Flyover Stock: Grocery Outlet Holdings (GO)

A unique business model in discount retail paired with meaningful founding family ownership is entering a new growth phase

Executive summary

Discount retailers like Dollar General and Dollar Tree have sold off hard in recent months, dragging down multiples on Grocery Outlet Holdings to their lowest levels since the 2019 IPO.

Grocery Outlet has a unique model in discount food retail. Like Ollie’s and TJX Companies, they are opportunistic buyers of closeout deals, offering customers a “treasure hunt” shopping experience of deeply-discounted consumables.

Local independent operators manage the stores and split gross profits with GO, creating a simple model that lets each party do what it does best.

The founding Read family continues to own over 5% of shares outstanding, which will provide important long-term perspective as the company enters a new growth phase.

Podcasts have become one of my favorite research tools. Search Spotify or Apple, and you’ll likely find a podcast series or episode related to the company or one of its executives.

So I was delighted when I came across the “2 Discount Grocers and a Microphone” podcast series while researching this month’s Flyover Stock: Grocery Outlet Holdings (GO), which runs the Grocery Outlet Bargain Market stores.

Two Independent Operators (IO) who manage Grocery Outlets host the program. In most episodes, they interview other IOs from Grocery Outlets around the country to talk about best practices and discuss a variety of challenges.

In two episodes, they interviewed upper management at Grocery Outlet corporate – Chief Purchasing Officer Steve Wilson and Senior Vice President John Decker. After reading this report, I recommend listening to the episodes to give you a better sense of how the company operates.

In one of the episodes, the hosts discuss special moments during their time as IOs, and one of the stories drove home the company’s mission to “Touch Lives for the Better.”

The IO was eating at a restaurant, and the waitress noticed him as the manager of the local Grocery Outlet. She raved about the store and how it allowed her to feed her family with five kids with dignity and provide them with wholesome food that she couldn’t have afforded otherwise.

(Indeed, one of GO’s most popular offerings is its NOSH – natural, organic, specialty, and healthy – lineup. It has proven popular with consumers who want to avoid processed foods without paying retail prices.)

For various unfortunate reasons, there are “food deserts” scattered across the United States. This means areas where citizens, either because of low income or limited access, cannot source or afford fresh food.

The ultimate solution to this problem is beyond the scope of any single entity. Still, Grocery Outlet Bargain Market is helping to correct it, and it’s always a bonus backing a company that's improving people’s lives.

Here’s an example of what a GO store opening meant to an underserved Philadelphia community.

Importantly, for us investors, GO can provide its valuable services with attractive unit economics. It sees store growth opportunities in markets wherever shoppers like a bargain, which is pretty much everywhere.

Business overview

Market cap: $2.7 billion

Revenue TTM: $3.82 billion

P/E Ratio (forward): 27x

Number of analysts covering: 12

All market data as of October 30, 2023

If you’ve researched Ollie’s Bargain Outlet or TJX Companies, the Grocery Outlet business model will resonate with you.

Consumer goods companies regularly produce too much of a particular product, have a struggling product line, or have inventory approaching expiration. In those cases, the consumer goods companies need to dispose of the inventory. It costs them money to send it to landfill, so one way or another, they want to limit their losses.

In those circumstances, they often turn to discount outlet retailers like GO, who they can rely on to take large quantities of inventory for pennies on the dollar and pass along the savings to their customers.

In addition to scrounging some return on their investment, the suppliers offloading to outlets also want to maintain pricing power on their more successful items in full-price retail stores. For example, if Nestle had to move an oversupply of one flavor of Haagen-Dazs ice cream bars, they don’t want to drop the price by 70% in a Kroger, otherwise Kroger customers would buy the discounted flavor instead of the full-price flavor that was selling just fine.

Having outlet partnerships also allows consumer goods companies to innovate more freely because they know they can offload misses to outlet partners. One way to imagine GO is as a pressure-release valve for the consumable products industry.

GO uses these opportunistic buys from consumer goods companies – which GO calls “WOW!” deals - to drive traffic to their stores. What can’t be purchased at opportunistic prices, GO fills in shelves through traditional avenues.

Approximately half of GO’s purchases are opportunistic, the remaining being traditional.

From the customer’s perspective, GO provides deep discounts to full retail prices in a treasure hunt environment. While I haven’t shopped at a GO (yet), I have shopped at independent grocery outlets, and it’s remarkable how much you can get for your dollar.

In short, it’s a win-win for all parties.

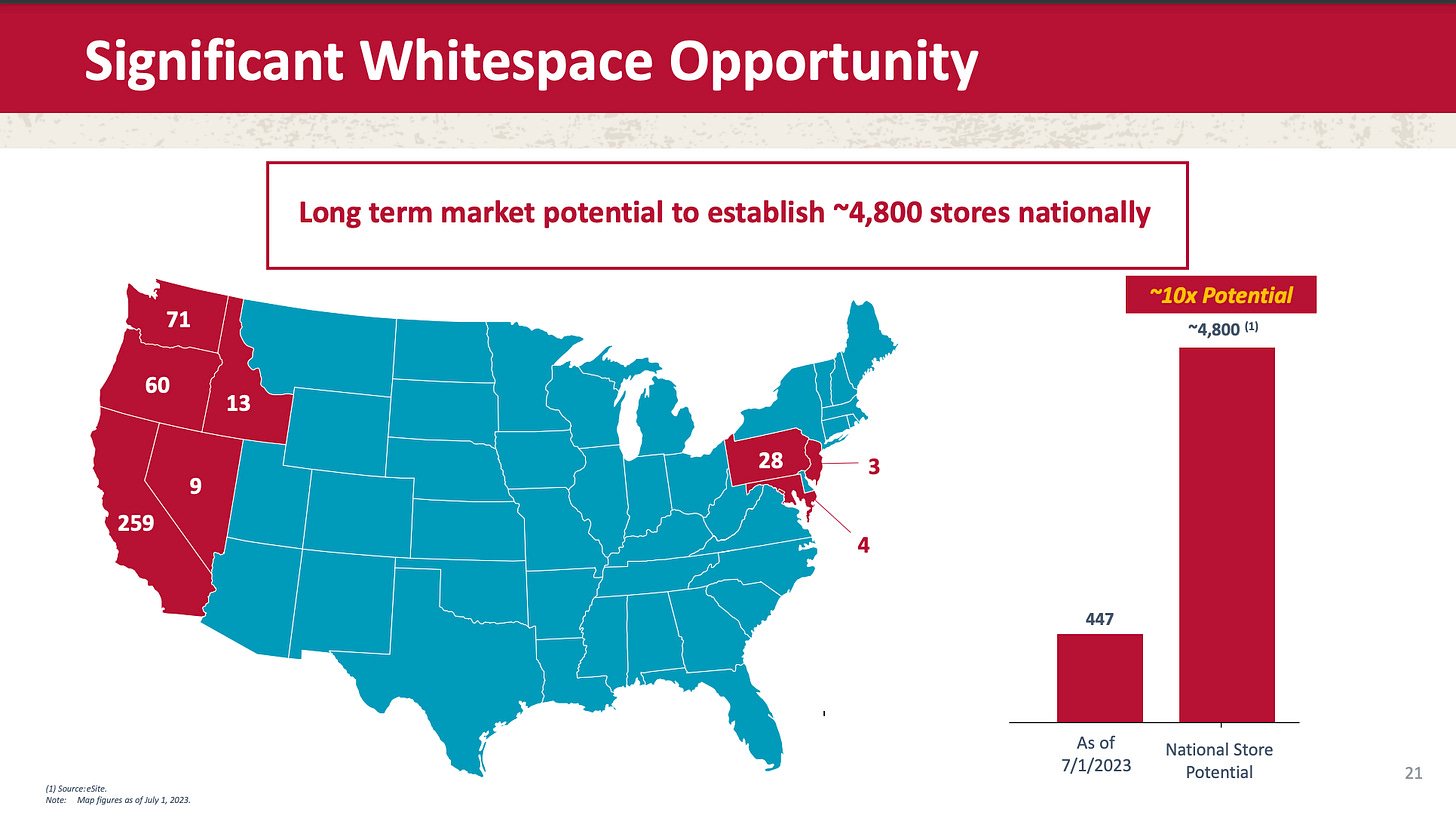

As of July, GO had 447 stores located in the states of California, Washington, Oregon, Pennsylvania, Idaho, Nevada, Maryland, and New Jersey.

The relationship between GO and IO is remarkably straightforward.

GO puts up the capital investment for the stores, handles the pre-opening expenses, sources inventory, and handles corporate-level marketing.

An entrepreneurial IO manages the store's working capital, taxes, and employment wages and benefits and does community-level marketing.

The two parties split the store’s gross profit. Another way to think about the relationship is that GO pays the IOs a commission for selling its inventory on consignment.

GO extensively vets the IOs through its Aspiring Operator in Training (AOT) program, which includes shadowing an established IO, classes at headquarters, and a business plan review that includes competitive analysis and financing modeling. Out of about 30,000 annual leads for IOs – a figure that’s up 50% in the last four years - GO selects about 70 to put into its 6-9 month AOT program.

Once the store hits maturity in approximately four years, the IO can generate a handsome income, as illustrated by CEO RJ Sheedy in the latest earnings call:

“Since 2019, average operator net income has grown in the low single digits on an annual percentage basis. Strong commission growth, combined with labor and operating efficiencies, have more than offset higher store-level expenses such as wages and utilities. And last year, average mature store operator net income exceeded $250,000.”

As one of the slides above shows, GO has big growth ambitions to take the store count from just under 450 to 4,800. For some perspective, that's approximately the footprint of Ace Hardware and Advanced Auto Parts.

The store target is indeed ambitious but is still possible. Dollar General and Dollar Tree have over 19,000 and 16,000 locations, respectively. A lot would have to go right for GO to approach 5,000 stores. And there are risks to this strategy, which we'll discuss below.

Let’s start with the moat analysis.