Flyover Stock: Games Workshop

The fantasy game miniature maker is about to take its place on the big screen and could further monetize its IP

Note: I don't intend to regularly profile companies I already own, but UK-based Games Workshop is a company that quality-minded investors should know and study for its intellectual property-based moat and thoughtful management team. Most investors outside of the UK do not know it, and with just four sell-side analysts covering it, GW qualifies as a Flyover Stock. I do not plan on selling my position in Games Workshop anytime soon, but at a minimum, I will not transact in the stock for 14 days after the publication of this post.

Executive summary

A high-margin hobby retail business that stands to grow its royalty income in the coming decade with media licensing deals.

Management consistently produces insightful annual reports with a straightforward communication style.

GW’s cash flow machine is accompanied by an ironclad balance sheet and thoughtful dividend policy.

When I started researching Nintendo about five years ago, one of my conclusions was that Nintendo was only entering its nostalgia phase. This transition presented an enormous opportunity for Nintendo management to capitalize on its intellectual property (IP) in new ways and generate shareholder value.

For the first time in its history as a video game company, generations could pass down their love for Nintendo IP. This phenomenon creates a generational communication tool, similar to how love for local sports teams can connect grandparents with grandchildren. These are deep and durable sentiments.

Consider the power of the Disney IP over time. There's no rational reason for people to travel to Florida in the middle of the summer to sweat in line for hours and spend thousands of dollars for the privilege. But they go to Disney theme parks to connect with the IP they associate with happy childhood memories and want to share that with their kids and grandkids.

Buffett said this about Disney at the 1997 shareholder meeting:

"Just think of what somebody would pay if they could actually buy that share of mind of billions of people around the world. You can't do it. You can't do it with a billion-dollar advertising budget, or a $3 billion advertising budget, or by hiring 20,000 super salesmen."

Given its ability to capture mindshare, nostalgia-based IP is valuable - especially today when distraction is just a swipe away. This scarcity makes it valuable to media companies, as evidenced by Universal’s eagerness to partner with Nintendo to produce movies and theme parks.

IP needs to be appropriately cultivated and managed, however. Consider the Hanna-Barbera characters like the Jetsons and Yogi Bear, which have not remained relevant and are thus difficult to monetize.

As such, when you come across properly managed nostalgia anchored IP, you should take notice. In 2021, I started researching a UK-based company called Games Workshop, which I thought fit the mold. I made a small investment but overpaid at the time—more on that in a moment.

Though I didn't grow up playing tabletop miniature wargames (MWG), I've come to appreciate that it's a passion for many. It gained popularity in the 1970s and 1980s with the rise of fantasy and science fiction and is a much bigger industry than you might suspect.

Similar to Dungeons & Dragons, MWGs are rules-based, and outcomes are usually determined by rolling dice. Each character has attributes like strength and movement that the player can deploy based on the roll outcome. The combination of chance and skill creates the potential for a wide range of outcomes and entertainment.

In 1983, GW was the first MWG company to create proprietary models when it launched Warhammer, a medieval dark fantasy-based game filled with elves, dragons, and orcs. The game included rich character backstories and a rulebook.

In 1987, GW built off the success of Warhammer by introducing Warhammer 40,000, a science-fiction fantasy MWG set in the future.

Today, the Warhammer universe remains the core of Games Workshop’s IP.

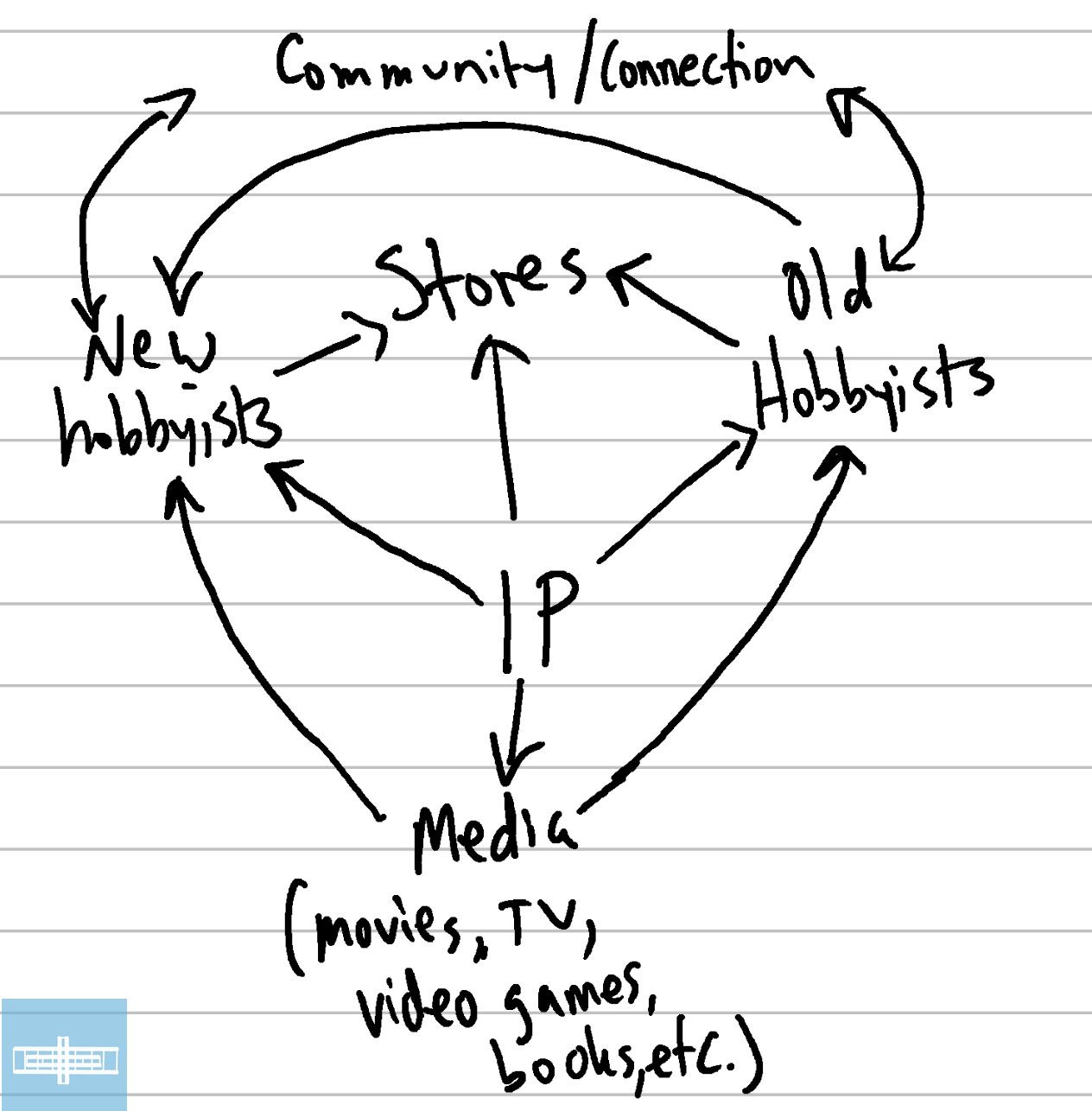

As the video below illustrates, the hobby is multifaceted. Some hobbyists are more interested in the gameplay, while others are more interested in painting the miniatures. A community aspect also reinforces engagement with the IP and encourages participants to stay up-to-date with the latest editions.

Over the decades, Warhammer IP has spawned scores of books (in 1997, GW launched a publishing arm called Black Library), and video games have licensed it since 1991.

However, a series of hit fantasy movies and television drove engagement growth for GW and the MWG industry, as this 2021 InPractise interview with a former GW managing director illustrates.

When I was at school collecting this stuff, you were very much in the geek crowd for doing such a thing as opposed to being in the cool kid collection. It was very niche; people did not understand it and very much poo-pooed it. Similarly with people who read comics. Over the past 20 years there has been an adoption of fantastical stories, from Warhammer all the way through the whole Marvel universe, the Lord of the Rings movies, Batman and Spiderman films, and what is great is the adoption of the creativity, being able to be told. CGI meant that what we used to have to imagine, can now be put on screen. That brought all the geeky imaginative hobbies into the main stream which changed everything.

While Warhammer has historically been a secondary beneficiary of this trend, serving as an outlet for engagement with Lord of the Rings IP, it's gaining traction on its own.

In December 2022, Games Workshop and Amazon Studios announced an agreement to produce movies and television content based on Warhammer 40,000. In December 2023, it was announced that the series would be produced by Henry Cavill, a self-described Warhammer enthusiast and former Superman and The Witcher star.

When Cavill starred in The Witcher on Netflix in 2019, sales of The Witcher 3 video game (launched in 2015) jumped 550%, and book sales jumped 560%. Expansion of the IP to new audiences drove increased demand for earlier products, renewing interest from existing fans and expanding interest to new audiences.

Nintendo management recently noted on its Q&A with analysts that the Mario movie that came out last summer expanded its IP reach to new audiences and drove incremental hardware and software sales:

“From the perspective of expanding the number of people who have access to Nintendo IP, the movie has played a larger role beyond its effect on earnings. We recognize that movies are a very effective way to generate interest in Nintendo games.”

As such, the opportunity for nostalgia IP-driven growth at GW is clear. How well management capitalizes on that opportunity will drive the business and the stock over the next decade.

Let's get into the business of GW and better understand its moat, the management team behind the business, and its valuation.

Key statistics:

Market cap: $4.1 billion, as of May 10, 2024

P/E ratio (ntm): 22.5x

Headquarters: Nottingham, UK

Number of sell-side analysts: 4

The business

Games Workshop is vertically integrated and controls all tangible and intangible aspects of the business, from the paint to the publishing.

The business is divided into four segments:

Please note: The original version of this article erroneously swapped Retain and Trade. I regret the mistake. It has been corrected.

Retail (23% of 2022-23 group revenue): These are company-owned stores that only stock Games Workshop products. They are branded as Warhammer stores. As of the last report, there were 535 company owned locations. About 400 of these are single-staff locations where one store manager runs everything. Depending on local demand, GW will add or subtract staff for each store. GW is quick to close company-owned stores when the economics are not working.

Trade (54%): GW sells into third party retailers, numbering over 6,500 in over 70 countries. These include everything from niche hobby stores to big box retailers like Wal-Mart. GW uses these retail partners as a way to test new markets or to have a presence in markets where it doesn’t make sense to have a standalone store.

Online (19%): These are sales made through one of GW’s owned web stores and are run centrally from Nottingham.

Licensing (5%): Royalty income from granting third-party licenses to use its IP. A small slice of the pie today, but comes with 100% gross margins.

The biggest growth opportunity is licensing what management recently called “some of the best under exploited intellectual property globally.” In recent years, the vast majority of licensing revenue came from PC, console, and mobile video games. That will change with the Amazon Studios relationship, as I expect the deal to generate revenue well in excess of historical licensing revenue.

Work on the Warhammer series will begin in 2025 and we haven’t been given any insights as to how much the deal is worth to Games Workshop. I offer some valuation considerations below.

GW is also growing its retail store count, which would come in handy if the Amazon series does well and consumers new to the Warhammer IP want to get started with the hobby. The company aims to add 30 stores this fiscal year, or about 5% growth.

Warhammer stores only carry GW products and include paints for the miniatures. The company believes the stores are the best place to begin the hobby as newcomers can ask questions and trial different sets.

GW regularly discusses their customers as having the “hobby gene.” Not every consumer will want to collect and paint fantasy miniatures and compete with them against their friends, but people with the hobby gene are more inclined to do so.

Historically, GW’s core customer demographic has been teenage boys and adult males, consistent with most digital and physical gaming activities. There’s typically a drop off in activity between the ages of 18 and 25. As one Reddit commentator noted in response to a question about why they left and came back to Warhammer, they “stopped because girls suddenly became more interesting,” but then “started again because I missed the painting.”

Another said, “I left because of no money. I came back because of money.” Teenagers are typically financially supported by parents who subsidize the hobby. When the teenagers go out on their own, money is tighter and a miniature gaming hobby is no longer the top priority. The hobby is often reignited once they have discretionary income again and lose interest in partying.

Moat width

Score: 3 of 5

Time is needed to establish nostalgia-based IP like GW has compiled over the last 40+ years. It takes decades for the first generation of players to become parents, caregivers, aunts, uncles, etc. to pass down their love of the hobby. Once this gets started, however, it becomes self-reinforcing.

This cycle leads to lower advertising and marketing costs than would have otherwise been necessary to grow the business.

An overlooked or misunderstood point is there are also network effects related to these game franchises. The franchise becomes more valuable as new players enter the market, as those players not only become new customers but are also new opponents and make their own contributions to the storyline. They can then evangelize their newfound passion with others, further expanding the network.

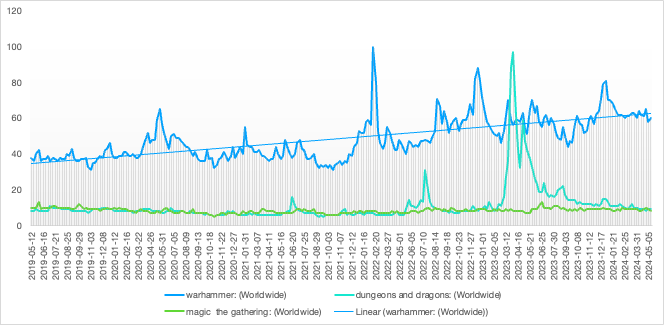

Rivals for hobbyist time include Magic: The Gathering, Dungeons & Dragons, and other tabletop games. Interestingly, there are often collaborations between this set where Warhammer characters are found in Magic: The Gathering and for a long time GW produced Dungeons & Dragons miniatures.

Moat durability

Score: 3 of 5

The key to GW’s moat is product relevance. As discussed in this post, irrelevance is the quickest way for network effects to unravel. In this spirit, GW’s moat - and the business itself - was in real danger in the 2000s. Under a different management team, GW milked its partnership with Lord of the Rings and didn’t reinvest in its own IP. Hobbyists found Warhammer sets to be stale and uninspiring.

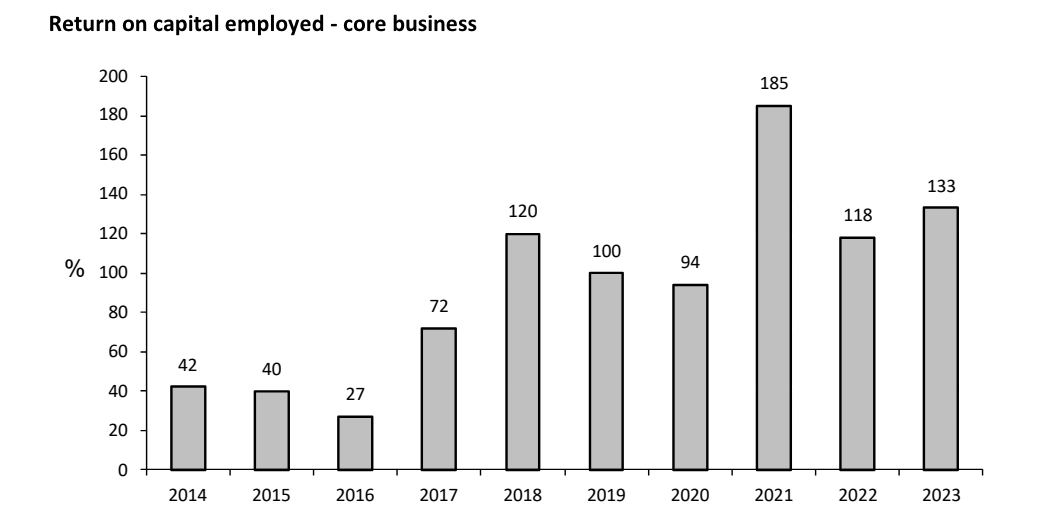

Fortunately, GW recovered under CEO Kevin Rountree who took the reins in 2015 after serving as CFO from 2008 and COO in 2011. More on his leadership in a moment.

As we’ve discussed, economic moats give management time to adjust and adapt. GW’s IP provided Roundtree with the opportunity to lead the resurgence.

And GW’s IP is resilient. Consider the following quote from the aforementioned InPractise interview with a former GW managing director:

One of the absolute charms of building your own IP, such as Warhammer, is that it is constantly evolving and you can introduce new things. Models which were sculpted 10 years ago start to look a bit dated so you re-sculpt them and release those, and people add them to their army. People who were not playing 10 years ago see them and think they look fantastic.

This quote reminded me of Buffett’s line about Disney’s IP being like having an oil well where the oil seeps back into the ground. Maintain the trust with customers and they will come back again and again to enjoy the IP.

As long as GW management proves good stewards of its IP and maintains - and ideally grows - its relevance, the company’s moat is durable indeed.

In recent years, there has been some concern around 3D printing. And while it’s possible for someone to print a replica, in gaming circles that can be seen as bad form.

This comment from a Reddit poster on the subject summarizes this point:

I'm quite happy with the idea of printing conversion pieces, or unique models - meaning you design a specific model for yourself and print it.

As a general principle, I'm not a fan of printing entire units or exact copies of official models. The main reason behind that is because as a player of the game, I am invested in the strength of the company that makes the game. Whatever other argument people want to make against GW, they are the source of the game I love to play, and I need them to be in a strong place so that they continue to support the game.

Players will often complain about the prices charged by GW, so it seems reasonable for them to look into 3D printing options, but part of the price they’re paying is the underlying narrative created by GW. Replica pieces also cannot be used in formal competitions.

Moat trend

Score: 5 of 5

The moat trend at GW is positive. As the Google Trends keyword data suggests, searches for “Warhammer” have trended higher over the last five years and I expect that to continue over the next five years on the back of the Amazon Studios partnership to produce movies and television series around GW’s IP.

Consistent with the above chart, subscribers to “Warhammer+” - a premium subscription service ($60/year) - have increased to 169,000 in November 2023 from 105,000 in May 2022.

It’s reasonable to think that digital gaming options will suppress demand for physical games, but the opposite has proven true. In fact, the internet and social media has only strengthened the communities around physical games. 30 years ago, a Warhammer hobbyist in Nebraska might have had a hard time connecting with other players; today, tens of thousands of fellow Warhammer fanatics are a click away.

Augmented reality (AR) may even bring tabletop games to life in new ways and deepen the experience.

Physical, in-person games like Warhammer can also be seen as a way to balance out an increasingly digital, impersonal lifestyle at home and work.

To be sure, there are limits to how far GW can grow. Its growth strategy in Asia has been disappointing and the hobby and/or the narratives may not land in all cultures. Not every teenager wants to collect fantasy miniatures, so we need to be mindful when forecasting the business.

Stewardship

Score: 5 of 5

GW is led by the aforementioned Kevin Rountree who joined GW in 1998 on the accounting staff, became CFO in 2008, COO in 2011, and CEO in 2015. While GW’s turnaround was a group effort, Rountree deserves the credit as the buck stopped with him through much of this period

CFO Rachel Tongue has a similar path as Rountree, joining GW in 1996 as an accountant and moving up the ranks, becoming CFO in 2020.

GW consistently has one of the best annual reports. While it could have a 200+ page glossy report filled with Warhammer and other IP illustrations, the reports are effectively Word documents filled with direct, plain-spoken, and insightful language.

Some of my favorite commentary from Rountree from the last annual include:

“We believe shareholder value is created, primarily, by not destroying it.” (I love that.)

“Our ambitions remain clear: to make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit. We intend to do this forever. Our decisions are focused on long-term success, not short-term gains.”

“We measure our long-term success by seeking a high return on investment. In the short term, we measure our success on our ability to grow sales whilst maintaining our core operating profit margin at current levels.”

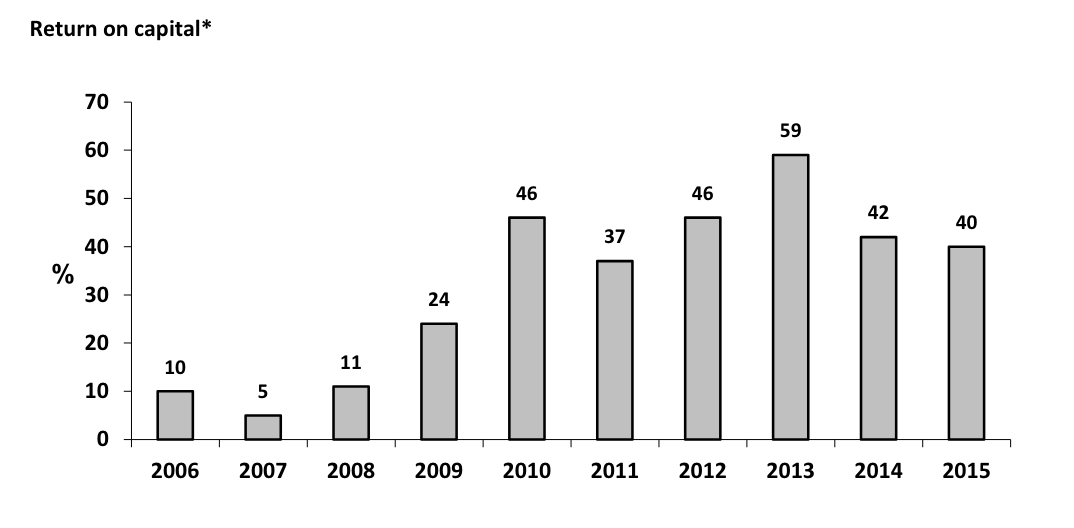

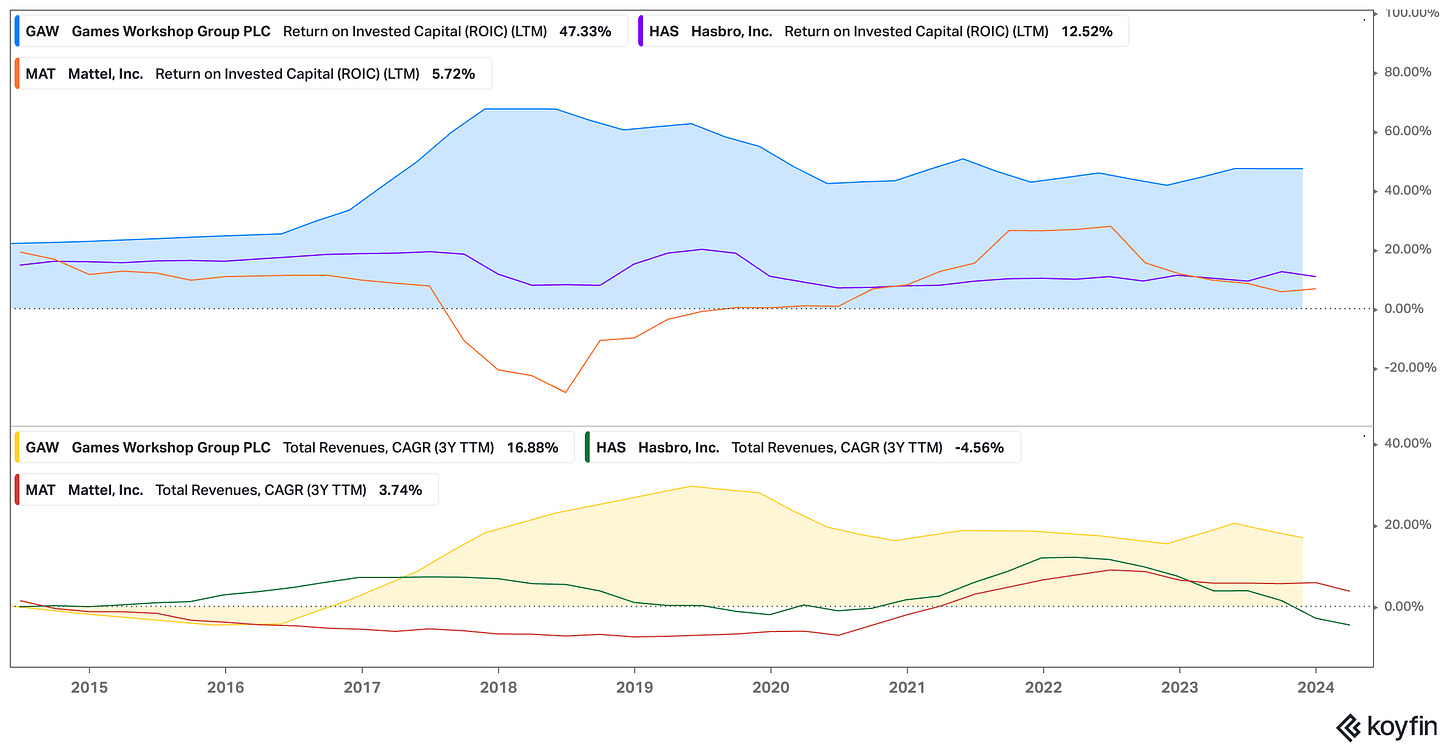

On that last point, GW has done well under Rountree’s leadership:

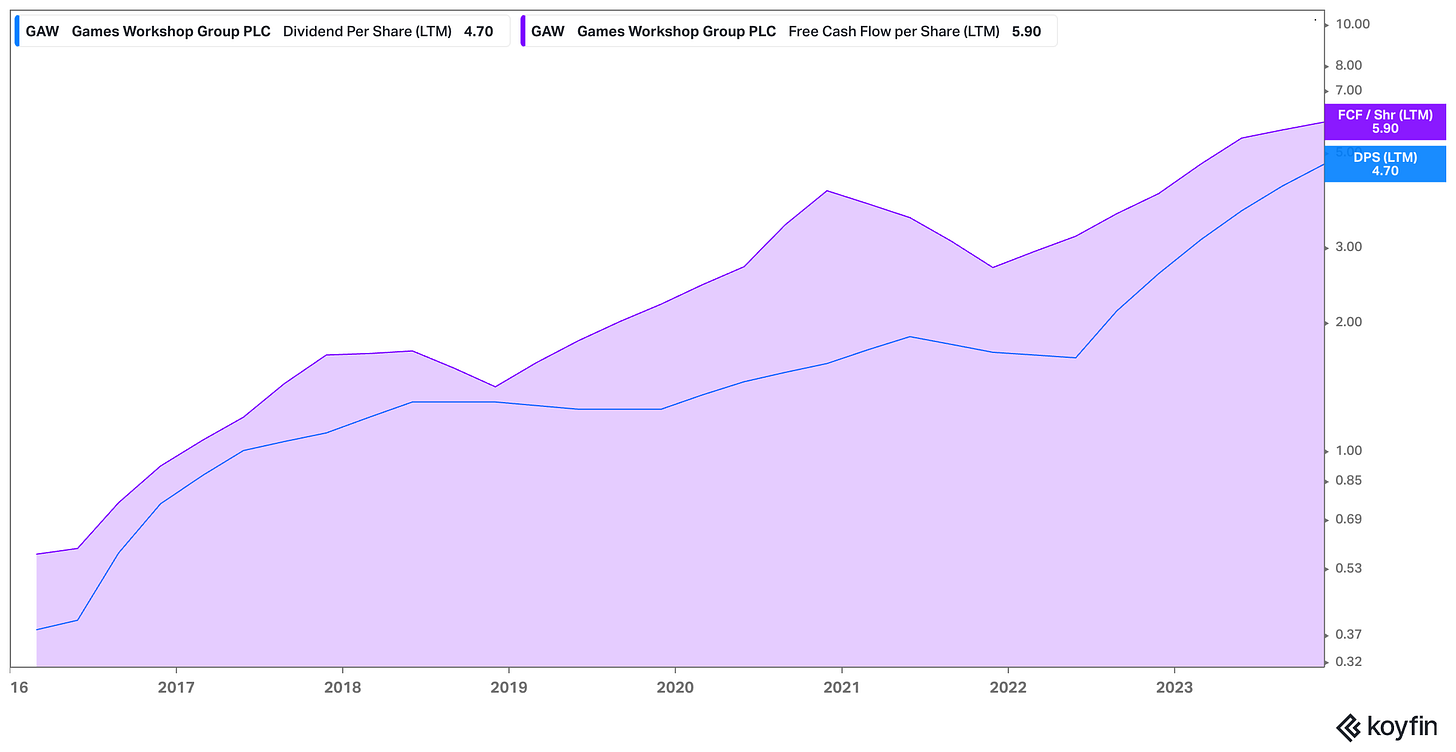

It’s clear that GW management is thoughtful about capital allocation. The dividend amount, for example, is determined after arriving at a buffer accounting for three months of working capital investments and six months of tax payments. GW aims to return what it considers “surplus” cash to shareholders in “ever increasing amounts.”

The company has not made use of buybacks in recent years and there seems to be some reluctance to deploy them. That’s a slight negative in my book. GW is authorized to repurchase just under 10% of diluted shares outstanding.

Notably, GW does not have a long-term incentive plan (LTIP) for management, as “we believe that LTIPs could have the potential to unbalance the organisation with individuals being incentivised to achieve personal goals, at the expense of the wider organization.”

I’ve read a lot of proxy statement and remuneration reports, but I don’t remember seeing a company specifically turn down a long-term bonus scheme because it might drive a wedge between executives and staff. I tip my cap to them.

Indeed, GW has a “flat” organization structure that gives senior management the ability to make big decisions. In the last 18 months, Rountree divided the structure into two groups - one handling the core retail business, the other focused on the global IP. This shift is another reason to think GW plans to make licensing a much bigger piece of the pie in the next decade.

Further on that point, in 2019 the company added European TV executive Kate Marsh to the board in order to shore up its experience in media

GW’s balance sheet is rock solid and it hasn’t had any financial debt since 2009.

As we discussed with Toro, companies who come through existential crises are usually scarred by the experience and undergo permanent cultural change. That seems to be the case at GW, too, after the 2008 scare put the company close to bankruptcy.

Consequently, I expect GW to be conservatively run for at least another decade. At the end of November, GW had GBP 111 million in net cash and increased its cash buffer when considering dividends so that it can be assured it controls its own destiny.

Simplicity

Score: 3 of 5

GW is a straightforward business with the biggest complications being numerous revenue channels - retail, trade, online, and licensing - each with their own growth and margin profiles.

If you’re not an avid or casual wargame player (I’m neither), you risk being “out of the loop” to player sentiment changes. There are message boards and blogs you can follow to stay up to date, but because the consumer profile of these games follows a power law, GW’s fortunes can be disproportionately impacted by a small group of players.

Forecastability

Score: 2 of 5

Investors have the information necessary to make unit economics-level forecasts for the core retail business. Annual revenue in the core retail business will depend on general interest in the hobby, consumer discretionary income, and the success (or failure) of recent additions to the GW product lineup.

North America is also GW’s largest market by revenue, with the UK only accounting for 22% of last year’s revenue. As such, currency fluctuations can add a layer of forecasting complexity. Notably, GW does not hedge against currencies.

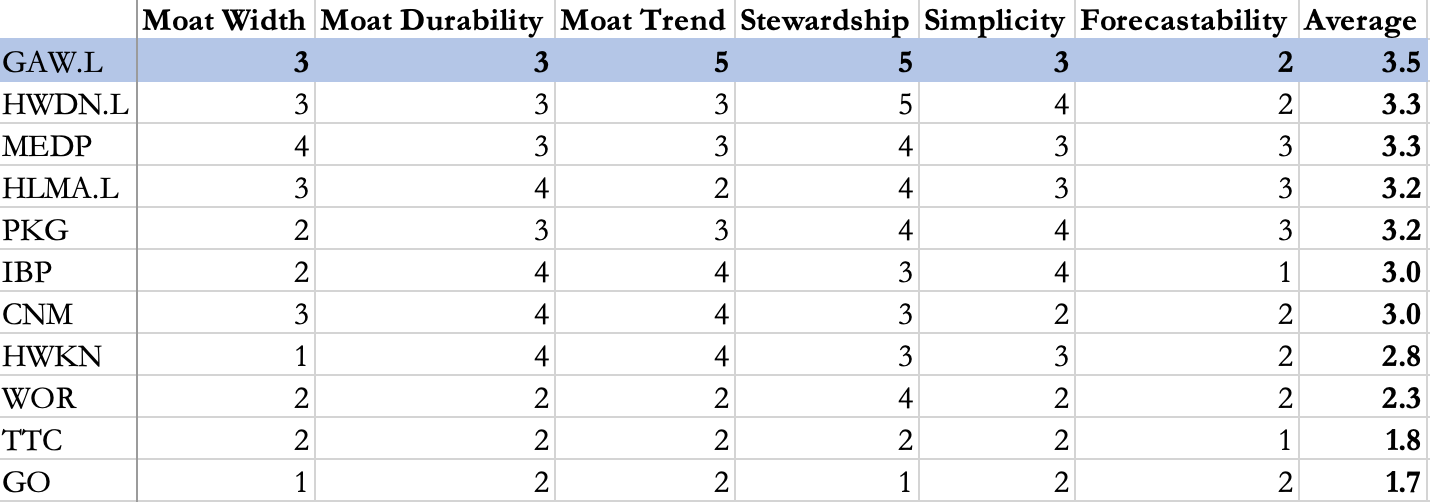

Flyover Stock Score

3.5 of 5

Here's a breakdown of the above scores, alongside my scores for the other companies profiled thus far at Flyover Stocks.

GW has the highest score thus far, primarily due to the perfect moat trend score. Let’s consider if today is a good time to invest in GW.

Valuation

I mentioned earlier that I overpaid for my initial stake in GW in July 2021. It was an unforced error on my part, and due entirely to valuation laziness rather than wrongly assessing the underlying quality of the business or its prospects. Fortunately, it was appropriately sized in the portfolio.

GW is an idiosyncratic business and doesn’t have any apples-to-apples competitors in the public markets. The closest thing is Wizards of the Coast (WoC), which owns Dungeons and Dragons and is held inside Hasbro. GW and WoC have similar operating margins in the mid-30s and growth profiles. If WoC had been spun out, it would have made for a great comp to GW.

GW has a different ROIC and revenue growth profile from Hasbro and Mattel, making multiple comparisons tricky.

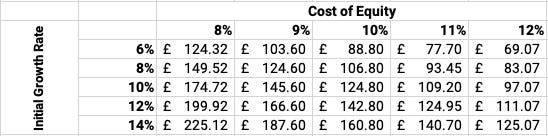

I don’t normally recommend using dividend-discount models as most companies pay out less than half their cash flow as dividends (if at all) and have more complicated capital structures. But there are exceptional cases where companies intentionally pay out nearly all of their free cash flow as dividends. GW is one example; Admiral Group is another.

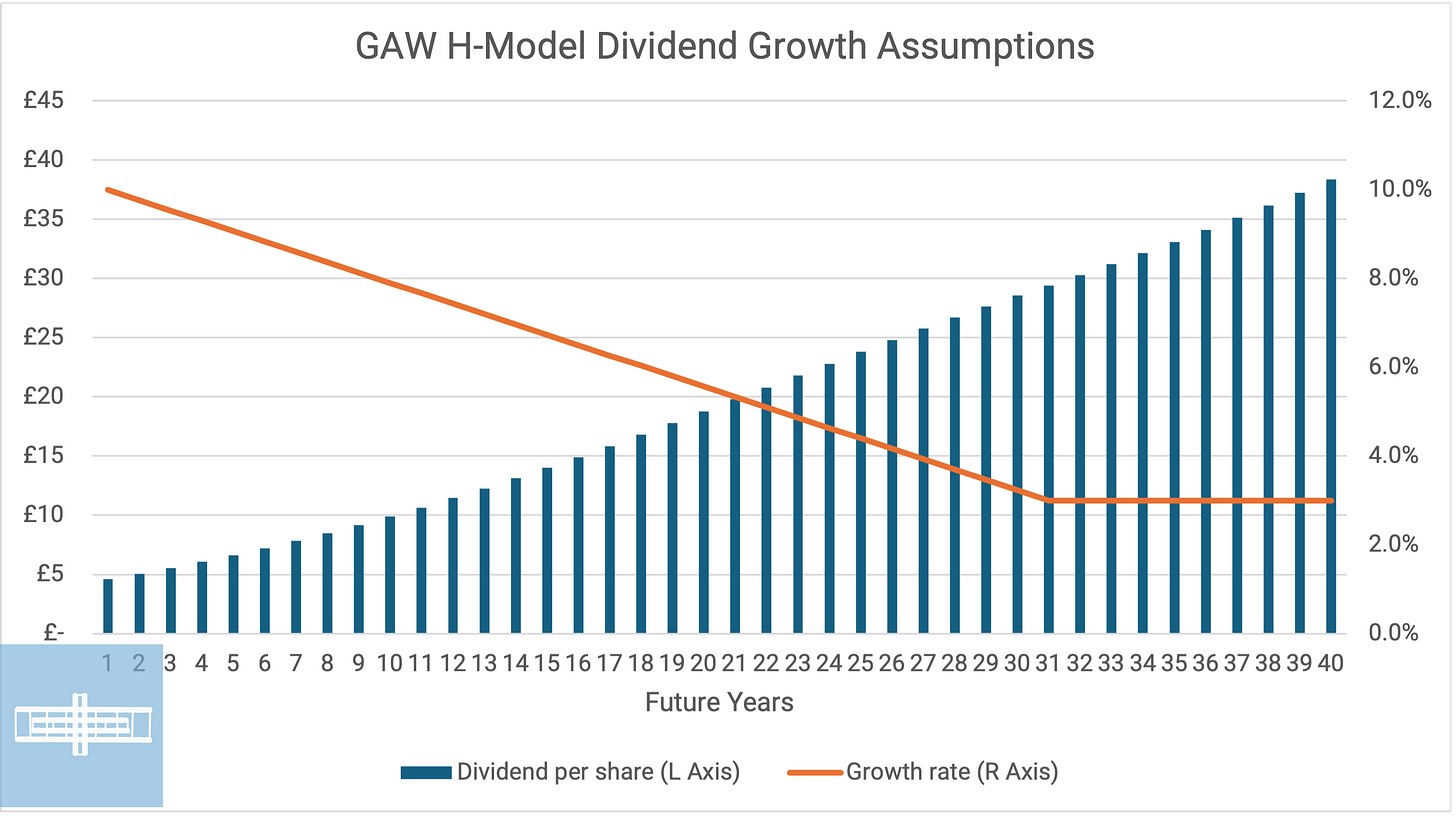

The dividend-discount model I prefer to use is the “H-Model.” It’s similar to the two stage DDM, but does not assume a sharp drop off in dividend growth from the high-growth to terminal phase, but rather accounts for a linear decline to a terminal growth rate over a specified period of time. This pattern is more consistent with corporate behavior, as companies tend to slow dividend growth over time rather than go directly from a high growth to terminal phase.

Below is the GW valuation range assuming various cost of equity and initial growth assumptions in the H-Model. The constants are a 30 year extraordinary growth period, an initial 10% annual growth rate, and a 3% stable/terminal growth rate.

Graphically, here’s what the H-Model assumes for the dividend per share (roughly FCF per share) and annual growth rates.

If you agree that GW has a wide moat, has a positive moat trend, and its products will remain relevant for at least another decade, the above baseline assumptions are a reasonable starting point.

If you do not think GW has a wide moat, you would shrink the extraordinary growth period, which would accelerate the company’s path to terminal growth and reduce the fair value.

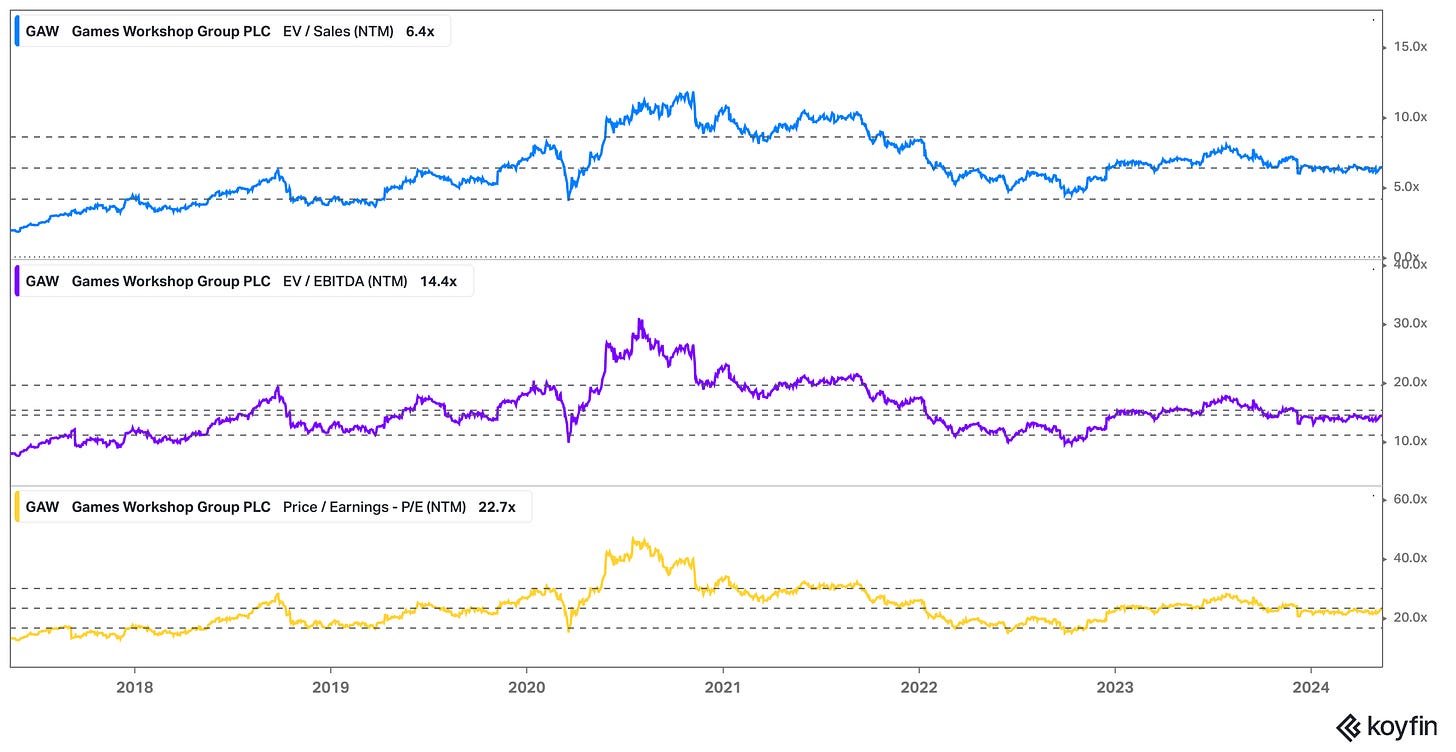

On a multiples basis, the stock is trading near 7-year averages.

We don’t yet know how much the Amazon Studios licensing deal might be worth. Much will depend on the reception by non-GW players. My guess is that Amazon is cautiously optimistic about the partnership given that the IP is far less known than the Lord of the Rings and The Hobbit, which they licensed from the Tolkein estate for a staggering $250 million.

I’m working with a fair value range of GBP 125-135 today compared with a current price of GBP 100 at the time of publication.

Bottom line

GW is an excellent company that isn’t well known outside of the UK and the hobbyist world. Its nostalgia-based IP is in the early stages of being shared across generations and licensing deals should bolster its value over the next decade and beyond.

Stay patient, stay focused.

Todd

At the time of publication, Todd and/or his immediate family owned shares of Games Workshop, Amazon, Admiral Group, and Nintendo.

Disclaimer:

This material is published by W8 Group, LLC and is for informational, entertainment, and educational purposes only and is not financial advice or a solicitation to deal in any of the securities mentioned. All investments carry risks, including the risk of losing all your investment. Investors should carefully consider the risks involved before making any investment decision. Be sure to do your own due diligence before making an investment of any kind.

At time of publication, the author or his family may have an interest in the securities mentioned or discussed. Any ownership of this kind will be disclosed at the time of publication, but may not be updated if ownership of a particular security changes after publication.

This newsletter does not provide buy or sell recommendations and articles should not be interpreted this way.

Information presented may be sourced from third parties and public filings. Unless otherwise specified, any links to these sources are included for convenience only and are not endorsements, sponsorships, or recommendations of any opinions expressed or services offered by those third parties.

Flyover Stocks has partnered with Koyfin to provide a discount to Koyfin’s services for Flyover Stocks readers. The W8 Group, LLC, which publishes Flyover Stocks, may receive a commission from a reader’s purchase of products linked from this page as part of an affiliate program.