Flyover Stock: First Watch Restaurant Group (FWRG)

A niche restaurant concept with a 41 year track record that's spreading across the country

Executive summary

First Watch restaurants have a niche in the breakfast, brunch, and lunch daypart and, despite low national brand awareness, have proven the concept over a 41-year history.

Executives and directors own 5% as a group; the CEO holds regular calls with front-line employees and works shifts in the restaurants.

Management believes there’s potential for 2,200 company-owned locations in the U.S., up from 531 today.

Having spent my teenage years in northern New Jersey, I appreciate a good diner and the role diners play in their communities. I have fond memories sitting in diner booths fitted with mini-jukeboxes like the ones made famous in the final episode of The Sopranos.

So when I recently visited my best friend in New Jersey and he suggested we go to breakfast, I fully expected we’d visit one of our old diner haunts. To my surprise, he recommended a First Watch restaurant - a chain I was familiar with in Cincinnati, but I didn’t realize it was expanding across the country.

The New Jersey location was packed, despite no fewer than a half-dozen diners in a five-mile radius.

That’s when I thought, “If First Watch can succeed in Jersey, this company might be onto something.”

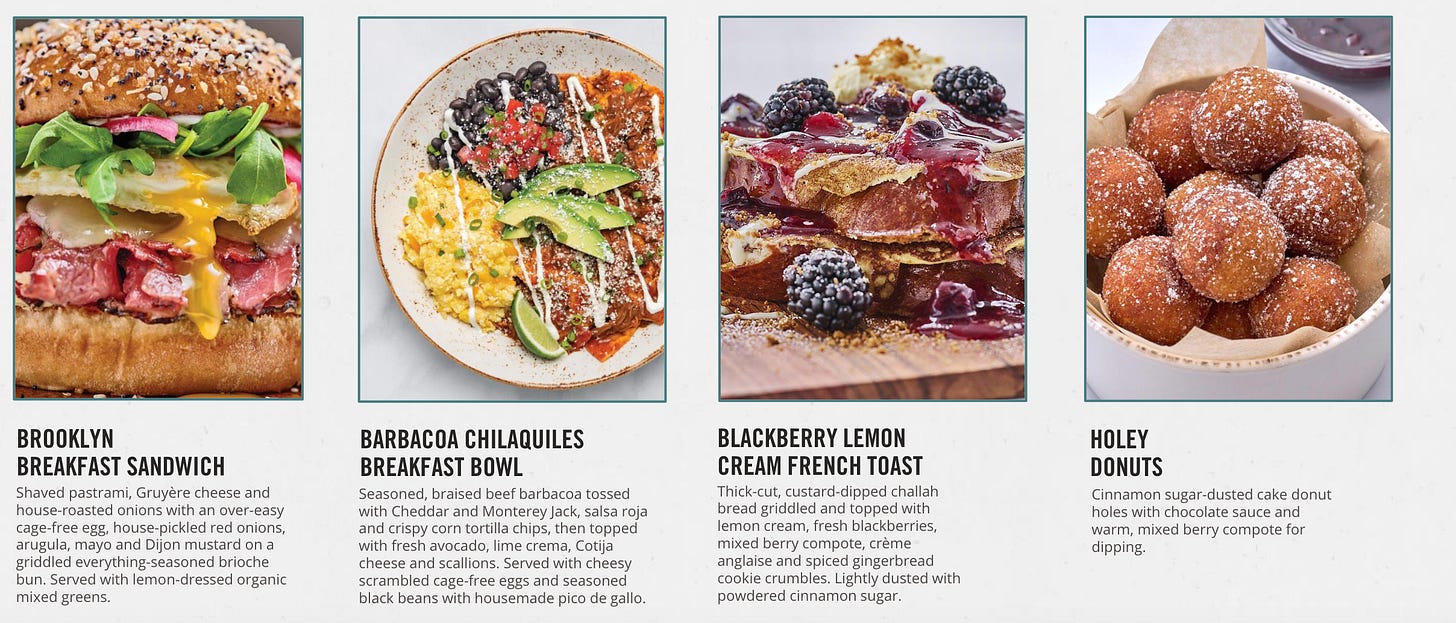

First Watch restaurants serve “elevated” breakfast, brunch, and lunch options featuring fresh ingredients (no heat lamps, deep friers, or microwaves), “instagrammable” plating, and, in many locations, alcoholic beverages like mimosas. One of FW’s specialties is fresh squeezed juices which it serves in both alcoholic and non-alcoholic beverages.

The average customer ticket is about $17 - relatively expensive as far as brunch goes, but far from the average ticket size of dining out in the dinner daypart.

FW locations are open from 7:00 a.m. to 2:30 p.m. each day and, despite only being open for 7.5 hours a day, do over $2.2 million in annual unit volume (AUV). In fact, FW’s AUV is higher than both Denny’s and IHOP despite both of those franchises typically being open for 24 hours.

Weekend brunch is the key opportunity for First Watch and accounts for about 45% of revenue; weekday breakfast accounts for another 35% and weekday lunch at 25%.

Of the 531 locations (as of Q1 2024), 432 are company owned and 99 are franchised. First Watch’s growth over the past 40 years was supported by a franchise model, but the preference is now for company-owned locations and FW has acquired some of its franchises in recent years to accelerate that process.

While franchising can be a capital-light way for restaurant concepts to scale, the company-owned approach is preferable when a restaurant wants control over all facets of the operation.

When dealing with fresh food at scale, in particular, the risk of poor execution and supply chain mismanagement is considerable. A foodborne illness outbreak could impair a restaurant’s reputation.

A typical FW restaurant has dimensions of 3,400 to 6,000 square feet and seats about 120-150 customers at a time. They fit nicely into vacant retail and restaurant locations and that’s been a steady source of opportunity. Some of the former occupants of current FW locations include jewelers, chain restaurants, and clothing stores. Locations are customized to fit local interests.

First Watch has developed a virtuous corporate culture rooted in its “You First” principle that emphasizes service at all levels of the business. It regularly receives workplace awards including a place on Newsweek magazine’s Top 100 Most Loved Workplaces in both 2022 and 2023. Its one-shift, no night-shift model appeals to waitstaff and cooks who prefer to have their evenings open and staff turnover is lower than the industry average.

Maintaining relevance with customers is critical to a restaurant’s long-term success and part of that is offering novel menu items. First Watch’s menu rotates five times a year and is based on its “We Follow the Sun” concept, which emphasizes seasonal offerings to ensure quality ingredients and meet consumer preferences.

FW’s long growth runway for new locations, history of positive same-store sales, and 20% restaurant-level margins, make it an attractive company to learn about today.

Let’s take a closer look at First Watch’s competitive position, management team, and valuation.