Meeting with Medpace; Biotech Funding Cycle vs. Interest Rates

What's ailing the biotech funding cycle and when will it turn again?

Disclaimer: At the time of publication, Todd, his immediate family, KNA Capital Management, LLC and/or its clients owned shares of Medpace.

Please read additional disclaimers.

Last week, I attended an analyst meeting at Medpace headquarters in Cincinnati where the group met with President Jesse Geiger and CFO Kevin Brady and got a tour of Medpace’s on-site laboratories.

Since Medpace’s founding in 1992 by current CEO Dr. August Troendle, the contract research organization (CRO) has focused on managing clinical studies that enable small- and mid-sized biotech and medical device companies to gain regulatory approvals.

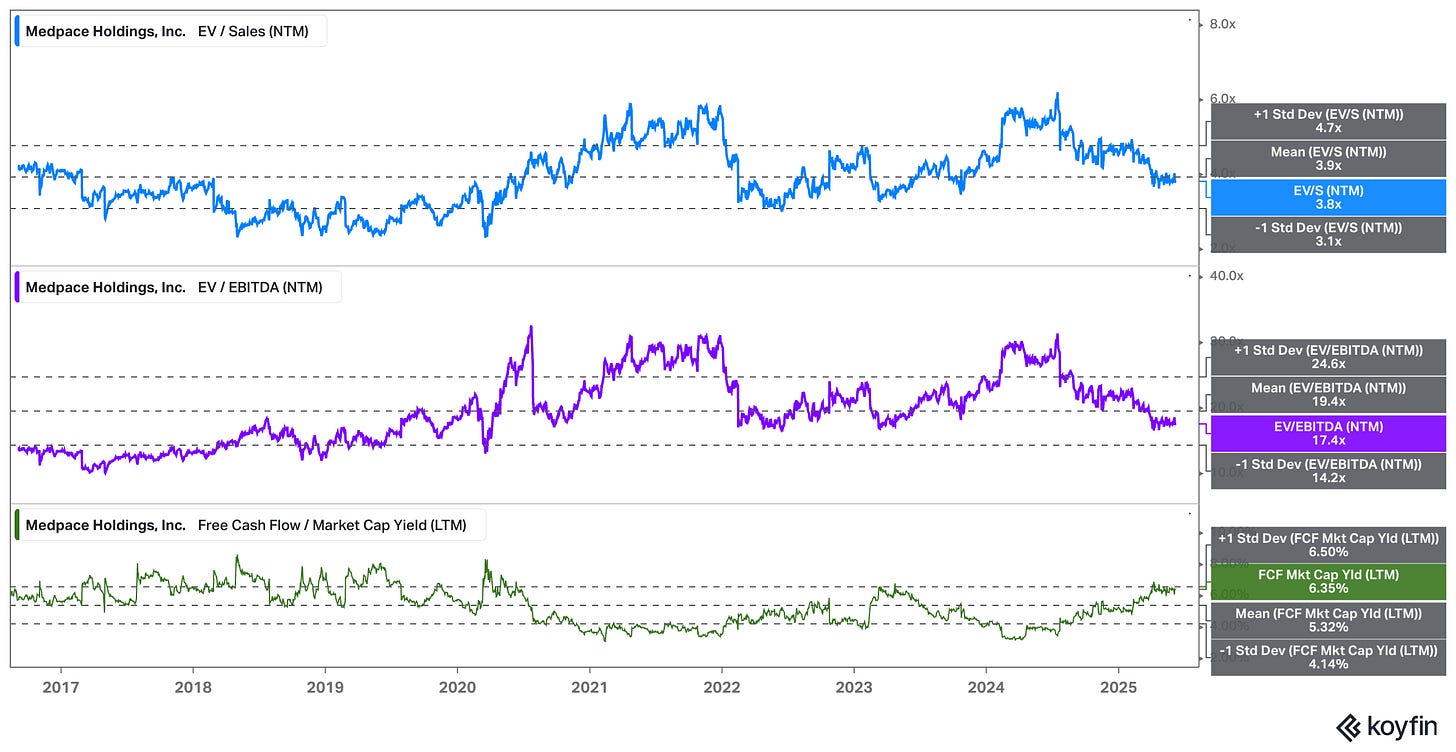

Despite a history of strong performance since its 2016 IPO, Medpace’s stock has been beaten up over the past year - down 27% versus the S&P 500 up 13% on a total return basis - and multiples have reverted back to pre-COVID ranges.

The biggest headwind at the moment is the depressed biotech funding environment that enable Medpace’s clients to finance their clinical trials.

What follows are my notes and observations from the meeting and tour, with a particular focus on what’s ailing the biotech funding cycle.