Flyover Stock: Cavco Industries (CVCO)

Benefitting from consolidation in the manufactured homes industry

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC or its clients owned shares of Berkshire Hathaway.

Please see important disclaimers.

The US housing situation is messy.

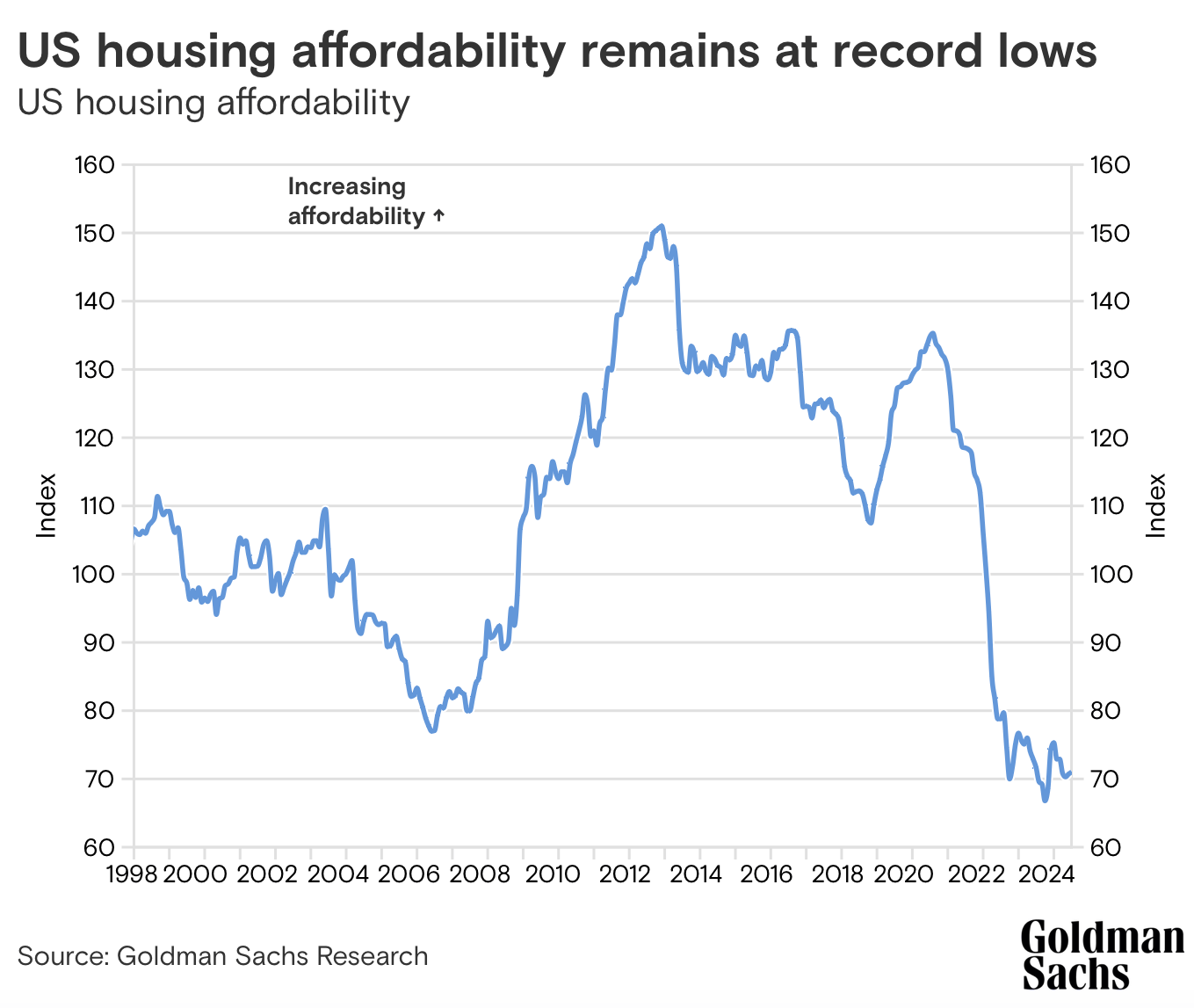

At the top of the complaint list is housing affordability. To be sure, affordability varies widely by metro area, but at the national level, a cocktail of issues - from higher mortgage rates to rising Millennial demand - has led to homeownership being out of reach for an increasing number of Americans.

This could be an entire post on the US housing market, but suffice it to say that the current environment has led more Americans to consider alternative solutions.

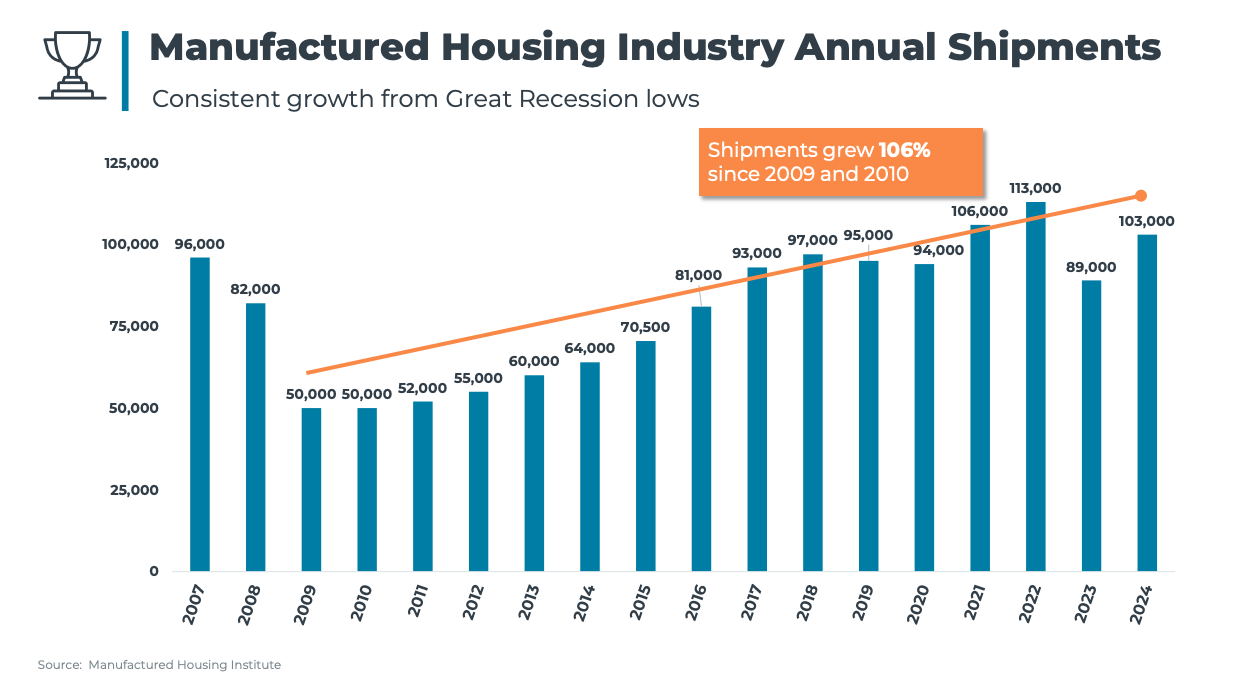

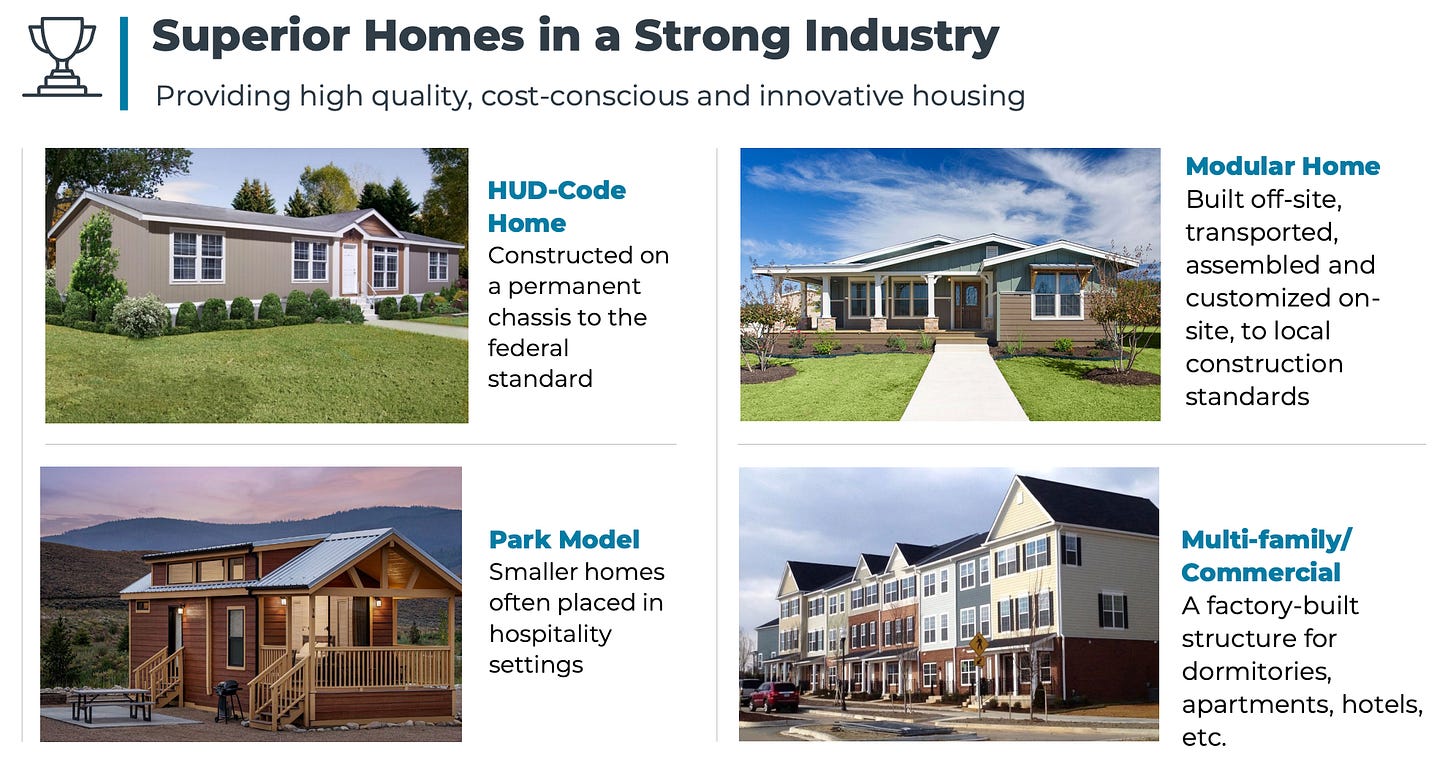

One of these alternative solutions is buying manufactured homes. According to the Manufacturing Housing Institute, the cost of a manufactured home is approximately one-third of the cost of a traditional site-built home (excluding land). This is partially achieved through tightly-controlled factory construction, where homebuilders benefit from economies of scale, bulk material sourcing, and a lack of weather delays.

Further, once ordered, a manufactured home can be built within a week and on site within 1-2 months versus an average 6-9 months start-to-finish for an on-site “stick-built” house.

Demand comes from two general sources. One is from individuals who secure land separately (own or lease), get all the necessary approvals from the zoning board, and order a manufactured home to be placed on the site. The second is developers of planned communities, often owned and operated by REITs, which generate rental income from the homes. These planned communities can quickly generate rental housing supply for a variety of needs: permanent residence, weekly rentals near vacation sites, or temporary worker housing near drilling or pipeline sites.

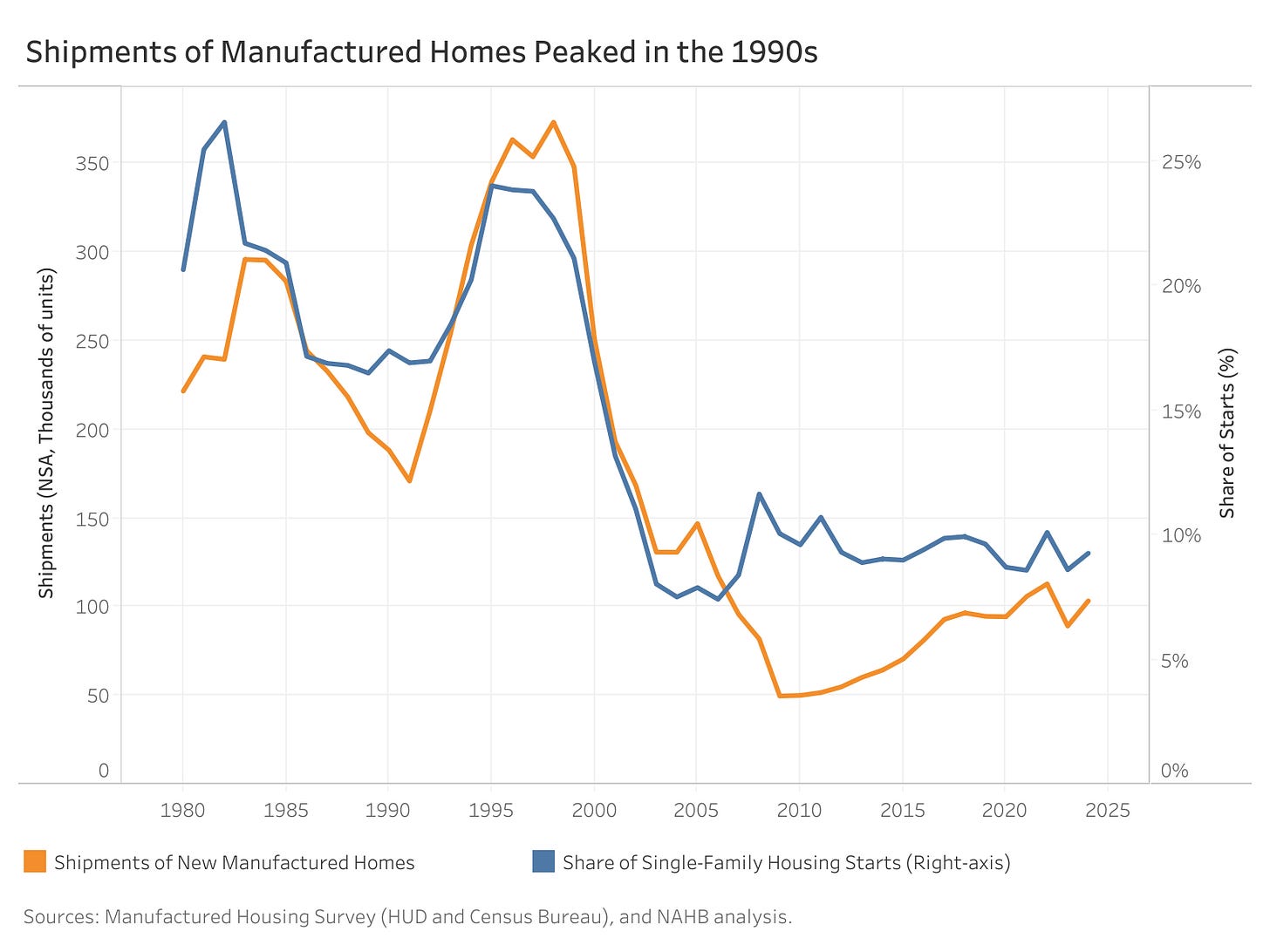

As the chart below illustrates, manufactured homes used to be a much bigger piece of the US housing supply. This was due in part to a securitization boom in the 1990s, which led to aggressive lending and eventually poor outcomes for both manufactured home buyers and lenders. Around 2000, manufactured home foreclosures spiked, leading to more supply of existing manufactured homes, which pushed down prices across the board. As a result, there was a wave of bankruptcies and consolidations among new manufactured home builders.

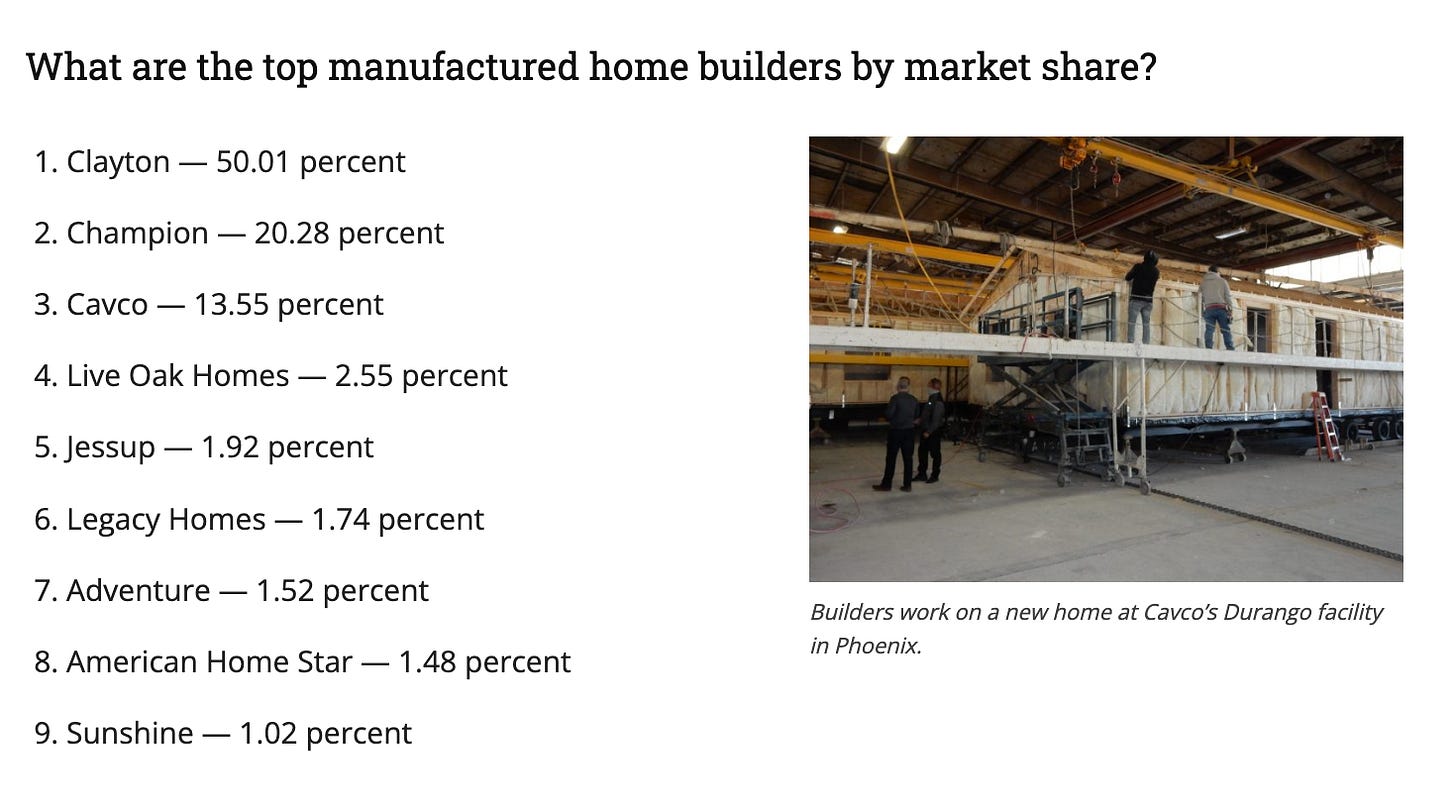

Today, three producers - Clayton Homes (Berkshire Hathaway), Champion, and today’s Flyover Stock company profile Cavco Industries - account for about 80% of all manufactured homes produced in the US. The key takeaway for the survivors from this period was that having strong balance sheets and controlling financing were key to survival.

In the most recent quarter, for example, Cavco had $375 million in cash and no financial debt. That figure will adjust once the recent $190 million acquisition of American Homestar closes, but it’s being financed with cash on hand. And all three have their own lending arms.

In 2003, during this period of turmoil in the manufactured housing industry, Warren Buffett’s Berkshire Hathaway acquired Clayton Homes. The value opportunity was there along with his admiration of Jim Clayton (Clayton Homes founder), but from a moat perspective there were some emerging trends that pointed to the industry being a better place to invest after the dust settled.

Let’s take a closer look at some of those factors now.