting undervalued issues through detailed studies; but in the light of the enormous amount of research now being carried on, I doubt whether in most cases such extensive efforts will generate sufficiently superior selections to justify their cost.

While the subsequent 48 years has shown that good analysis can still pay off, Graham correctly understood that good analysis alone isn’t sufficient in a more competitive market. In competitive markets, good research must be paired with prudent behavior to produce outperformance. Ignore the flashing lights of the casino that encourage action and stay patient and focused.

Music recommendations

My wife and I recently saw Ben Rector in concert, playing alongside the Cincinnati Pops orchestra, and it was one of the best shows I’ve ever seen. If you don’t already know his music, start here:

A local bluegrass band called Moonshine Drive recently released their first album and I’ve had it on repeat.

Stay patient, stay focused.

Todd

At the time of publication, Todd and/or his family owned shares of Berkshire Hathaway.

Disclaimer:

This material is published by W8 Group, LLC and is for informational, entertainment, and educational purposes only and is not financial advice or a solicitation to deal in any of the securities mentioned. All investments carry risks, including the risk of losing all your investment. Investors should carefully consider the risks involved before making any investment decision. Be sure to do your own due diligence before making an investment of any kind.

At time of publication, the author or his family may have an interest in the securities mentioned or discussed. Any ownership of this kind will be disclosed at the time of publication, but may not be updated if ownership of a particular security changes after publication.

This newsletter does not provide buy or sell recommendations and articles should not be interpreted this way.

Information presented may be sourced from third parties and public filings. Unless otherwise specified, any links to these sources are included for convenience only and are not endorsements, sponsorships, or recommendations of any opinions expressed or services offered by those third parties.

Flyover Stocks has partnered with Koyfin to provide a discount to Koyfin’s services for Flyover Stocks readers. The W8 Group, LLC, which publishes Flyover Stocks, may receive a commission from a reader’s purchase of products linked from this page as part of an affiliate program.