Flyover Stock: Packaging Corp. of America (PKG)

Packaging Corp. enjoys an advantageous position in a consolidating industry and has sidestepped its peers' capital allocation blunders.

When International Paper (IP) acquired competitor Temple-Inland a decade ago, the U.S. Justice Department’s anti-trust division grew concerned. The deal as proposed would have combined the largest and third-largest U.S. containerboard producers and amounted to 40% of North American capacity.

Worried about the impact to consumer prices, the DOJ ultimately ruled that IP needed to divest some of its acquired assets. In the ruling, it shared an important insight that “Corrugated boxes made from containerboard are used to ship more than 90 percent of all goods nationwide.” (my emphasis)

Look at your recycling bin this week and see how vital containerboard and corrugated packaging are to the economy. (As for my family, I’m amazed at how much cardboard and aluminum cans we recycle each week.)

Containerboard is the catch-all phrase for the raw material that goes into corrugated boxes and other corrugated products. It consists of two parts: linerboard, the smooth outer layer, and medium, the fluted filling sandwiched between sheets of linerboard.

Linerboard and medium are shipped to box plants that shape the containerboard into corrugated boxes and products to meet customer specifications.

Corrugated packaging is a remarkable product that enables the economy to securely – and relatively cheaply – ship most of our food and beverages, consumer goods, chemicals, and manufactured products across the country and worldwide.

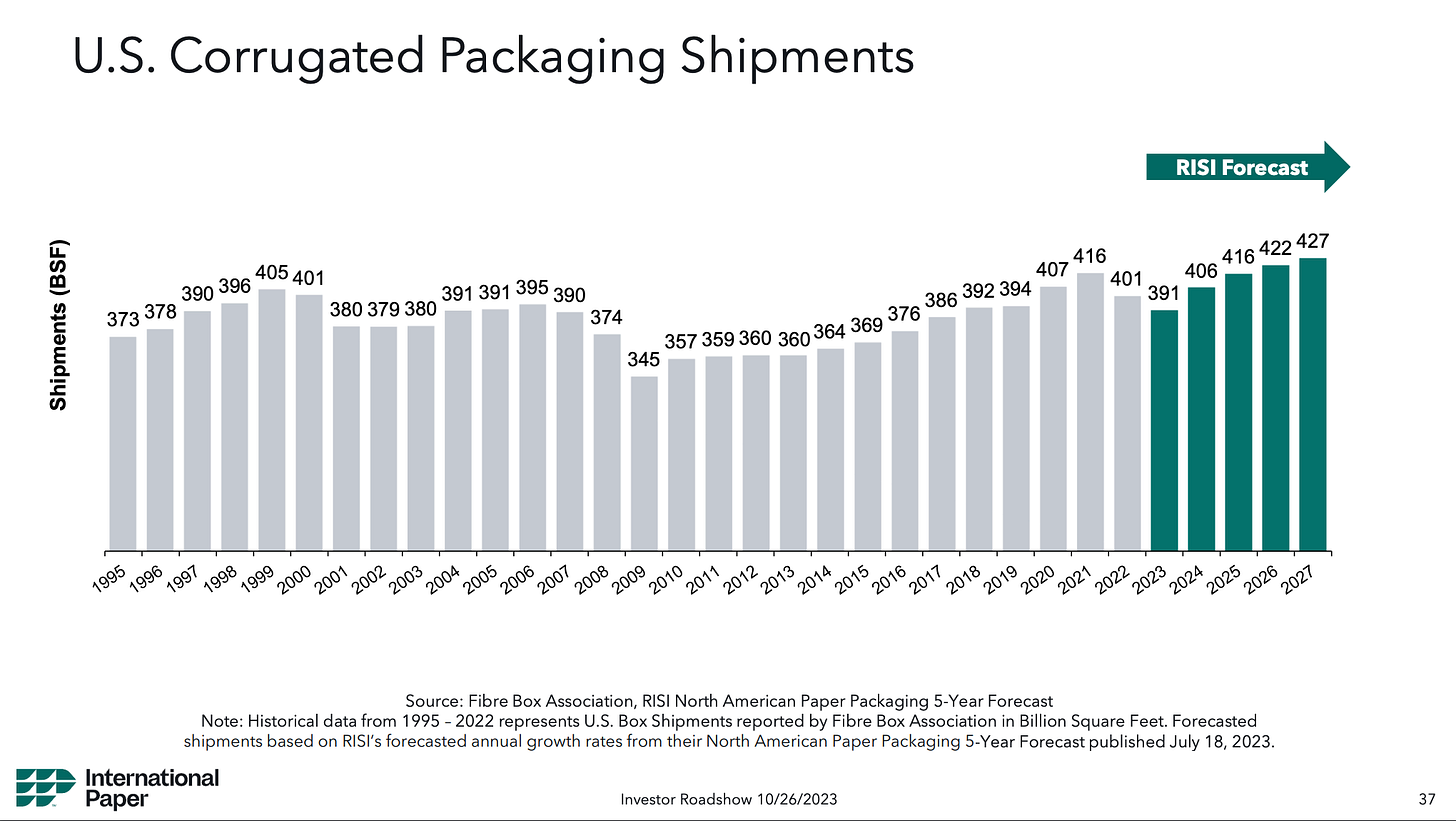

Fastmarket’s RISI, a data provider for the forest products industry, estimates that corrugated box demand will recover in the coming years as the COVID bullwhip demand swings stabilize and again grow with the economy.

Containerboard can be produced from virgin—that is, freshly pulped tree—or recycled fiber sources, called "OCC" or Old Corrugated Containers.

Importantly, fiber strength depletes with each recycling iteration, so the industry depends on continuous virgin fiber sources entering the system. Moreover, some customers specify virgin fiber for premium boxes and displays as it's the "best-looking" type of corrugated product available.

Fortunately, the United States has plentiful timber available to provide virgin fiber to the containerboard industry. Other countries that lack an adequate timber supply, such as China, rely on timber and recycled pulp imports and internally recycled corrugated products.

Packaging Corporation of America (PKG) is the third-largest containerboard producer in the United States with an 11% share of capacity, after International Paper (30%) and the pending merger of Smurfit-Kappa/WestRock (20%). Over the last twenty years, the industry has steadily consolidated toward an oligopoly.

PCA is in an advantageous position in the oligopoly as the larger players with more capacity are the ones who need to cut capacity first in downcycles, leaving PCA’s mills and box plants with higher relative utilization rates.

Management has navigated the changing industry dynamics and hasn’t engaged in aggressive M&A activity like its peers. (See IP’s recent bid to acquire UK-based DS Smith and the pending Smurfit Kappa/Westrock tie-up.) Instead, PCA maintains a solid balance sheet, makes tuck-in deals, and opportunistically repurchases stock.

It’s proven to be a better model than those of its larger peers.

I was unconvinced of PCA’s moat when I covered it at a previous employer for over three years. My thesis was that because new capacity can be "turned on" through idled newspaper and uncoated free sheet (printing paper) machines, and the construction of recycled-fiber mills, that any ability to out-earn the cost of capital was temporary.

But that hasn’t been the case.

Let's dig into why I was incorrect in assessing PCA's moat.