Flyover Stock: Stock Yards Bancorp (SYBT)

A great bank with a great name

Key stats:

Headquarters: Louisville, KY

Founded: 1904

Market cap: $2.14 billion

Number of analysts covering: 6

Background

Today's urban residents are largely disconnected from the origins of their meat. Most are unlikely to encounter a cow, chicken, or sheep unless they travel 20 miles or more beyond the city limits.

But it wasn’t always this way.

Before the end of World War II, many American cities hosted sprawling stockyards where livestock was gathered, traded, and processed. The sights, sounds, and smells of the meat industry were a constant presence for city-dwellers.

At the turn of the 20th century, meatpacking was one of the largest industries in the U.S., employing tens of thousands of laborers. The need for financing in these operations was considerable. Farmers needed credit to get their livestock to the stockyards, stockyards needed capital to upkeep facilities, and livestock was often used as loan collateral.

It was in this context that in 1904, Stock Yards Bank was formed by local businessmen to finance the livestock trade in Louisville, Kentucky.

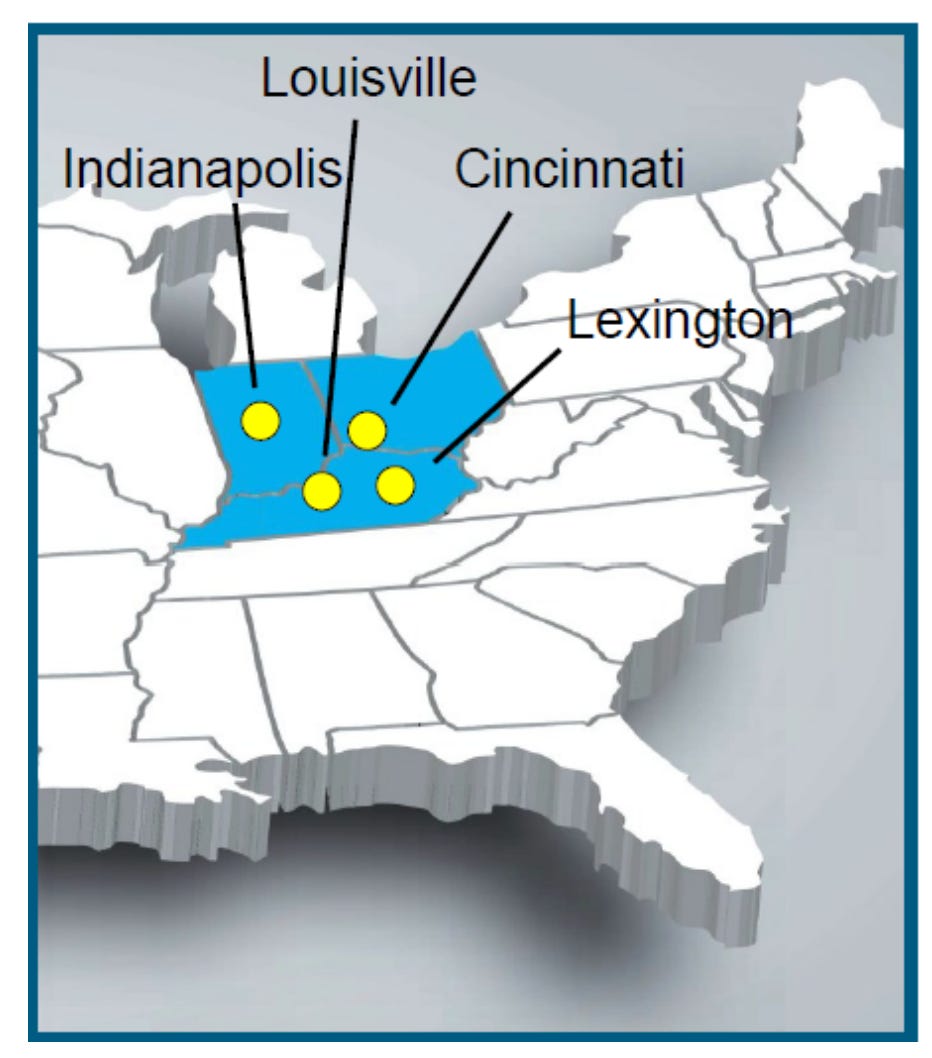

Today, Stock Yards is the largest Kentucky-headquartered bank and the largest bank-owned trust company in the state. While it is now a much larger bank, part of Stock Yards’ appeal is its connection to the Louisville market, where it ranks #3 for deposits in the metropolitan area. In the last 21 years, Stock Yards expanded into the Indianapolis market (2003), Cincinnati (2007), and Central Kentucky (2021).

This region has proven economically resilient with a number of Fortune 500 anchors such as Procter & Gamble and Kroger (Cincinnati), FedEx and Eli Lilly (Indianapolis), Brown-Forman and and UPS (Louisville). The region is also increasingly important for e-commerce and freight transportation. 50% of the U.S. population, for example, is within half a day’s drive from Cincinnati. There’s good reason why FedEx, UPS, Amazon, and DHL all have major operations in the area.

For quality-minded investors, most banks are not worth researching. They typically lack economic moats and face increasing regulatory costs and limitations. Fast growing banks can do well for a while, but accompanying that rapid growth tends to be declining underwriting standards, undisciplined lending, and/or poor asset-liability management. Slow growing banks, in contrast, are best picked over by deep value-oriented bank specialists.

I prefer to look somewhere in the middle: banks situated in steady economic regions, with steady growth in book value, consistent low-to-mid teens ROE, good underwriting discipline, smart management, and preferably an uncommon specialty that might be misunderstood or misvalued by other investors.

Stock Yards Bank fits that bill.

Let’s take a closer look into what makes Stock Yards a bank worth having on your research list…

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC or its clients owned shares of Brown-Forman and Amazon.

Please see important disclaimers.