Flyover Stock: AptarGroup (ATR)

A world-class pharmaceutical dispensing business hiding in a packaging company’s skin

Todd Wenning is the founder of KNA Capital Management, LLC, an Ohio-registered investment advisor that manages a concentrated equity strategy and provides other investment-related services.

At the time of publication, Todd, his immediate family, and/or KNA Capital Management, LLC or its clients do not own shares of AptarGroup.

Please see important disclaimers.

When I covered the paper and packaging companies in a previous job, I didn’t have many “moat-worthy” companies to pitch to my clients.

Paper and packaging is technically a part of basic materials, so most of my companies were just trying to keep their heads above water and avoid making silly acquisitions.

Most of them struggled on both accounts.

In basic materials, most moats are built around low-cost advantages rather than differentiation, but Aptar is an exception. In fact, I consider Aptar more of a healthcare company than a packaging company.

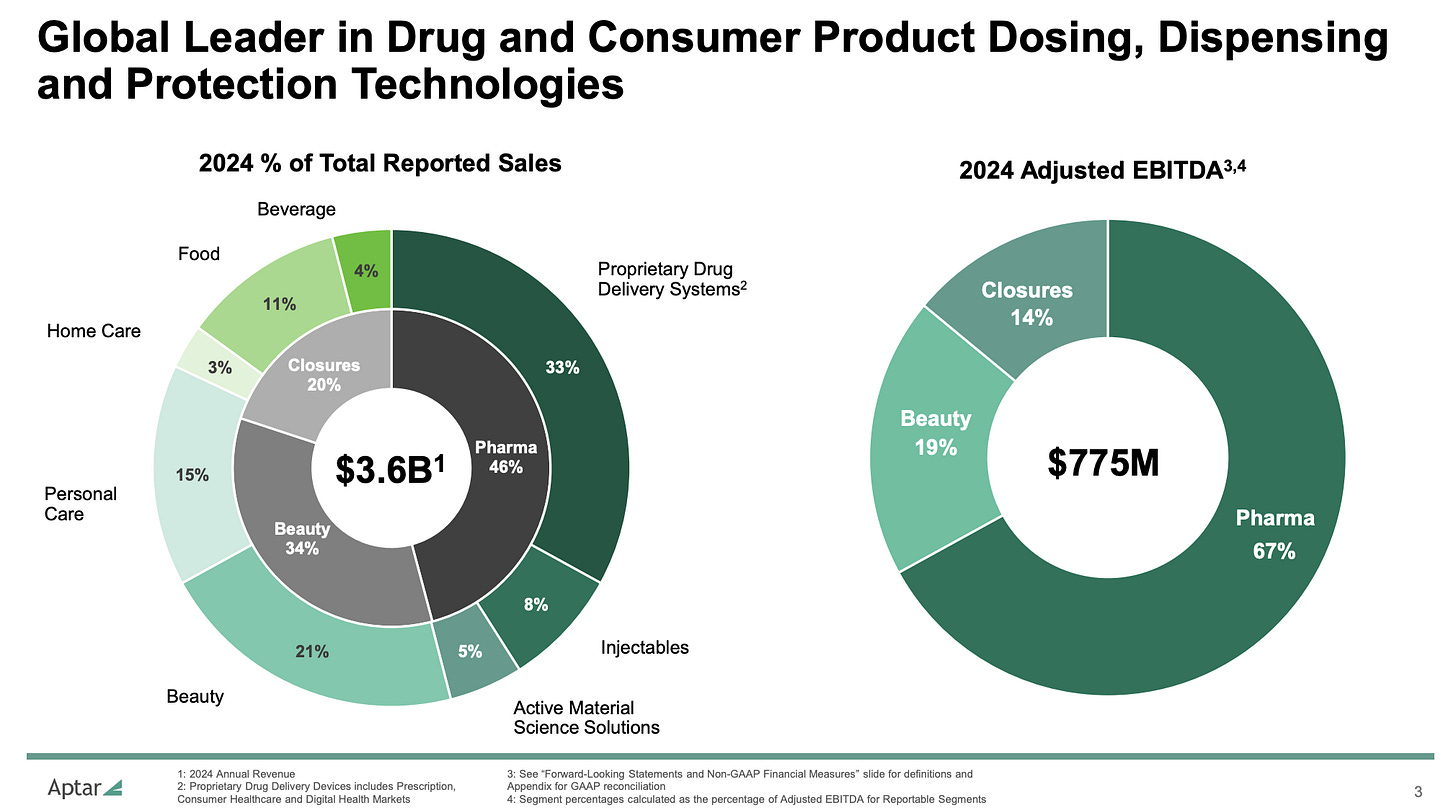

The reason that Aptar is included in basic materials/packaging is that it makes dispensing equipment for a variety of end markets, including food and beverage, beauty and personal care, and pharmaceuticals.

These range from commoditized flip-top ketchup closures and aerosol valves all the way up to specialized drug delivery stems via nasal, oral, and injectable solutions.

The commoditized products are more in-line with the broader basic materials sector. The healthcare products, however, are differentiated and are worth further investigation by quality-minded investors. More on that in a moment.

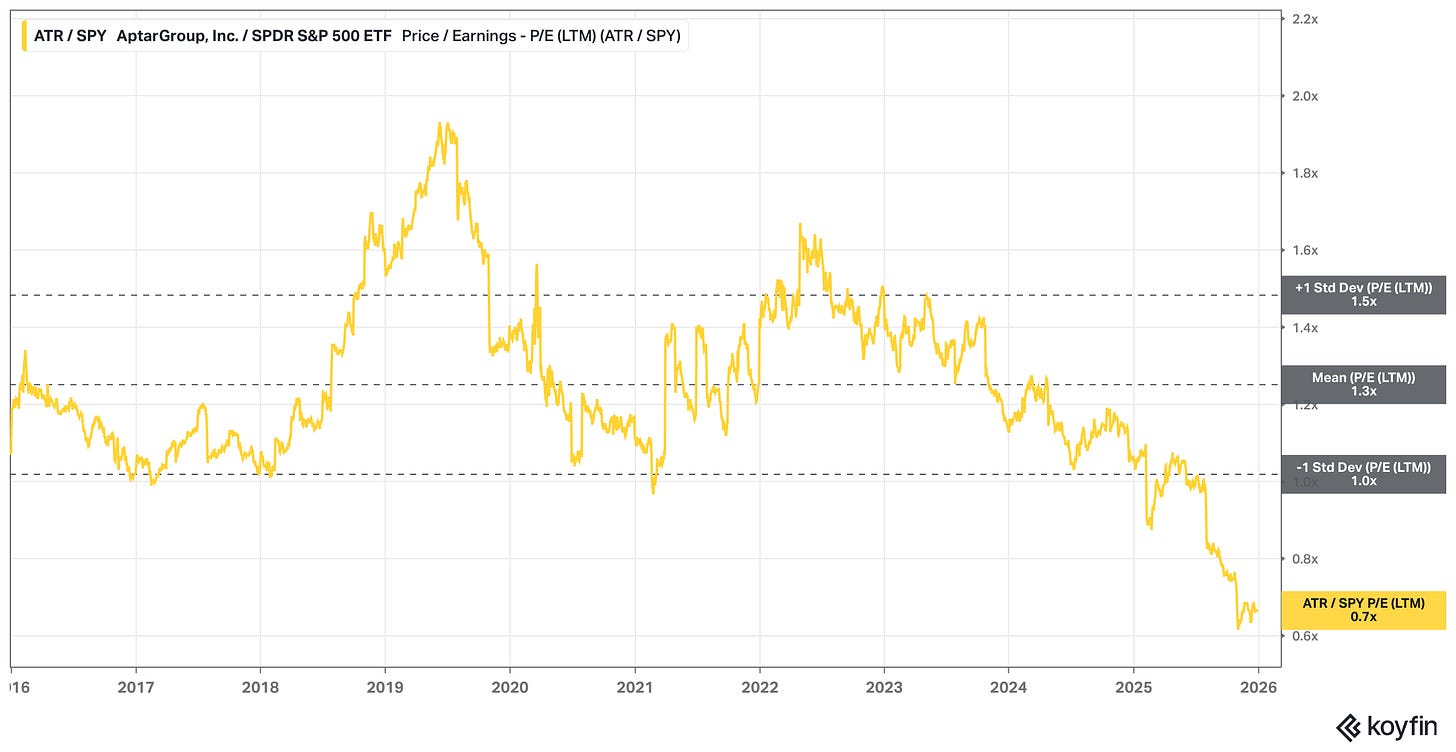

In part because of its attractive pharmaceutical segment, Aptar’s stock has typically traded with a premium multiple to the S&P 500. As the chart below illustrates, however, Aptar’s P/E today (19.8x ttm) is at its lowest level relative to the S&P 500 in a decade. We’ll dive into that dislocation in a moment, as well.

But first, let’s take a look at Aptar’s moat width, depth, and trend, as well as its management/stewardship, forecastability, and simplicity.