Flyover Stock: Wise (WISE.L; WIZEY)

Reshaping Cross-Border Payments with Speed, Simplicity, and Scale.

15 years ago, when I worked in the UK, I regularly converted pounds to dollars to pay some bills back home.

This process was not cheap, transparent, or particularly easy back then.

Today, digital platforms have made the process a bit easier but it’s still not a straightforward or cheap process.

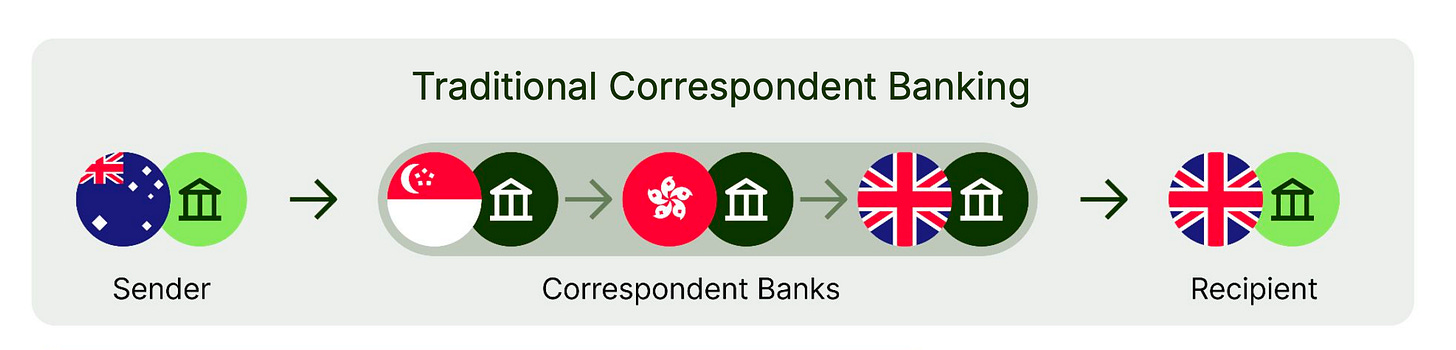

Due to the complex network of banks involved in cross-border currency transactions, regulatory costs (e.g. “Know Your Customer” rules), and legacy systems, there are multiple layers of costs involved in each transaction.

Conducting a personal transfer of GBP to USD using traditional banks, for example, costs between 2% and 5%, depending on the amount transferred and the speed with which you need the money (i.e. wire vs. ACH transfer). Included in that amount is typically a nominal fee from the initiating bank plus a markup on the going exchange rate, which is not always known by the transacting customer. This opacity works in the banks’ favor.

The less common the currency pair - say, Australian dollar to Polish zloty - the more intermediary banks are likely involved in the transaction and the higher the costs. The average global remittance - small amounts moved between countries, primarily by migrant workers - costs 6.6% according to the World Bank.

As you might imagine, in an increasingly globalized economy where trillions of dollars move between countries, cross-border transfers can be a lucrative business for the intermediaries. There’s little incentive to change or drive down costs.

Meanwhile, consumers and businesses doing the transactions pay the high fees as a matter of course and lack the knowledge and alternatives to demand a better deal.

Inefficient, opaque, and expensive markets overseen by unmotivated parties are ripe for disruption. Wise co-founder Kristo Käärmann is leading the charge to make it easier and cheaper than ever to transfer currencies and is employing a business model used by some of this generation’s best companies to get it done.

Premium Flyover Stocks subscribers, your content follows below.

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC or its clients owned shares of Amazon.

Please see important disclaimers.